Briefly noted

Crude Oil — sitting flat, markets not panicking about Israel/Iran yet…XAUUSD at 2,324…

Apple — iPhone shipments down 10%…uh oh, what happens when you don’t innovate … who is buying the Apple Vision Pro ?

Asahi — aiming for 50% of all sales to be in the non-alcoholic component…

Droneshield (DRO.ASX) — Up 12% as of writing…we said this was an interesting speccy situation a while ago…obviously is up on the prospect of escalating war

Roman’s revenge

Some Roman Empire thoughts to start your day — Eileen Power on the decline of Rome (from Medieval People)

“How could they imagine that anything so solid might conceivably disappear?”

Does it strike a chord? Here we are — in our world of solid buildings, unfathomable luxury, nigiri sushi that can be delivered within 20 minutes or so. This is not all doom and gloom but it is sobering to remember that even the most solid societies crumble. We are currently within the cult of the S&P 500 — if you pay attention to any finance “influencer” they will tell you that the only thing one need do is allocate entirely to the S&P 500. This is wonderful, but only factors in 100 years or so of stock market data — data which still sees significant drawdowns — see below:

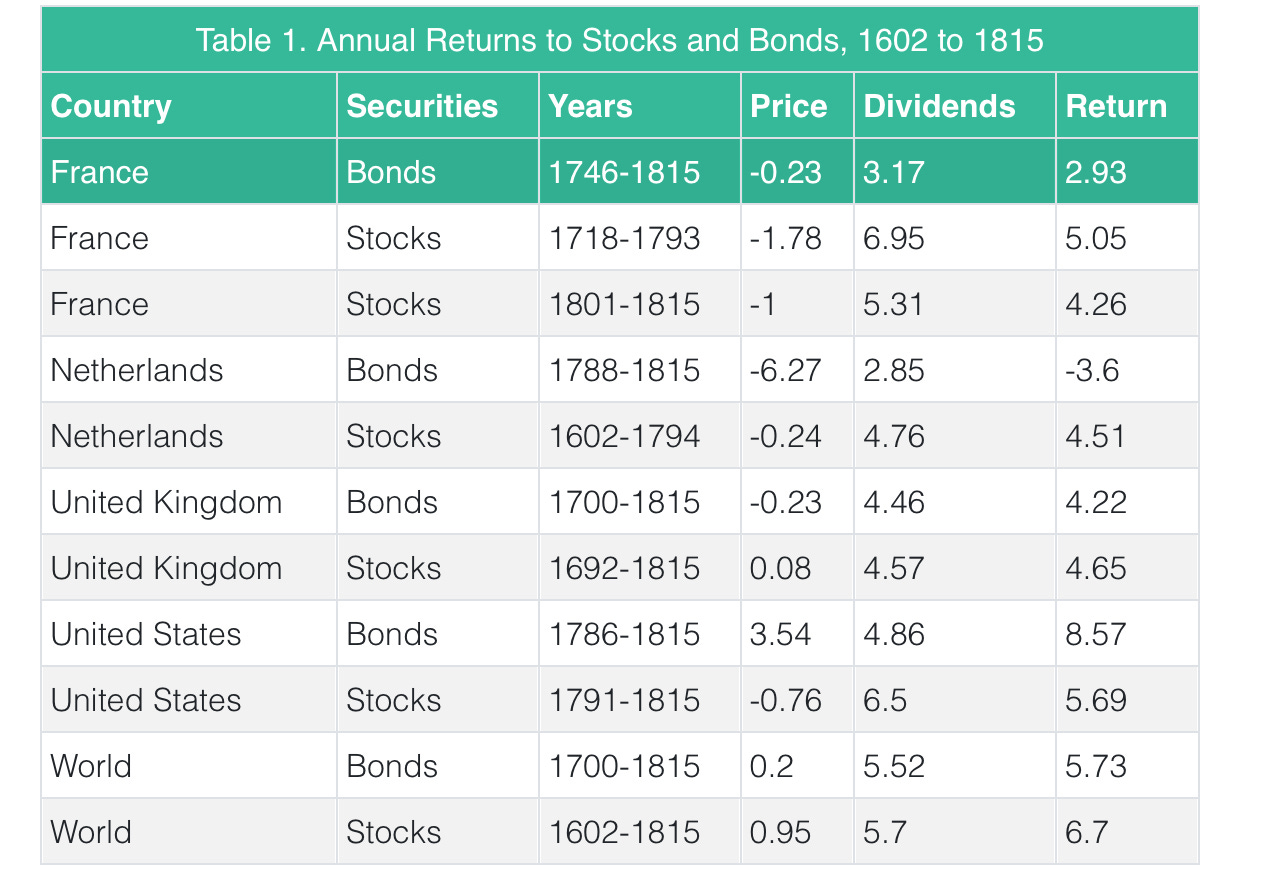

This is relatively unusual. We had stock markets in the 1700s. They didn’t return as much as the S&P has on average. On average, the capital gains stocks returned from 1605 - 1815 was a mere 0.95% (the rest was capital returned via dividend). Expecting the 10% heuristic that is invoked by the S&P 500 is perhaps irrational and asking for too much, on the scale of hundreds of years.

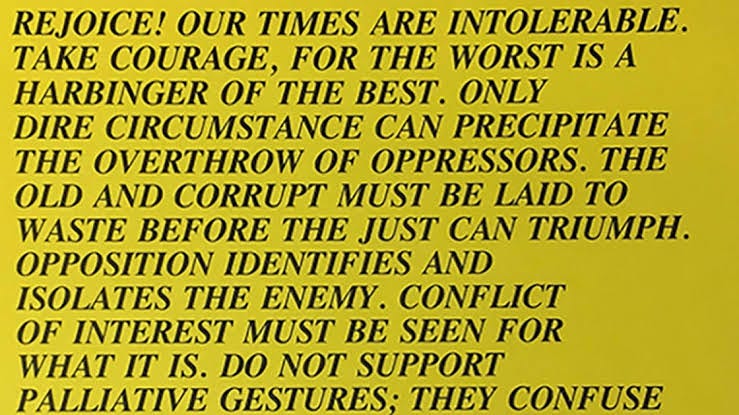

We are living in interesting times. Global conflict is getting worse. The US is involved in two proxy wars — Israel/Palestine (and now Iran) and Ukraine/Russia. They aren’t slowing down. We have the very real possibility of a Trump presidency. This is not a “doom is coming” post (I swear!) Rather — it’s a question — should we consider the last hundred or so years of US excellence, and should we wonder if that is likely to continue? I wonder if the Romans realised they were in the decline of their while they lived in arguably the best conditions that anybody had know up to that point. It all goes to zero. As per Jenny Holzer — Rejoice! Our times are intolerable!

