Reading Astrid’s fantastic book - “how luxury conquered the world” - and thinking a lot about Hermes (still). Love this quote, originally from Henry Ford — “the business that only makes money is a poor one”.

Macro

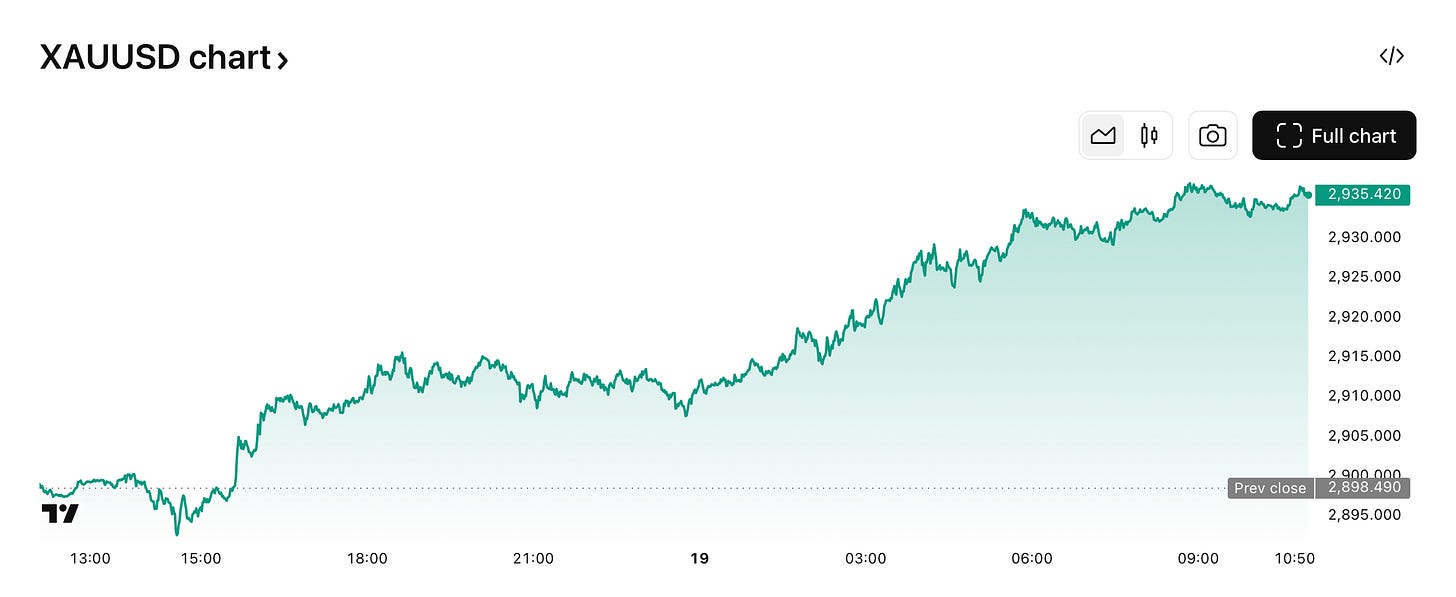

Ukraine/Russia peace deal feels imminent (also, if the US isn’t going to fund Ukraine, then who is?) — expecting gold price to tank as a result (as always, do your own research, blah blah). XAUUSD is teetering on highs…until the fat lady sings, the so-called “safe haven” asset will probably remain there. But after…?

Also noting Aussie cut rates — 4.1%, whereas likely RBNZ will drop to 3.75%. 0.35% rate gap.

Finally, credit card delinquency rates — ticking up — not near 2008 levels yet, but it’s getting there…

NZ

Bit to digest — goodbye to John at EBOS, who presided over a fairly excellent run. Stock traded in the 20s when he was appointed in 2018, now sits around ~41. He always had a good head for numbers and at ASMs I was always impressed by how well he knew every single detail of the business — the kind of CEO a company wants!

