Game of Board Seats at Fletcher | Why NZ real estate will decline more

Between a thorn and a hard place

NZ

WHS — Downgrading FY24 EBIT to $22-30mn — excluding Torpedo 7 divestment (they paid $52mn for it, and sold it for $1…excluding operating losses, etc that’s a hell of a poor result). Trading at 97c as of writing or down +9%…oof!

FBU — Another day, another lot of board changes. This time Rob McDonald is stepping down. Feels like a variation of the Warhol quote — “in the future, everyone will have their 15 minutes [of fame] on the Fletcher Board”. The company still needs to show it can turnaround...Not convinced yet. Note that CSR and Boral are both departing on the ASX… I don’t think a bid for FBU at the price it is at is out of the question…you buy it cheap and weed out the rot…ditto could happen for James Hardie… while I expect residential property to continue to decline in NZ, I think there is always money to be made in big govt and private sector contracts — it’s cyclical, dummy.

Kiwisaver — Hardship +_ first home withdrawals hit a record $182mn in May. Speaking of…

Why NZ Real Estate will decline more — the end of the bubble

I think NZ real estate is facing more of a decline. Interest rates remain high, immigration is down, and the artificial demand that was created by people buying out of FOMO (or out of storing wealth, given no cap gains) has been quelled given those high interest rates. You can see for yourself what the climate is out there: each day it seems a building company is in liquidation or a construction project is put on hold. You can go on TradeMe property and look at the number of increasingly cut-price listings.

