There’s only one way to start this — Hello, I am now part of a fund manager now! And if you like what I write and how I invest, then you can even invest in the fund — The Elevation Capital Global Shares Fund.

A little backstory — I started my career as an analyst at Elevation Capital, working for Chris Swasbrook. I first met Chris when I was 24, almost a decade ago (I’m getting old). I emailed a few fund managers and he was the only one who replied — also, he was the only value investor I could find in New Zealand. I sent him a report on Williams Somona and he replied, with his trademark almost-unreadable writing1 with “very good’ (Williams Somona wasn’t a bad pick, it’s up +480% or so since). I got to know Chris, and eventually I started working for him.

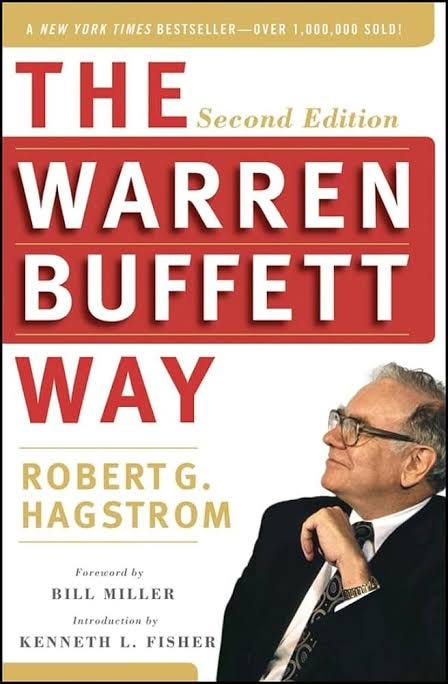

Almost a year ago Chris suggested that we should consider working together again at Elevation Capital. Being an owner in a funds management business is the dream of every boy who picks up a copy of The Warren Buffet Way at the Caroline Bay Carnival in Timaru, right?

So of course I jumped at the chance. Working under Chris I developed my research skills, writing here at BlackBull Research and interacting with the market has honed me in many ways; when I started at BBR we had about 300 of you reading this. Now there’s almost 10,000. Never in my wildest dreams did I think so many would read my notes — and certainly I never thought I’d have the honour of being an owner in a funds management business when I was that 11 year old at the Caroline Bay Carnival who became enamoured with The Warren Buffett Way and the old man on the cover.

The book that started it all…

Yet here we are. I’m beyond excited — I want to invest in stocks, write about them, and manage money until I am very old. I do not dream of having a Ferrari or a yacht — I dream of being as old as Charlie Munger was and still being sharp as a tack. There’s always something new to learn.

Here’s the deal: I’m going to start writing my almost-daily emails exclusively for Elevation Capital investors and subscribers, at

(for those not ready to make the jump, don’t worry — I’ll be writing a couple more general emails here a week; for my institutional readers, you can always pay and subscribe to Elevation Capital Research). To my mind an investment in the Fund is a double-win — you get to grow your capital, and read what I have to say. There’s not many funds in the world where the portfolio manager communicates with their partners on an almost-daily basis. You can expect the same frank, down-to-earth remarks that I make here. I’ll also be putting out longer research reports on the Fund’s holdings.Why am I doing this? You know, I grew up in Oamaru. It’s tiny. There’s about three pubs and a lot of farms on the outskirts. In the course of writing this newsletter, and making instagram and TikTok videos, I’ve met many of you and emailed with a lot of you. Here’s what I’ve learnt: there’s a whole lot of society and the country that doesn’t particularly like the jargon-heavy suit-and-tie old-boys-club way of investing and communicating. As I’ve always maintained, investing is when you buy a portion of a company at a good price. The jargon? I’ve no time for that. McKinsey? Even less (look at their work at The Warehouse and Spark and judge for yourself…)

There’s a lot of you who like how I speak freely, don’t pull punches, and don’t write in unreadable nonsense. Some of you are managing directors, CEOs, lawyers; others are farmers and tradesmen and artists and chefs and everything in between. That’s what I want to keep going — I want to continue to build Elevation Capital as an investment firm that is for everyone, invests with common sense, and isn’t afraid to call it like it is.

