Max Stupid Melt-up with Cheese, please

I wrote earlier this week of what I term “MAX STUPID”, though I’m sure proponents of efficient market theory nonsense would say “MAX STUPID” is just the market pricing in the “real value” of Exciting AI-linked ventures.

Anyway — where are we on MAX STUPID??

Well, China announced stimmy (it’s all about the Yuan, baby) and as I guessed, there was something of a melt-up in luxury stocks like Kering. See my detailed technical analysis below:

This is great for us and our clients, because I have been telling you to own Kering because it’s so cheap for ages. It re-rated from 13x earnings to 15x earnings over a matter of days — all on the back of a China stimulus announcement.

Money printer go brr.

Now, look — I think we can all remember what happens when you have too much stimulus. Remember the last time we turned on the money printer (over in the US and here in NZ and most other places) we experienced inflation. But I’m not being nuanced enough, actually — even though the PBoC is issuing around 1.5% of China’s GDP worth of bonds, the more interesting thing is the uh, very Japan-like measure that is being used for sustaining the stock market.

Quoth from The Economist:

More surprising were two new tools to boost the stockmarket. The central bank will help firms buy back their own shares by refinancing bank loans used for that purpose. And it will help securities companies, insurers and other institutional investors raise funds by making their balance-sheets more robust. They will be able to borrow safe, liquid assets like government bonds from the pboc, using their riskier, less liquid assets, such as stocks, as collateral. The combined size of these tools was 800bn yuan, Mr Pan said, although he could double or triple that limit if need be. “It is all possible,” he concluded.

Old heads will remember that the bank of Japan owns about 7% of the Japanese stock market1 (via ETFs). Now, China isn’t proposing to own the market outright, but when your largest (effective) debt-holder is the Bank of China, then there is not much of a difference between outright owning portions of the stock market or owning the debt of those companies at rates which make the state a de-facto owner of the company anyway. Either way, it’s money printer go brr.

Short term, then, this is a great boon for luxury stocks and associated companies of them — by way of how good this whole “MAX STUPID” thing is, look at this basket of companies — luxury, booze, cars, etc —

Also, look at regional equity inflows (via DB) — plenty of substance going towards the US and China.

The reason I call this all MAX STUPID is because, obviously, we are still in an economically difficult situation — we’re in a recession, stimulus or no stimulus — if you have any doubt, look at the accelerating delinquency rates, higher hardship withdrawals from KiwiSaver accounts, etc… or just look at the fact that China just desperately piled on a bonfire of stimulus…

But to borrow from George Soros, what we have going on here is reflexivity — i.e. if lots of capital flows into certain sectors, more people and allocators will follow the trend and more capital will flow on as a result.

I described it yesterday, mid-rant, as like this:

Imagine you have a pot of cheese sauce melting away. It’s boiling on the stove, it’s hot, it’s tasty — yum!

But then Dave from across the road wants some cheese sauce too and he adds some more to the pot. DAVE LIKE CHEESE, DAVE WANT SOME CHEESE.

The pot is getting pretty full now, and it’s boiling away. But hold on — Carol would like some cheese, too. Carol is adding cheese to the pot! CAROL LOVE CHEESE

Now we’re getting all a bit worried about the pot. It’s about to boil over. B-b-but — we need cheese?! Cheese, please?! MORE CHEESE. CHEESE! CHEESE! CHEESE! WE LOVE CHEESE IT ALMOST MAKES US CRY!

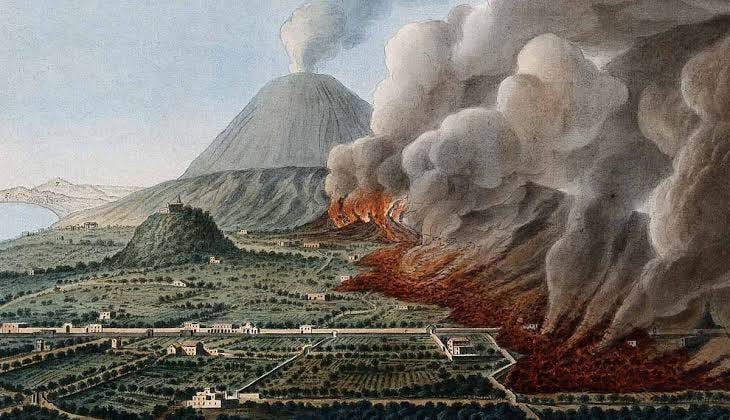

And then — all of a sudden — that pot of cheese boils over, overflows, it melts up. We’ve got a volcano over here, guys.

We are MELTING UP

Stocks only go up!!!

And that — I mean — that’s where we are, folks. Melt-up territory. Here’s a diagram of what I’m talking about:

We have multiple ingredients for a melt-up right now. We have:

China stimmy

The Fed cutting rates

The expectation that the Fed will continue to cut rates

AI nonsense hype

Oh yeah — with all that together — you’ve got yourself a melt-up, baby

But hold on — what happens after a melt-up?

A: A melt-down.

Economic fundamentals still matter. If you don’t think we’re in a recession you’re not paying attention. But, short term, could one ride the melt-up? Of course… follow the monkeys… reflexivity, really, is about following lemmings — but not going over the cliff.

Got it? Ok, cool. Stocks melt up, stocks go boom, etc.

https://www.esri.cao.go.jp/en/esri/content/e_dis376.pdf