NZ

Great piece on EBOS with John “Twinkle Eyes” Cullity - link. EBOS is one of those stocks you just own and don’t think too much about (as I’ve said before — there’s basically three great NZ stocks — MFT, IFT and EBO).

Spark — another downgrade (!). I’ve been a bit slow on this one — yes it’s cheap (if you value it at the multiples IFT paid for Vodafone/One) — but seems like management might struggle to organise a piss-up in a brewery. Divesting their remaining stake in the towers business, Connexa, is a stupid move, and the great once-monopoly Spark is starting to look like any other telecommunications company. If I were a real analyst, and not a professional silly bugger, I would be downgrading here.

NZME — No investor day this year.

AoFrio — Great revenue growth. 32%. Kudos to Greg and co. It has been our top performer this year in the NZ model portfolio — ~47% return CYTD. Only wish it had a bigger weighting!

Working from home — Found this hilarious —

Public Service Minister Nicola Willis cannot name any businesses that support the Government’s work-from-home directive, despite saying data is critical to understanding the subject.

You can’t base everything on your “reckons”, Nicola!

Aus

Medadvisor — Weak earnings — Revenue growth of 3.5% for the quarter. Nothing to write home about. Update: Stock down 40% on the news — am picking up more here.

Pilbara — cutting lithium output. This is part of the bigger narrative around China — for all the hoo-ha about China stimmy, there’s a clear signal in the market that they’re not buying as many resources as before. Bad for Australia and bad for mining.

US earnings szn continues —

Holy guacamole Alphabet — the Google parent saw net income of $2.12 per share vs. estimates of $1.84; and revenue of $74.6bn (at this point I am thinking of the book Titan about John D Rockefeller, and I’m thinking about the clear parallels between Standard Oil & Google…it’s the machine that just keeps pumping).

Hard to fault anything here. It keeps powering through — noting 32% margins. Noting a $1.9bn profit on its cloud segment (wasn’t that long ago Cloud was marginal at best), and $28.5bn profit in total… like I said, hard to fault anything here…top marks. 10/10.

