Modelo! My Corona! LVMH!

It's a jam-packed Tuesday - plus Bremworth and Warners

Let’s talk about those booze stocks, then! What a way to start the day

Constellation Brands — Grandpa Buffett just bought +$1bn of this thing. They make Corona and Modello. I don’t quite understand why he bought it — but I’m trying to — if you want a pure-play beer stock, then Heineken makes more sense (seasonality is a big thing with beer, and as summer hits the northern hempisphere, you sell more). I have made a helpful chart with my cutting-edge software below:

By the way — just thinking about hempsipheres, here’s a true map of the world:

Heineken trades at 11.6x price to free cash flow, whereas Constellation trades at 18x. But the bigger thing with Constellation is they have a messy portfolio — there’s wine, spirits, and the Crown Jewels of the beer brands. Beer has grown tremendously, while wine and spirits has shrunk from ~$3bn in 201 to 1.7bn in 2024. You’ve seen sustained double digits shrinkage of the wine business, while beer has grown at +6% (now, remember that they’ve hocked off the wine brands piece by piece).

However, if you look at the number of units shipped, constellation has grown units shipped from 246,400,000 to 418,100,000 from 2017 to 2024. Modelo is now the number 1 beer in the US. So does this go back to what Grandpa is always saying — “never bet against the US?”

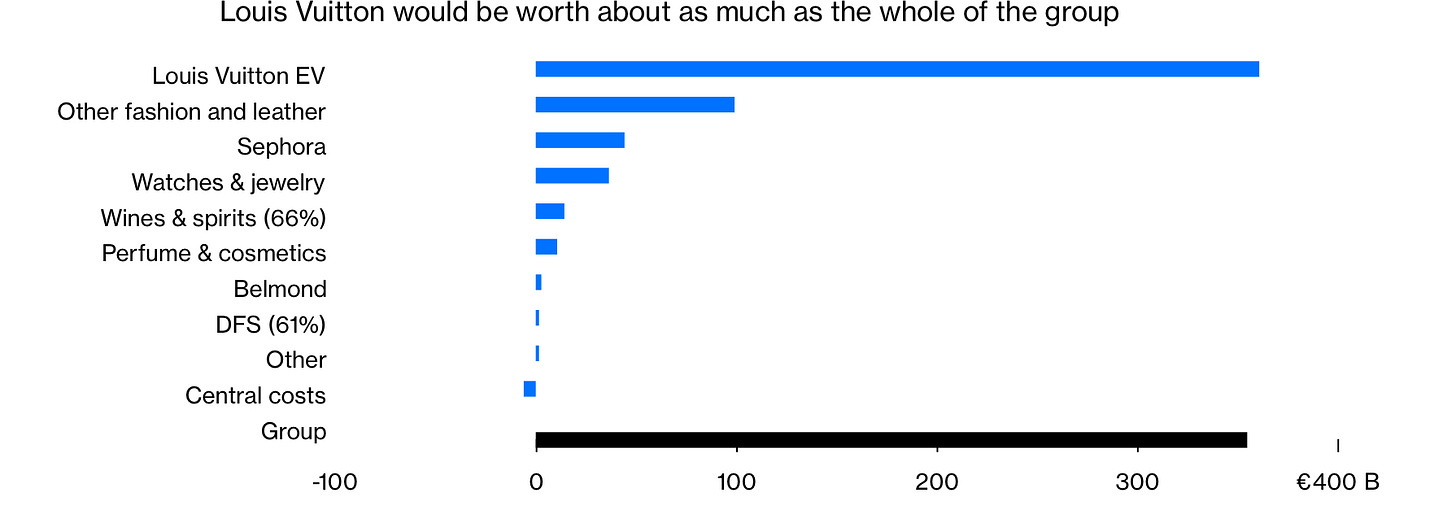

Also, tangentially, here’s a nice chart from Bloomberg on the sum-of-the-parts of LVMH. Basically, the core Louis Vuitton business is worth as much as the current whole:

There’s been murmurs they might divest Moet-Hennessy for a while. Champagne ticks along nicely, but nobody is buying Cognac (especially with — Trump voice — “tariffs”). A solution might be to distribute shares in MH to LVMH shareholders. Yet this is Arnault we’re talking about here — he has created an empire by being so big. Losing that size (even though it comes with a conglomerate discount), would be painful.