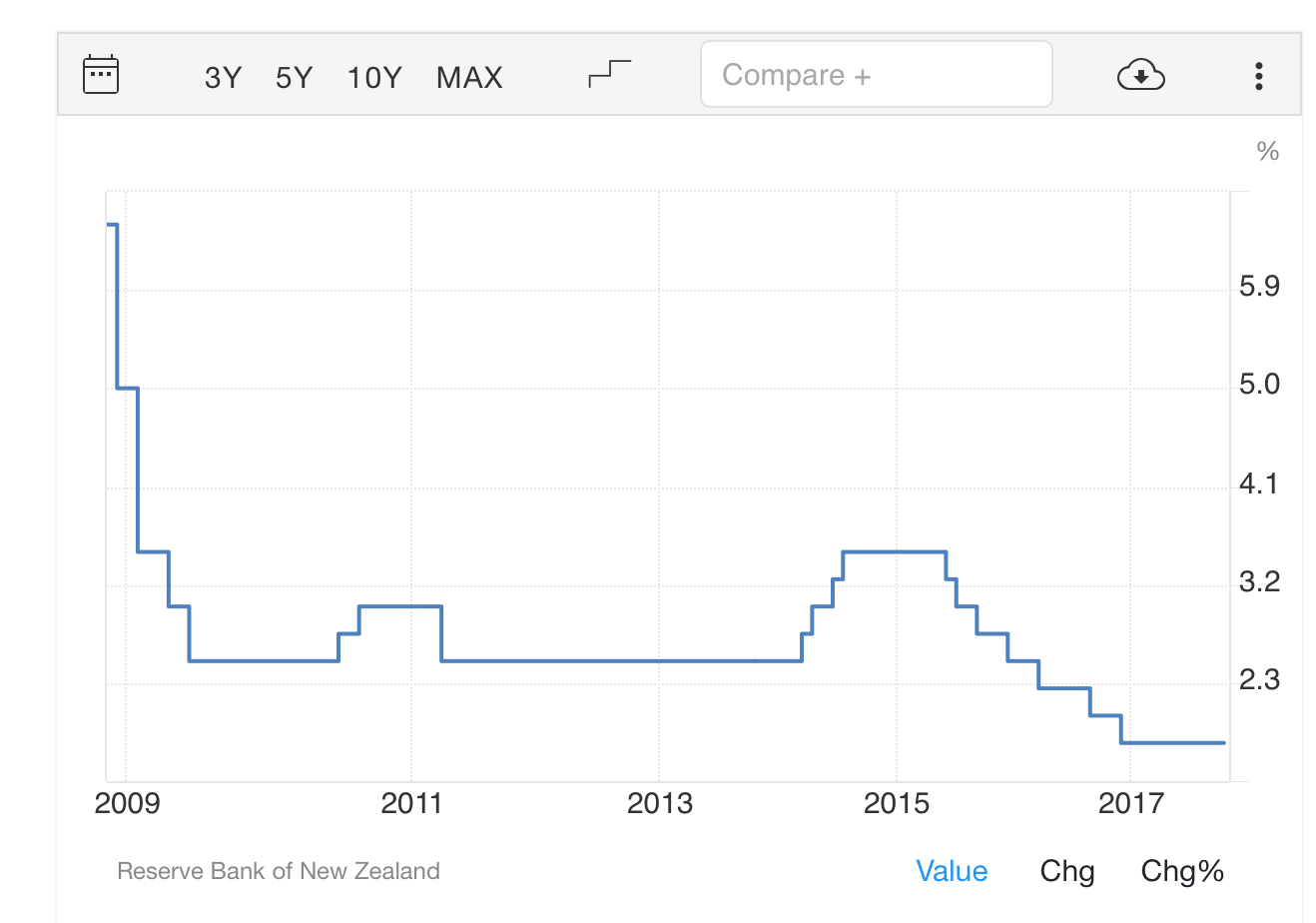

What fueled the property market during our years (and beyond) as Key’s “Rock Star” economy was a combination of high immigration, no capital gains taxes on property, and most importantly, low interest rates. In the wake of the GFC, during the Key Govt (2008 - 2017), the RBNZ cash rate dropped to 2.50%, before dropping to an even lower 1.75% by the end of the Key years.

RBNZ Official Cash rate, Key Govt (2008 - 2017)

The house price-to-income ratio increased in turn, accelerating even further during the Arden years. A projection in 2020 by the RBNZ was relatively accurate — the house price-to-income ratio sits at 8x as of 2024. This means anybody purchasing a house at the top of the market has likely lost money in their investment. If prices continue to decline — as expected — those top-of-market purchases will make an even worse investment.

However, a “decline” from 10x to 8x is hardly something to be proud of, or crow about — on a global scale we are still severely unaffordable. Australia’s major centres, too, are unaffordable on a relative basis. You can buy a house in the UK, US or Canada for a more reasonable price. In contrast, New Zealand’s property affordability has gotten increasingly out of control — from 2.8x income-to-price to +8x income-to-price from the late ‘80s until now.

I think it is unrealistic to expect this kind of ratio to remain. Remember the mathematical phenom of reversion to the mean. We should ask ourselves — what set of criteria has led to this valuation increase, and what set of circumstances might lead to its downfall?

The three culprits of our housing bubble

The first is a lack of capital gains tax — of course people are incentivised to buy an asset they won’t be taxed on (provided they own it for long enough). This remains as an incentive for those who are cashed up. They can afford to lose money in the short term if capital gains eventually outpace CPI. This is why alternative asset managers have religiously bought single family homes during every economic correction — they can afford to wait (all your money is made in the waiting).

The second is low interest rates, which act as an aphrodisiac to property prices. Borrow (practically) free money from the bank, wait until your first property has some capital gains, and draw down in the newfound “equity” in your property to buy another house — rinse, repeat.

