Have you heard the one about the oil prospector...

Or: what I've been thinking about this weekend

I’ve been re-reading speeches Buffett gave to his inner circle back around ‘08 and also around the time of the dot com bubble (I have them in a bound clear plastic folder, there’s a bunch of Graham in there too). One thing I’ve been thinking about is the obvious: valuations for some companies have been bonkers, and due to the way indexes are weighted indexes like the NASDAQ and S&P also look bonkers in terms of valuation. TSLA regularly trades north of 100x earnings, for instance.

Now, the way I think about price to equity ratios is simple. I try and imagine I am a small prospector with a little inheritance from my father, and I’m going around looking at different places I could put my money to work. If I were to buy a company at 100x earnings and it never made another penny more than it already makes now, then I’d be waiting for 100 years to make my money back.

Obviously that isn’t a very compelling case. For one, I’d likely be dead, and two, perhaps there’s a farmer down the road with a farm selling at 12x earnings. Well, I’d be only waiting 12 years for my money. And perhaps I can increase the yield of the farm — buy some new tractors and so on — install some k-lines — then saying it’d grow at 10% more or so in terms of earnings a year I’d be looking at quite a good return on my investment. On the other hand, even if I purchased Tesla at 100x earnings, I’d still be waiting a long while — even at the quite modest 10% growth.

The current market reminds me of that old story about St. Peter.

An oil prospector, moving to his heavenly reward, was met by St. Peter with bad news. “You’re qualified for residence,” said St. Peter, “but, as you can see, the compound reserved for oil men is packed. There’s no way to squeeze you in.” After thinking a moment, the prospector asked if he might say just four words to the present occupants. That seemed harmless to St. Peter, so the prospector cupped his hands and yelled, “Oil discovered in hell.” Immediately, the gate to the compound opened and all of the oil men marched out to head for the nether regions. Impressed, St. Peter invited the prospector to move in and make himself comfortable. The prospector paused. “No,” he said, “I think I’ll go along with the rest of the boys. There might be some truth to that rumor after all

It stands for both the gold bugs furiously buying gold and the tech investors furiously spending on AI. There’s this remarkable thing about people that we follow others.

Back to the indexes. It may surprise you know that there are companies within said indexes that trade at quite reasonable valuations. For instance, Brown-Forman trades around 16x earnings. A few years ago it traded at a far higher multiple. The business hasn’t changed much: they sell a lot of Jack Daniel’s, and people still drink Jack. The market soured on it because people believe that people are drinking less. I invite those people to come by Ponsonby Road, or the Viaduct Habour on a busy Friday night. I can assure you, people are still drinking.

Or take Novo Nordisk, a component of the NYSE 100. Novo is trading at 16x earnings. Its stock price has roughly halved in the past 6 months. The remarkable thing with that is Novo’s business has not changed — it sells a lot of diabetes and weight loss products (WeGovy). Here’s Bloomberg’s projections for the next few years, as well as actuals since 2020:

I don’t know about you, but those numbers look pretty good to me!

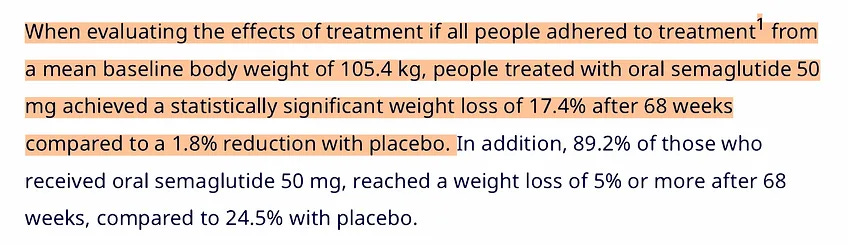

The market is worried because Eli Lilly1 had successful trials of an oral weight loss drug (it’s worth pointing out here that Novo is not a one trick pony — their diabetes segment accounts for a lot, too). But here’s the results of Novo’s oral weight loss drug trial:

Lilly’s comparator drug saw only 7.9% weight loss. So Novo’s is rather a lot better. And you can buy that drug pipeline for 16x earnings.

A digression — I suspect a lot of this is due to how “pod shops” work. What is a pod shop?

Well, imagine a sweatshop, except everyone is paid very well and there’s little teams of different portfolio managers, with their analysts and so on. You’re in a “pod”. You probably focus on one very specific sector, and your P&L is of daily concern — if you look like you’re gonna have a 7.5% drawdown, you’re going to be stopped out. If you exceed that, you’re at risk of losing your job. Your big boss probably looks like this:

This is Izzy Englander, who heads up Millennium — one of the biggest pod shops. You can probably imagine what it is like to work at one of these pod shops: immense stress. If you cover pharma, and you own Novo, you’re going to see everyone else buying Lilly and then you’re going to go — shit, I need to buy more of that so my P&L looks good. This is obviously a pretty bad way of thinking about investing in the long term, but the pod shop’s end product is focused on delivering investors a “safe” and stable return — if one pod underperforms, there’s always another to take their place.

There are, of course, inherent risks with that. I don’t think it’s a good way to go about business because you’re really reacting to short term market movements rather than the underlying value of the business. The resulting flows to or from a related equity can make it underperform in the short term. It’s a great thing for individual investors to take advantage of — because they don’t have the pressure of Izzy Englander, etc. There’s no Madame Guillotine to worry about.

Reminder: you can now invest alongside me

You probably already know, but for those at the back, you can now invest alongside me as I’m delighted to be co-portfolio manager of the Elevation Capital Global Shares Fund. My first order of business is driving long-term performance (I really urge you, if you’re going to invest, to think in years, not days). My second is getting out there and meeting as many of you as I can. If you’d like a yarn on the phone, flick me an email. I’m not in some ivory tower — you don’t need to have a Black Amex!

Most of my writing is now available exclusively for Elevation Capital subscribers — you can subscribe here. (Either invest in the fund and get all my content (including stock-specific research) for free, or you can pay $200 and get it per year).

You can invest alongside me here:

Listen, I’m not saying put your life savings with us — consider this an uncorrelated investment in a global basket of shares that you can hold in addition to the rest of your portfolio. Over the long term, I’d like to be able to say we made you money at a rate higher than the market.

We’ve had some nice pieces of press lately. It’s a funny thing, seeing your name up there like that. Myself and the team are beyond delighted.

The Elevation Capital Global shares funds both Novo and Lilly, because I think it’s best to own both sides of the trade here — you can have two winners. However, I think the Novo is better value hence why we own a lot of Novo than we do Lilly.