Some comic relief

I just love it when banks accidentally send too much money, like I don’t know, credit a client’s account with $81 trillion dollars. That’s what Citigroup recently did!

Citigroup credited a client’s account with $81tn when it meant to send only $280, an error that could hinder the bank’s attempt to persuade regulators that it has fixed long-standing operational issues.

The erroneous internal transfer, which occurred last April and has not been previously reported, was missed by both a payments employee and a second official assigned to check the transaction before it was approved to be processed at the start of business the following day. …

Citi’s $81tn near miss in April was due to an input error and a back-up system with a cumbersome user interface, according to people familiar with the incident. In mid-March, four transactions totalling $280 destined for a customer’s escrow account in Brazil had been blocked by a screen that catches payments that are potential sanction violations.

The payment was quickly cleared, but nonetheless remained stuck in the bank’s system and unable to be completed normally.

I mean, it’s kind of amazing — imagine if you wake up one day and you have 81 trillion dollars. You would be the richest person in the world! Your $280 transaction is now worth $81,000,000,000,000! Wow!

WBD

I’ve written a lot about WarnerBrothersDiscovery, I first wrote about it here1, and I’ve talked about it a lot in this newsletter. Long story short — giant monolith formed by the merger of Discovery and the spun-out Warner assets of AT&T2. The big issue was debt. They’ve managed to pay off a lot of debt — the company’s leverage ratio of 3.8x adjusted EBITDA is on its way to a ratio of 2.5x-3x gross leverage. They’ve paid a stunning 19 billion dollars of debt down in three years. This led to their CEO, Zaz, being probably the most hated man in the industry. But that leads to strong cash flow — I’ve said before WBD is like a debt product with an equity stub; now it is slowly becoming a pure equity play, with cashflow up the wazoo — the point to remember here is that Max, the company’s streaming service, is growing well — Max added 4.5mn subscribers, versus analysts expecting 2.5mn. That’s proof in the power of their content — their IP — and it is an indication that the company’s content can compete with Netflix.

Stock is up 49% in 6 months, and trades around 11 bucks. If Zaz can continue to reduce debt, the stockholders should be very happy3.

NZ

Painful trading update from the red sheds. WHS guiding a 14mn EBIT loss for H2, and sales for H1 were down 1.6%. I went to the Warehouse recently to buy a pool (the pool was great). It took ages to get someone to help us to get the pool. First we went to the concierge, who said oh maybe someone can help you. Then someone came 15 minutes later. What would Stephen do (WWSD?!)

Noting mortgage arrears are at an eight year high. There’s fairly unpleasant early KiwiSaver withdrawals reading here. “There is no recession in NZ”?

Bremworth — I’ve kept an eye on the often-struggling carpet company, largely because I think it could be an interesting arbitrage — the co has announced a strategic review, and it has said there’s been multiple approaches made by interested parties. Anyway, here’s Rob Hewett talking about doing a full board takeover and rolling the board. I wonder if this a prelude to a full takeover…? Speaking of preludes — here’s the greatest pianist of our generation, Solokov, playing Rachmaninoff Prelude in G Minor:

Aus

Wisetech continues to drop — $90.00 now. Richard White is by all accounts a very difficult individual. But the revenue growth is hard to ignore…just saying…if you have a strong stomach…

DGL — Ok earnings last week, but the stock fell sub 50c. That’s deep value there ‘cos you can buy it at 0.39x price/book. And they’re paying back more debt! You can also buy it for 8x fwd earnings. It’s a very ugly, boring stock, but it reminds me of an early Buffett investment.

https://www.elevationcapital.co.nz/insights/warner-brothers-discovery-ushers-in-a-new-era-of-content-kings

That is a longer story — at one point Warner Brothers was a conglomerate called AOLTimeWarner — remember what people used “America Online”?! This may have been the peak of ‘99 dot com bubble fizziness … of course, it didn’t end well.

There is still the issue of the cable assets, which are like a melting ice cube. I still think the best option would be to spin ‘em off, like Comcast is proposing to do.