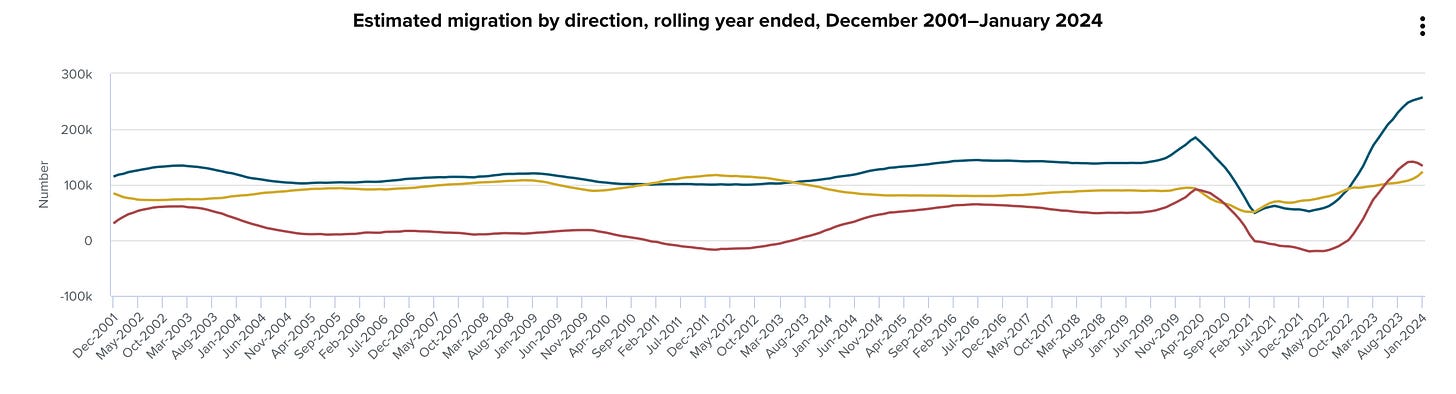

The final criterion is net positive immigration — i.e. what is the additional external demand for our housing. With the exception of COVID, we have had a steady supply of net migrants to our shores — if they weren’t here to buy a house, they were at least here to rent.

Two of those criterion are inverted now — increasingly, NZ citizens and residents are leaving at a faster pace than new immigrants can come in. And why wouldn’t they? New Zealand is unaffordable, remote from the world, has few career advancement opportunities and an ageing infrastructure that successive governments have declined to remedy (both Key and Arden govts are responsible for this). There is a lack of incentive to stay. We are reamed by the supermarkets every which way from here to Texas, and the Commerce Commission appears toothless. I digress. The other criterion is obviously low interest rates — they are not low, and the RBNZ does not look like it is going to lower them anytime soon. The result is that mortgages become increasingly unaffordable and consume a higher percentage of a person’s income. The end result, of course, is that those who leveraged and purchased multiple houses end up needing to sell them on the cheap — and quickly. The price action changes.

And now, a message from our sponsor, Warren E Buffett:

[Ben Graham] said, “You can get in a whole lot more trouble in investing with a sound premise than with a false premise.”

It’s a totally sound premise that houses will become worth more over time because the dollar becomes worth less. It isn’t because – you know, construction costs go up. So it isn’t because houses are so wonderful, it’s because the dollar becomes worth less, and that a house that was bought 40 years ago is worth more today than it was then.

And since 66 or 67 percent of the people want to own their own home and because you can borrow money on it and you’re dreaming of buying a home, if you really believe that houses are going to go up in value, you buy one as soon as you can. And that’s a very sound premise. It’s related, of course, though, to houses selling at something like replacement price and not far outstripping inflation.

So this sound premise that it’s a good idea to buy a house this year because it’s probably going to cost more next year and you’re going to want a home, and the fact that you can finance it gets distorted over time if housing prices are going up 10 percent a year and inflation is a couple percent a year. Soon the price action – or at some point the price action takes over, and you want to buy three houses and five houses and you want to buy it with nothing down and you want to agree to payments that you can’t make and all of that sort of thing, because it doesn’t make any difference: It’s going to be worth more next year.

And the price action becomes so important to people that it takes over the – it takes over their minds, and because housing was the largest single asset, around $22 trillion or something like that…Such a huge asset. So understandable to the public – they might not understand stocks, they might not understand tulip bulbs, but they understood houses and they wanted to buy one anyway and the financing, and you could leverage up to the sky, it created a bubble like we’ve never seen.

It wasn’t like somebody was thinking,” This is going to end in a paralysis of the American economy.” You know, they just – they started believing what other people believed. It’s very tough to fight that.

I want to make clear I am not predicting another GFC — but Buffett, commenting on the implosion of the housing bubble in the States, makes a good point. The “sound idea” that NZers hold so dear — the quarter acre dream — has quickly become a very dangerous one. Does anybody seriously believe a falling down shack in Ponsonby with no plumbing is worth +$2mn?