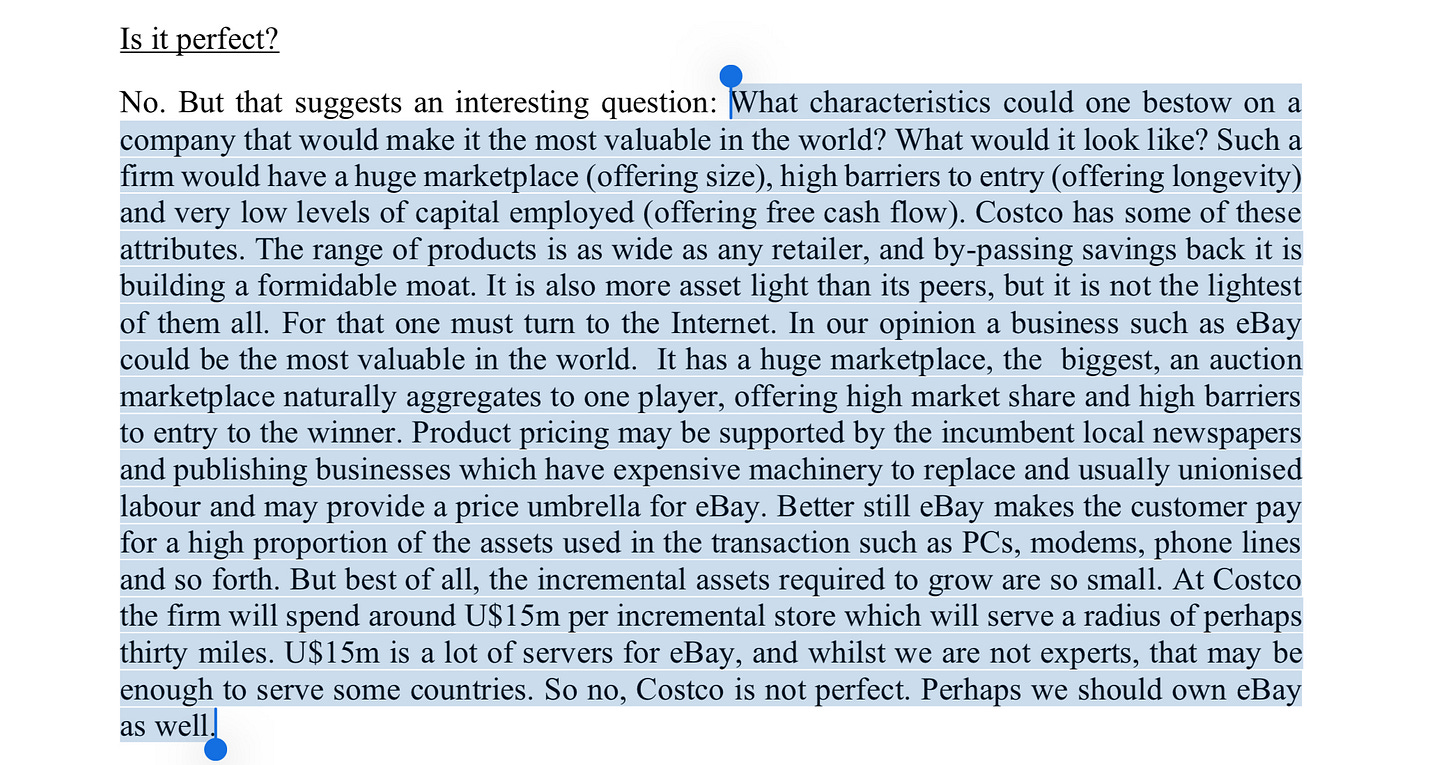

Google’s business model reminds me of Nick Sleep’s hypothetical model for ‘the world’s best business’. See below.

Google has many of these characteristics. Its services — search, maps, advertising, cloud, Android — penetrate the world. The barriers to entry are fairly wide. And we know just how much cash flow the model can generate — it has 32% margins! (Remember — that’s 32% margins with all of of Google’s moonshots and money-losing projects).

Is Google the perfect business?

Fast food more came in more disappointing — McDonald’s, Chipotle both batting below what they should — I think the obvious conclusion is the consumer is strained (I know, I’ve been saying this for a while now). When you look at businesses that deal directly with the consumer — i.e. fast food, fashion, etc — well, they’re none too pretty. I was at the Newmarket food court today — and I have to say — Westfield Newmarket knows no recession. But obviously this is a bright spot on a fairly bleak constellation — for instance, Commercial Bay is notably emptier (the shops — aside from Mecca — are empty as always).

Microsoft also a bit disappointing — seeing slow-down in its cloud segment, Azure — again I think this suggests that there’s some tightening of belts going on. Stock is down 4% after-hours on the news.

Are we still max stupid?

Can you guess this chart? Here’s some clues:

The company has a market cap just shy of $10bn.

Q1 saw revenue of just over $750,000 (that’s not a typo)

Maybe it’s an AI company, you might think. Or maybe one of those nuclear companies. Or, perhaps, it’s a cryptocurrency?? All likely guesses. But no. The company is Truth Social, Donald J Trump’s social media company.

I mean, this is the most pure “Trump trade” I can think of — take a company that makes no revenue (more or less) and write '“Trump” on it. That’s the perfect trade! The perfect expression of interest in whether you think Trump will be president next!

Also, I would like to point out that one of the world’s richest men is on stage jumping like this:

It reminds me of this1:

Anyway — that’s Truth Social. I think the bigger question is — are we still max stupid? I.e. are stonks still going to the moon? I’m starting to wonder if that trade is starting to wear thin — for instance, Meta had great earnings but the stock is down (people bought the rumour and sold the news). But the Trump trade — still in play.

Some uncorrelated trades I like

Here’s my gut feel. Microsoft is down because these things are “priced for perfection”. Any kind of vaguely disappointing result is going to be punished by Mr. Market. I’d tentatively say this is perhaps the end of the Mag 7 bubble, which is going to affect a lot of people who are blindly invested in the S&P 500 as the index is heavily weighted toward those Mag 7 stocks.

