Is Unilever, the most boring stock in the UK, now interesting?

Plus: Miu Miu, Prada, and the NZD/JPY

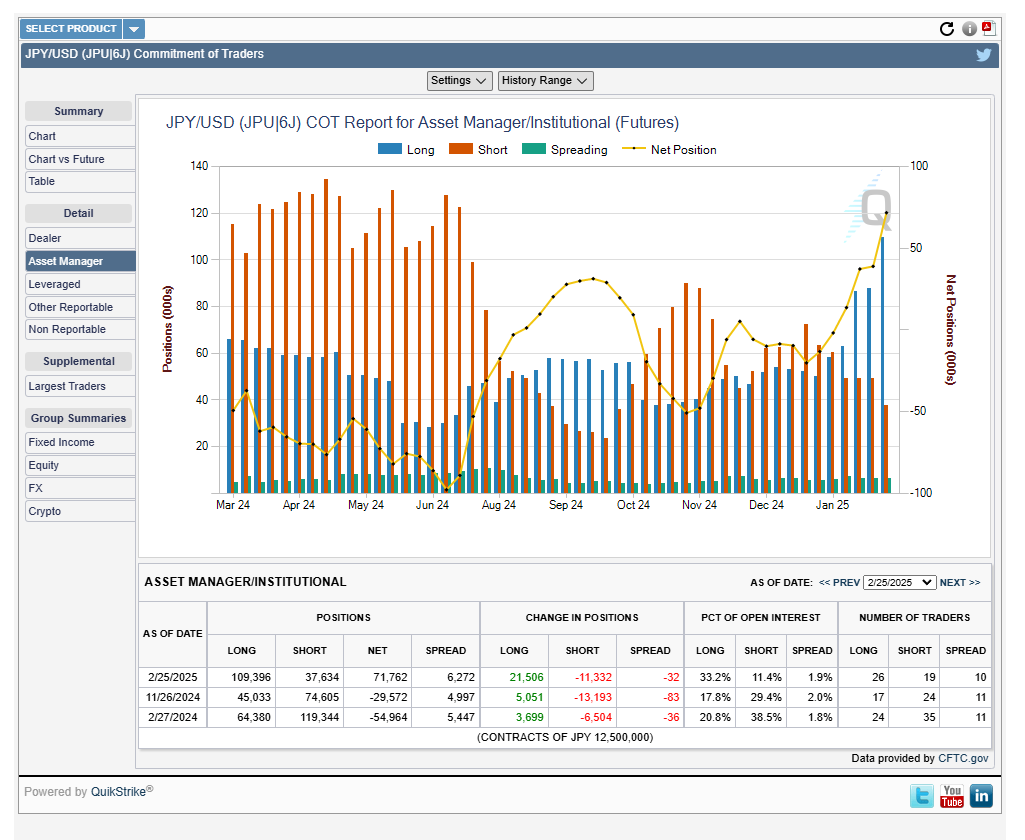

NZD/JPY

Noting institutions are going heavily long yen and heavily short NZD. Might imply a reversal to long yen (that “safe haven currency”), and may impact the high-beta currencies like NZD (and the Aussie).

With Trump’s tariffs, I wonder how the US dollar will fare…you’re kidding yourself if you don’t think this leads to stagflation…70’s redux…

Talkin’ ‘bout Unilever

Unilever is one of those stocks I’m aware of but have never had much interest in — it’s a large conglomerate that makes very boring things, like Dove soap (they also make Ben and Jerry’s ice cream). However, the great thing with boring companies is that they’re fairly predictable — if you think about companies that are inevitables, I guess Unilever is one of them.

The stock has done nothing for five years. The company had Paul Polman as CEO from 2009 – 2019, and the company did very well. After Polman stepped down the company entered into stagnation. There was nothing wrong with the company, per se – it just stagnated, and margins were largely boosted by price increases rather than organic growth. There was also the mistaken pushback to Polman’s “woke” ethos1 – from 2009 – 2019 the company roughly quadrupled in value. Subsequent management did not do this. “Woke”, works, in this context – Ben and Jerry’s has been one of Unilever’s fastest growing brands.