That’s why we altered the motto of Elevation Capital with this transaction to Independent Thinking | Common Sense Investing. Common sense is all too rare these days. I don’t pretend to know about crypto or some complicated company — what I do know is that a company like Universal Music Group will continue to control ~30% of the world’s music and reap the royalties from it — it’s an inevitable — I am pretty sure people will never stop listening to music. There’s a lot that will change in the next few years. AI, automation, those are all real. I’m interested in what won’t change — “inevitables” — music, luxury, alcohol, media, franchises like Formula One; companies that make money no matter what, like Visa and Mastercard.

The fundamentals of investing don’t ever really change. You buy a good company with good management and you hold it for as long as you can. In the long term, market shocks and crashes don’t really matter. $1 invested in the US stock market in 1870 would be worth’ve been worth $28,916 and the end of 2020. All those drawdowns — the Great Depression, the GFC, dot com mania — none of them really matter in the long term.

We’ve seen a lot of market volatility with Trump’s tariffs, and some people are acting like the sky is falling down (they’d do best to remember the story of Chicken Little…). Personally, I think there’s no better time to invest when stocks are on sale (my “pitch” for you to invest in the Elevation Capital Global Shares Fund: you can buy a fund when the market is down — so you get all these companies at a discount — and you get my daily notes. My money is where my mouth is — the Fund is where I’m now investing2).

We’re investing for the long term, and if you invest with us at Elevation Capital, that’s what we’ll be doing. I have no idea what will happen in a month, or two months, and so on. I do know that the companies we own will continue to be world-class and continue to generate significant sums of cash. I have no trouble sleeping at night thinking about that. Many of the companies in the portfolio are names you know because I talk a lot about them here — Hermes, Brown-Forman, Novo Nordisk, Alphabet (Google). All of the companies are ones I know well — they all are companies you could explain in one sentence to a five year old — no bamboozlement here.

I didn’t get here on my own. I’ve been lucky enough to have an incredibly smart team of co-investors who came along side myself in acquiring a majority stake in Elevation Capital — Michael Walker and Selwyn Loekman, who co-founded BlackBull, have made a significant investment in the acquisition of Elevation. I’m incredibly grateful to those two — they’ve backed me since day one here at BlackBull and have done a fabulous job growing BlackBull Markets. Ian and Teresa Pollard have made a significant investment as well — Ian co-founded Delta Insurance and is likely one of the best insurance underwriting minds I’ve come across (those who hear Buffett sing the praises of Ajit Jain, his insurance guru, will know just how valuable having an insurance mind is). Ian will join the board as Director. Chris, of course, will stay on as Co-Portfolio manager and as a Director whilst retaining a stake— his wisdom is invaluable and his knowledge of NZ financial markets probably only rivalled by the late Brian Gaynor.

Two friends join me too — Sam Thackery has been at Elevation for some time and can do the work of three coders in one. You should see the new investor portal he is building for us! Dylan French, who is head of risk APAC at BlackBull, joins alongside him. Dylan is my “no” man. Sometimes yours truly has an investment idea, and Dylan goes “NO”. Generally he is right, and the things we agree on tend to do well. You can think of him as a tall (and just as dry) version of Charlie Munger with far better quant skills. Both have purchased a stake in the company and I can’t wait to get started with the both of them.

Soon we’ll be hitting the road, doing roadshows and meeting you all (bring your friends and family!) — we’ll be going to the far North and the far South — expect a town hall in Gore and every other place. I think it’s essential to get out there — share a drink or a cup of tea with you all — and have a good yarn. That’s what it’s about, isn’t it?

If you’d like to invest alongside me, you can click the link below. Send me an email if you have any questions. I look forward to meeting many of you out on the road.

Yours truly,

Eden Bradfield

Never trust an investor who doesn’t invest alongside their clients — the more your interests are aligned, the better. The same goes for company directors.