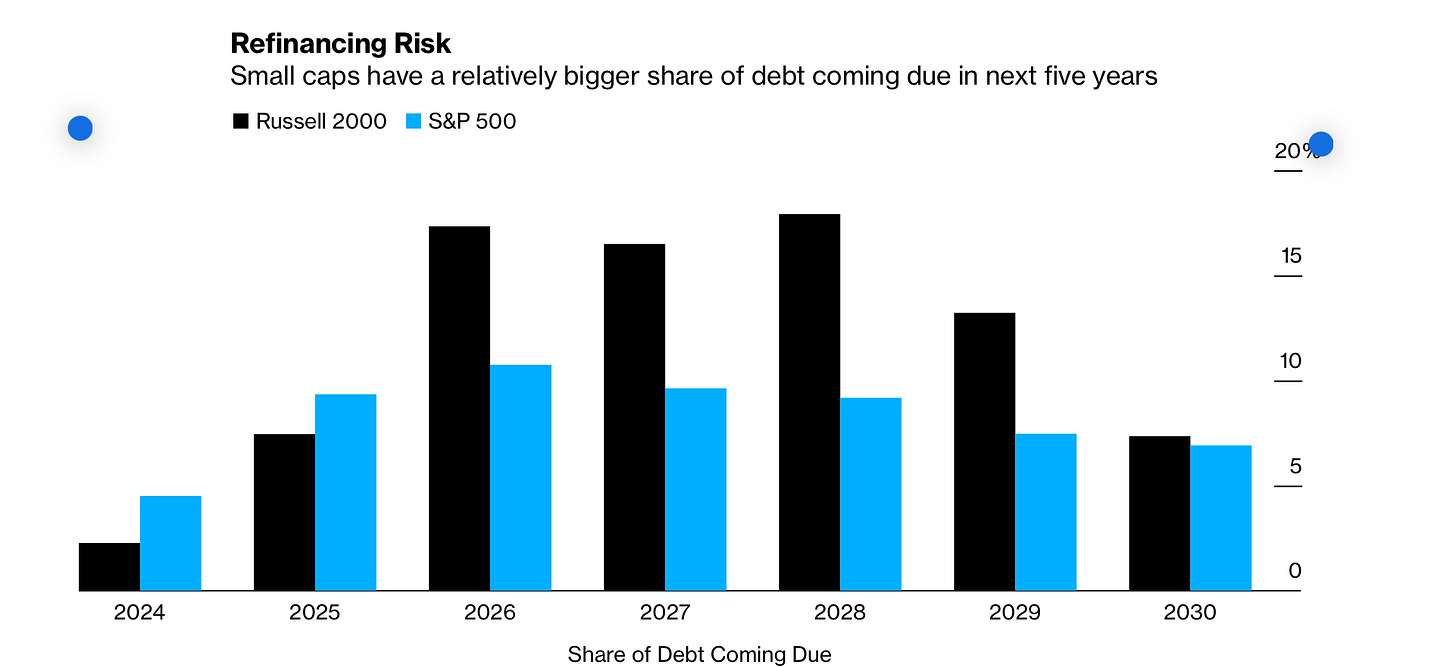

It would be suicide to short the Mag 7, though, or the S&P 500. What you could do, however, is short the Russell 2000 (not investment advice!!). 40% of the companies in the Russell 2000 lose money. A large proportion of them also have debt coming due. See the chart below, from our friends at Bloomberg:

What else could you do? Well — you could buy companies that aren’t Mag 7. Booze companies are trading around generational lows. The luxury houses — Kering, LVMH, etc — are all trading near their lower end, too. Of course, there could be more legs down before we see reversion to the mean. But it’s not rocket science. You could also buy things like Estée Lauder (we talked about that on Tuesday) or Nike. These aren’t dinky little companies — they’re great names trading at a discount to their future cash flows (Buffett gave us the appropriate way to value a company eons ago — simply take all future cash flows from now until judgement day, and discount that by the risk-free rate).

Things I’ve read recently

I really liked this story about keeping Electrical Audio going, the music studio founded by the late Steve Albini.

Howard Marks has a new memo out.

Also, this WSJ piece about Salma Hayek. She’s the wife of Pinault, who owns Kering, and is the brains behind the operation — I suspect Pinault’s move to buy CAA earlier this year was largely her doing.

Please don’t be upset with me, Mr Musk!!! I love Twitter — I mean X! What a great name.

(I’m reminded that Musk wanted to call PayPal “X”, too, and Peter Thiel shot him down. Wise.