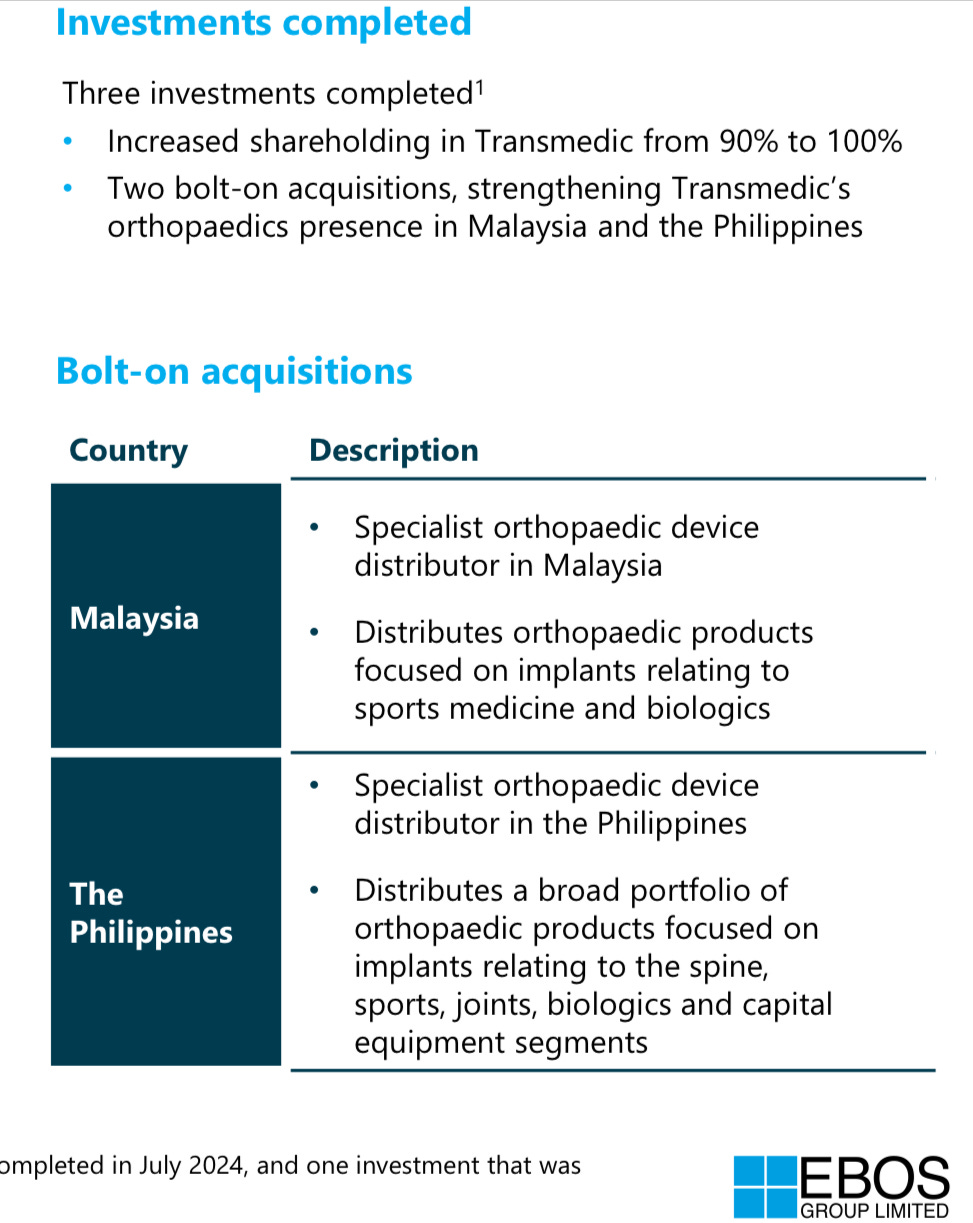

HY results — about expected — underlying EBITDA up +7.1% excl. Chemist Warehouse, revenue +9.5% excluding the same Chemist Warehouse contract. The question now, of course, is what does EBOS do post-Chem Warehouse. I think the slide below for Transmedic (now a 100% owned EBOS company) speaks to where they’re heading…

NZ Windfarms — no surprises here, Meridian buying the whole lot. Implied price over double previous NZ Windfarms stk price. I think this speaks to the fact that so many NZ small caps are undervalued — as I’ve said before, you could throw darts at a board of ‘em and find likely M&A targets. What could be next…?