What are the catalysts to buy this company now?

1) New CEO. Fernando Fernandez – described as a “human tornado”. He has a mandate from the board to turnaround the company, which includes spinning off divisions.

2) The big issue here is the food division – it’s lower margin and on a peer basis is valued at a lower multiple. We need to start there.

3) The company has signalled it intends to spin-off its ice-cream unit, likely as a new company. The ice-cream unit renders around ~8bn in sales, and holds a 20% market share globally. That’s value, and the new co should list at a +2x revenue multiple, which implies a +16bn EUR valuation (analyst estimates are around +18bn)

4) I believe the market doesn’t truly value the ice-cream unit as it stands (as part of a conglomerate). Much like the listing of UMG (ex-Vivendi), I expect this implies +10bn upside.

5) You can find comparators with other consumer spin-offs, like Haleon and Kenvue – Haleon has appreciated +29% since listing, while Kevnue has appreciated +25% in the past year.

6) Management’s metrics are tied to indicators I like, like ROIC. Under Polman, Unilever had a +18% ROIC. It currently sits at 11% or so. If management can move the needle on this (by divesting, focusing, and leveraging their highly profitable units), then shareholders will see the compounding virtue of ROI.

I still have some pause — it isn’t that cheap for the UK market, so you need to consider the differential between the US (and those US listed consumer companies) and the UK. Then again — if you consider the spin-off of the ice cream business reducing the lower-margin food business portion of Unilever’s revenue down to about 22%, then there’s a case to be made for multiple revaluation…

Prada

Prada — here’s a luxury story that’s outperformed peers in recent times — sales up +17% in 2024 — Miu Miu drove sales a remarkable +25% (+93% in Q4 alone!). It’s been a long, funny life as a publicly listed company for Prada — they listed on the Hong Kong exchange in 2011 and the stock surged, and then sat flat for ages, going sideways. There was a lot of doubt if the Italian family-controlled fashion house could grow — it’s a lot smaller than LVMH, Kering etc, and there’s a lot of focus on only a small clutch of brands (plus, the company had a disastrous foray into buying Helmut Lang and Jil Sander). And yet — here we are — in a year of recession for most of luxury, Prada, like Hermes and Brunello, has shined. Not least thanks to growing Gen Z demand of Miu Miu — I keep saying this, but it’s not enough to only sell to your 1% old-timers — you need to sell to the market with growing wealth. Gen Z, baby.

27x earnings — down 6.00% today. I avoided this stock for a while — maybe to my detriment? But now I am starting to think — is it dumb not to own Prada?

Consider also the rumored +US$1.5bn bid for Versace, Prada’s fellow Italian competitor. Capri Holdings owns it now — they haven’t grown revenue. I had to pause with the idea of chic, intellectual Prada buying Versace — brash, bold, a little tacky. Yet if anyone can make it work, it’s Prada…

Kering — I know I have been harping on about this one for a while ‘cos the Gucci and Saint Laurent owner is trading well under five year lows, but this little tidbit from Lauren Sherman’s excellent newsletter, Line Sheet (at Puck) — some validation!

I was told by one trusted industry source to buy Kering stock because it’s going to be a sure-bet designer—such as Hedi Slimane—but others keep pointing to lesser-known, yet still formidable candidates. Dario Vitale keeps coming up, despite his conversations with Versace. One thing to remember is that no Gucci designer has ever been a name before they started at Gucci, so a known entity would be a departure from that. Anyway, as my partner Bill Cohan likes to say, this is not investment advice.

Not investment advice, but you know — buy ‘em down and dirty, and ride ‘em high…I always remember how Walter Schloss was prone to look at companies trading at five year lows. That’s Kering for you…

Terry Smith famous railed against Hellman’s “woke” mayonnaise.