The annualised return of RE is not exceptional over time

It’s important to put it into perspective. From 1990 - 2023 the real rate of return on NZ housing was a mere 5.5% — (for comparison, the S&P 500 returned around 10.47% around that time, including dividends). When the return of housing rapidly outstrips inflation, as it has in recent years, the only answer is either — i) crazy inflation or ii) a correction to the downside as the value of property experiences gravity.

I think it is important to pop the bubble in a couple of assumptions — the first is house prices only go up. Auckland property prices are already down -20% from peak and I suspect there is more room to go — we have only seen the start of fire sales and liquidated “property empires”. House prices do not only go up, and nor will they necessarily outpace inflation.

The second assumption is that the lack of capital gains will continue to power property forward — it’s an incentive but doesn’t function as well with high interest rates, because it stops as many from being able to purchase said houses, therefore lowering demand.

We are already starting to see some signs of the great NZ property bubble breaking. Non-performing loans continue to tick up — ANZ added +$17.1mn in non-performing housing loans last quarter, while Westpac added +$55mn1. It’s small potatoes for their large loan books, but it’s worth noting the continual trickle of dubious debt into bad debt.

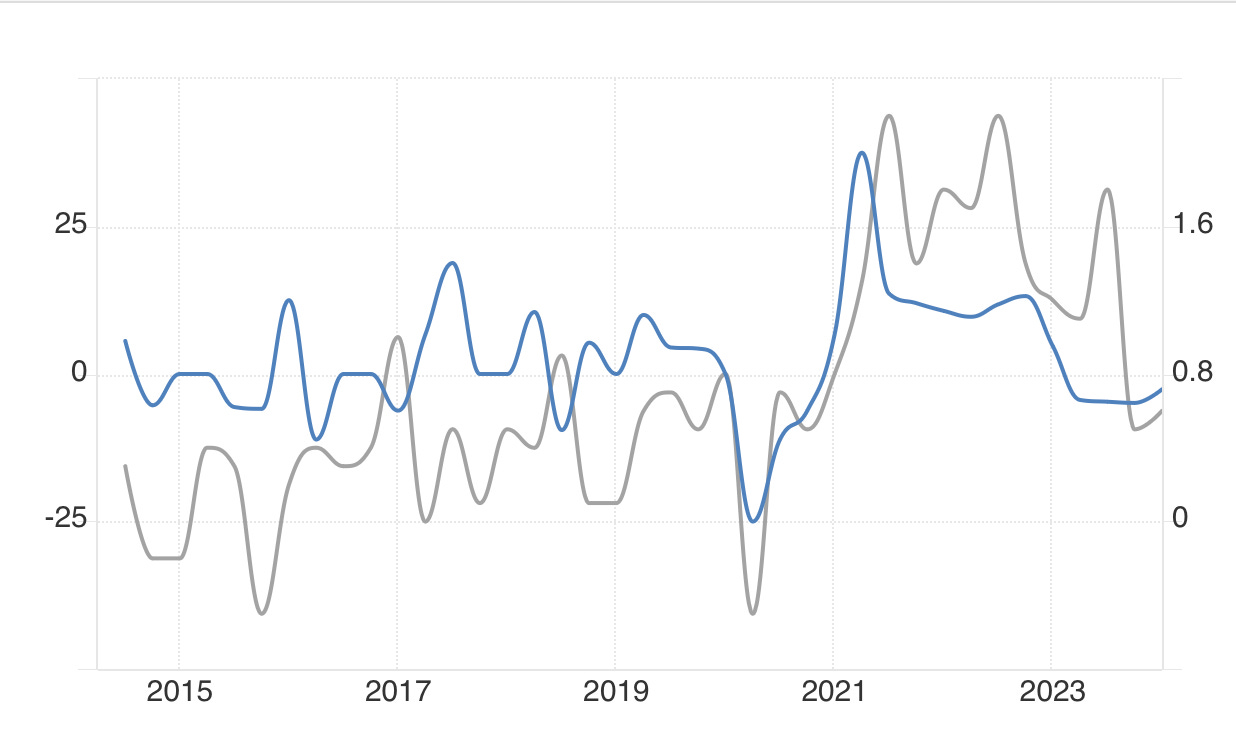

The bulk of mortgagees are now refixed to a higher rate (+7.00%). Rough math indicates +$15,000 of extra payments to be made per $500,000. The median Auckland house price is $1,000,000 — so assume another $30k whacked on top2. Here is the final culprit, then, of the issue — wage growth. NZ wage growth has been handily outstripped by CPI since the start of 2021 — meaning people aren’t only paying 8x price-to-income; they’re earning less money to pay their extant mortgages.