Fletcher — Feels like the first release in ages where there wasn’t a write-down. Of particular note is their Higgins business, which performed quite well — some good news for FBU owners who have had a decade or so of bad news.

Why booze stocks are so cheap (part 1002)

See below from my cutting edge AI1, “Eden GPT”.

Now, I do not think Brown Forman will return to 32x earnings anytime soon — if ever — but if you even half the implied return from multiple expansion you still have plenty of upside.

Ditto Remy — I do not love Remy because Cognac, for lack of a better term, is screwed. But there’s still obviously value there and it trades on a very depressed multiple — what’s to say the family has had enough and finds a buyer?

Finally, Diageo. Less upside but more certainty — Guinness sells very well among Gen Z while their spirits portfolio continues to ebb along, if only growth in the low single digits.

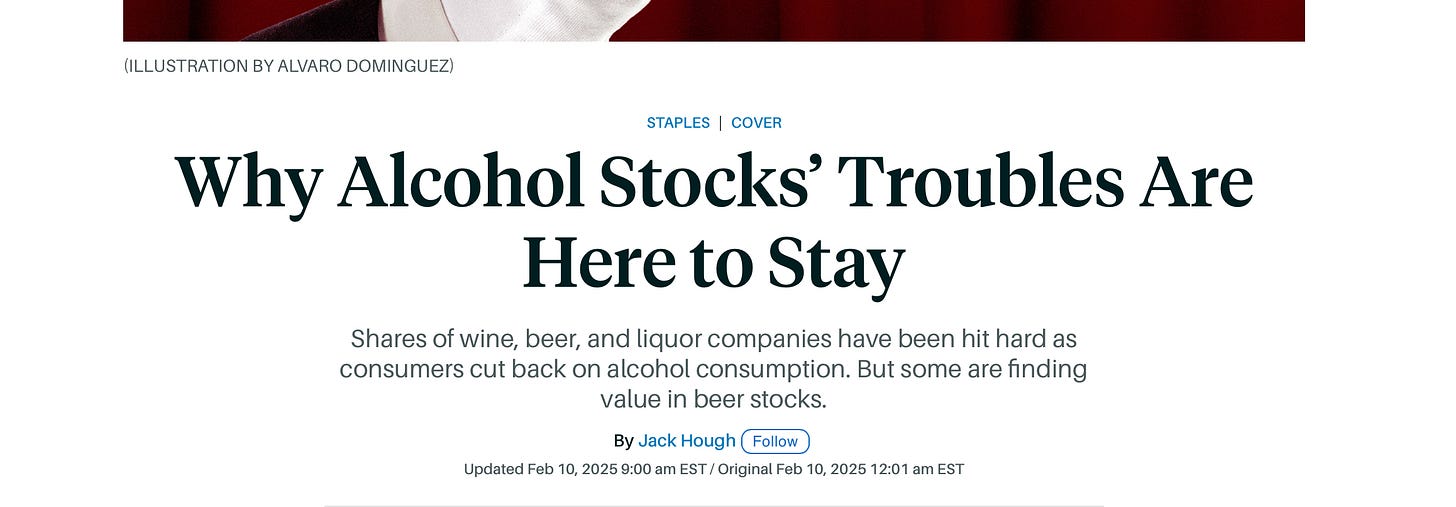

Valuations always tend to normalise, especially for companies which make staples. Paying 30x earnings was always too much — I used to look at Brown-Forman enviously, and wish it were cheaper. Well, now it is! And nobody likes it. Here’s a couple of headlines from Barron’s:

I love to go counter-consensus to the media, because usually that’s a sign of peak pessimism. Here’s some headlines about Meta when everyone hated the stock in 2022/2023:

Obviously, the booze stocks are not Meta — Meta is a cash flow machine! Zuck wears a gold chain! Zuck would like us to know he is a Cool Guy!

But still — price drives narrative. Everyone was dissing Meta in 2022 (and I felt like an idiot buying it), now they love it. Ditto booze stocks. People aren’t going to stop drinking. That’s it. That’s the thesis.

Pen and paper