NZX — banned words

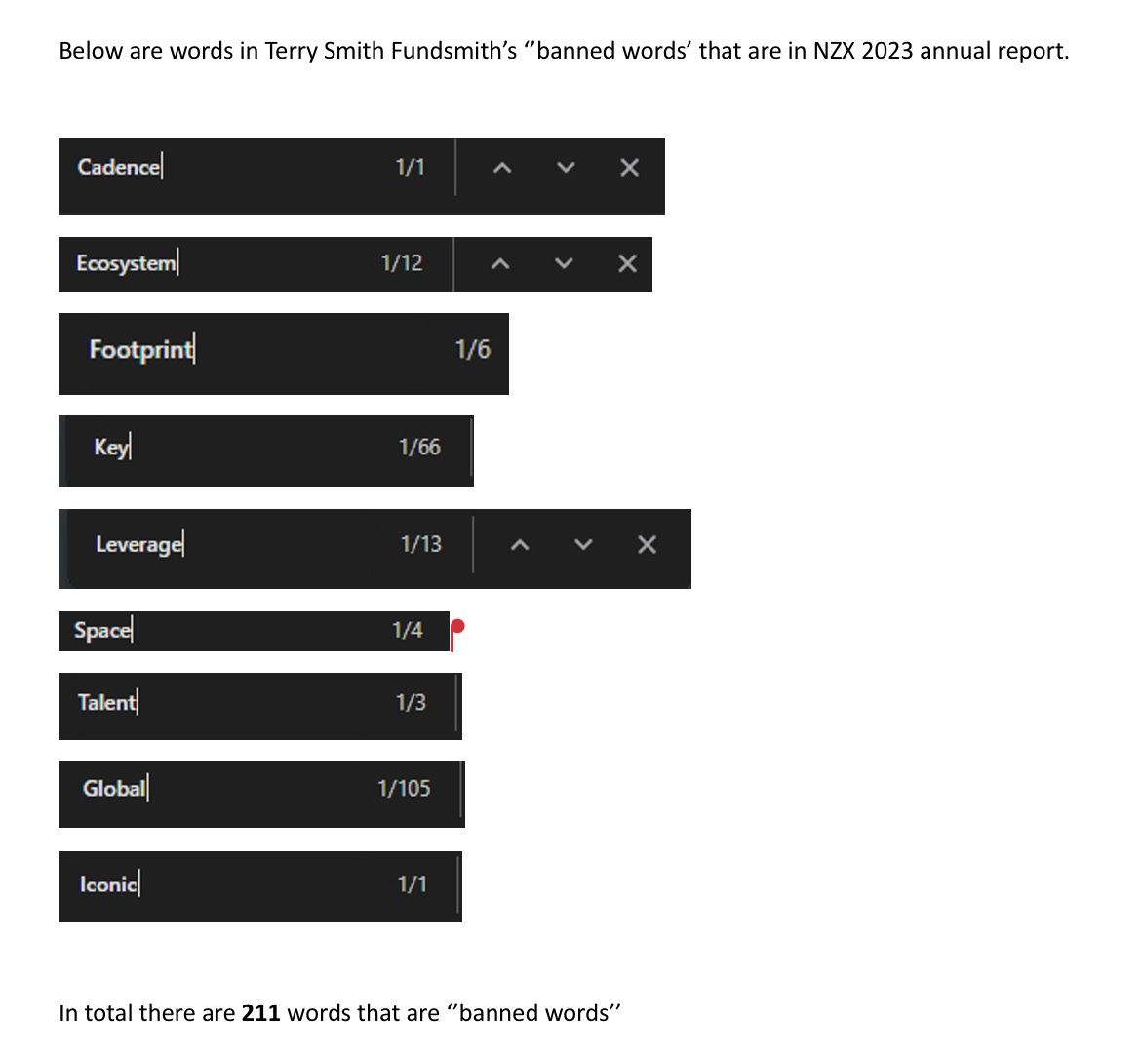

One of my favourite pieces of writing is Terry Smith’s list of banned words. Read it here. I am not going to shut up about the NZX until at least the ASM on Thursday, because the +38% increase proposed to the director’s fee pool is one of the worst examples I’ve seen of the dreadful “institutional imperative” in a while (remember when Coca Cola bought a shrimp farm?1). There is no reason the directors should be paid more, and there is very little justification for it. Anyway, we were curious how many banned words they used in their last report. Answer: a lot.

You won’t find that kind of propitiatory data anywhere else! Cutting edge analysis — you heard it here first ya’ll.

Thames Water

I’ve written about Thames Water at length a few times … the story is i) Thames Water privatised and Macquarie was the main owner ii) Macquarie and co paid themselves more dividends than the water utility could generate in cashflow iii) they did this by loading up on debt iv) Macquarie bailed and then sold it to other pension funds and so on the new companies did the same rinse and repeat process vi) Thames Water couldn’t pay its debt vii) Thames Water defaults, and its owners say “no no, this model is now not viable for us”.

This is actually what has happened. The UK regco demanded that Thames Water’s owners slash their enormous debt pile from 80% to 75% by 2030 and invest +$8bn in the company’s infrastructure. The owners of Thames Water responded - remarkably — by saying oh no the company is uninvestable!!