NZ CPI growth in % vs. real wage growth

Where are we now?

The result is something that should be obvious to all of us now — since at least the Key government we have cultivated a housing-mad nation under a particular set of circumstances that has led us to here, where the bubble can only deflate more as interest rates remain high. Those with access to lines of credit and ready cash will do well, as they have done in every other crash (as Uncle Bob Jones sez — just buy low, sell high, sit on cash in the meantime). It is the middle class who will likely do the worst — as their property or properties are liquidated. The result is likely an economic depression.

The problem I have with property is that it is relatively unproductive. It is not a business or a farm, making something. It simply sits there, earning yield (especially houses). If you take a look at the NBR rich list you will not be surprised to see the bulk of wealth has been created via property. Compare this to the US, where you have a rich list of men and women who have innovated (Google, Microsoft, Berkshire, Oracle, Walmart…). We have unfortunately created a system similar to that of Victorian England, of a land-owning elite who aren’t always (or often) innovators.

Take a look at the below chart — it’s embarrassing the owning-occupied property and professional services are our highest contributors to GDP (followed closely by rental and hiring real estate services (!)

Solutions?

We have a leaden and unproductive economy — at the moment the way to wealth in NZ has been — buy a house, reap capital gains, rinse, repeat. The most plausible solution I can see is to change the incentives — change the FIF (foreign investment fund) regime for one, which is outdated and penalises investing overseas in superior passive assets which could grow Kiwi wealth(compare the NZX50 to the S&P 500 for instance). Consider changes to capital gains tax — while property owners will shudder, when we eventually move to a low interest rate environment we risk creating this disaster again. Consider incentivising innovation and actual businesses (the best solution I have for this is one I heard recently — an accelerated deprecation regime, which allows businesses to depreciate assets at a faster rate). I would also argue that the cost of raising capital or listing on the NZX needs to be lower — we have innovative companies (Xero, Rocket Lab) who end up listing elsewhere because the benefits are null to be listed here.

Ultimately, I think the change may be less of a tax and policy one than a change to the Kiwi mindset — there is no value to be had in being a self-depreciating and property-hungry country that has a relentlessly tall-poppy attitude to anything new or brave or innovative. Once we we world-beaters — we were world-leaders at EFTPOS, the vote for women, the Britten motorcycle, no.8 Wire — we need to get there again. You can’t do that by sitting at home, watching Seven Sharp, and buying another semi-detached in Upper Hutt.

https://bankdashboard.rbnz.govt.nz/asset-quality

Remember — people were previously using the excess equity in their homes to refinance or take out money — now they are obligated to pay more of their mortgage at a higher rate

Good article mate. Good to see it getting significant traffic on twitter etc.

Someone has to call this stuff out.

Couple years ago I was watched as a friend and partner (mid 30's) purchased a normal/nice seeming 4-bedder for $2.9M in Sandringham Auckland. I thought he said $1.9M and I was holding my mouth (holy shiit), but it was $2.9M.

Its down at least $500K in 3 years. Serious money for a young family, thinking they are making a safe investment. Not to mention their loan is probably around $1.5-2.0M, meaning at least $100K/year of interest payments.

I have no clue on what planet this makes sense. Unfortunately it looks like it was peak market pricing.

I swear people won't believe anything about housing ever going down, until it literally slaps them in the face.

Nice Piece. I’m receptive to property falling another 15-30%. I think when The trifecta of further house price falls, more recession and higher unemployment continues the RBNZ will cut. A higher inflation regime will cause the NZD to fall if the reserve bank is cutting . They will sacrifice the currency to cushion a big chunk of the fall in property prices. In other words the 35-50% fall from peak prices won’t also include a NZD that is 20-30% lower in USD terms in most punters heads