I mean — it’s the economy, stupid. Of course the company is uninvestable — it’s been loaded with debt and stripped of value — what do you expect? The owners of the asset went on the say — well, we’re happy to write off the value of our “investment” — thank you, goodnight (while Thames Water claims it has not paid dividends since 2017, it has paid £200mn in dividends to associated companies within the Thames Water group).

This is the risk private equity poses. It is all very well to pay our cash flows from an asset, but the if you strip the whole thing clean and load it with debt there are no more remaining cash flows to pay anyone with. There have been murmurs in New Zealand about privatising our water infrastructure — buyer beware. Three Waters was always flawed…but I’d rather not a Thames Water-type disaster happen.

Hong Kong Shanghai Hotels

A very detailed write-up from Andrew Brown on Hong Kong Shanghai Hotels here. Hong Kong Shanghai Hotels owns The Peninsula Hotels as well as a number of high quality assets — it has been a component of our Global Model Portfolio for some time (much to our disappointment — it is hardly the best performer!)

I am a sucker for assets where there is hidden value. I attribute it to my being dragged around by my mother and grandfather to garage sales as a small child. Hong Kong Shanghai Hotels is one such asset — it trades at a 76% discount to NAV per share, so even if I am wrong by a wide margin on the undervaluation, I still have a lot of rope left to hang myself with — I am buying $1 of assets for 24 cents, but even if that figure is not correct I’ve got an incredibly wide margin between 24c and a dollar. I like those odds.

Aussie update

+3.63 CYTD vs +3.59% our benchmark (S&P Aus 200)2.

Hardly much to write home about — very slight outperformance that has been mired by a few laggards. Droneshield has appreciated +85.92%, while QBE has appreciated 21.75%, Uranium 16.78% and NextDC 14.68%. On the other hand, laggards are Duratec (-21.05%), DGL (-10.05%) and Lynas (-10.75%). You will recall that last year DGL and Duratec were star performers for us — what happened? Well, DGL had a hard knock from less-than-stellar results, while Duratec is well off its Jan highs of $1.70. Not particularly concerned with either of those — I hate to see red in the portfolio, but it happens — “the money is in the sitting on your ass”. DGL trades at 11x P/E, 9x EV/EBIT, and 0.7 P/Book. It is pretty cheap on those multiples. Duratec is also relatively good value — it trades at 10x EV/EBIT and 0.6x EV/Sales. I see no reason to cull them in the portfolio yet.

As Buffett is always saying — if you love steak at $20.00/kg, you’re going to love it at $15.00 per kg.

Lynas is another story. The demand for rare earths and lithiums is slowing. Tesla recently cut the output of production at its Shanghai plant, while Abermarle, Australia’s biggest lithium producer, cut its forecast citing weaker demand. On the other hand, I note that Twiggy Forrest and co are putting more money into lithium than ever — I suspect that Twiggy (and Gina, she of the bad meme book and billions) know more about the future of lithium than I will ever. So, I defer to their actions. I am not optimistic for the future of Lynas in the short term.

Uranium continues apace. There has been no change in the supply/demand dynamic. If anything, the rise of “AI” everything means that the demand for an efficient source of power is more than ever (Next DC’s CEO mentioned this recently — all that compute needs to be powered!). QBE continues to be in fine fettle — gross written premiums increased to $21.7bn while investment income increased to $1.4bn (US). Favourably, cash return on equity increased +16.00%, while funds under management sat at $30.1bn. More importantly — as we have seen with Tower and so on — the catastrophe claims ratio sat at 6.6%.

We probably will add to our DGL and Duratec positions. The business case has not fundamentally changed. Otherwise, all quiet on the western front.

When he ascended to the company's summit in 1981, Coke executives expected the beverage business to increase earnings only 3 or 4 percent a year. Seeking growth elsewhere, the company acquired such busineses as the Taylor wine company, a shrimp farm, a pasta manufacturer and a plastic-cutlery operation.

At first, Mr. Goizueta continued that strategy. A year after he took the helm, seeking a strong year-round performer, he bought Columbia Pictures.

Gross of fees, trading costs, etc — it is a model portfolio