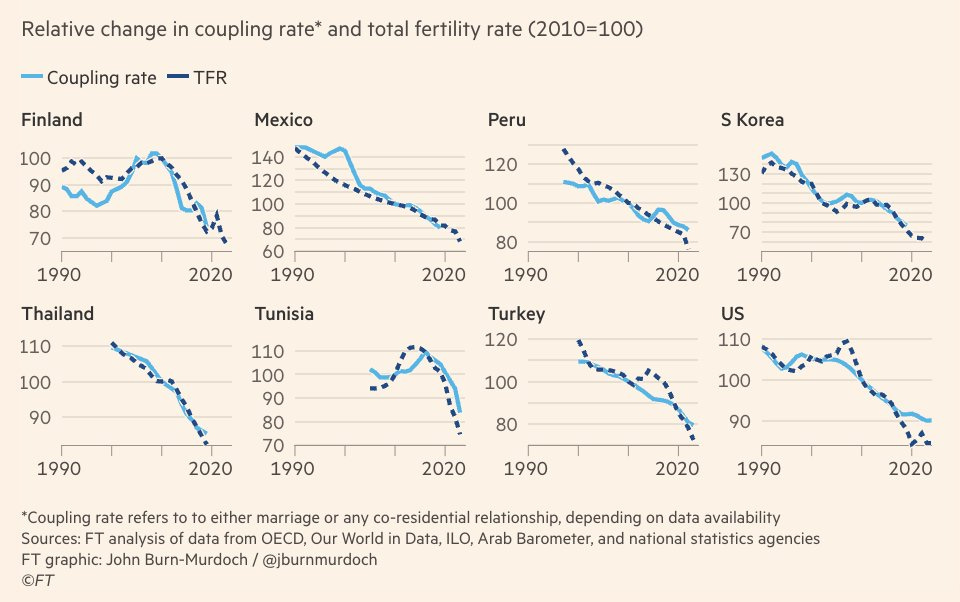

Chart of interest…baby bust

NZ

Fletchers — Noting James Miller appointed to board, likely chair. I wonder if he’s going to have a hand in breaking the co up… all pure speculation but really, if a monopoly like FBU can’t make money, why should it exist??

Pacific Edge — Medicare not covering it. Long statement from company which is full of boo-hoos (wouldn’t you also be crying?!) … long story short, dead in the water.

Nada else. It’s Jan.

Aus

Titomic — Still interesting at 18c…note plays well into the “Trump trade”

Treasury Wine — less wine sold… China ain’t buying Penfolds…

Quote unquote (from Ali Gündüz on twitter)

"After a 13,000 year craze, humanity has finally stopped consuming alcohol to feel good in the 2020s." -- historians in 3025

M&A

Bain Capital offering $1.8bn Aussie for Insignia Financial, matching CC Capital’s bid — i.e. American money would like entry into the ~4 trillion dollar Aussie superannuation sector. Bid feels a bit paltry — only a 7.5% premium. Snooze.

Fashion M&A starts off with a hiss and a bang — Barclays reportedly shopping around Versace, which is currently owned by Capri (remember that Capri was recently the subject of a failed merger with Tapestry…). Prada reportedly an interested buyer though I have my doubts — Versace should be a much bigger brand than it is — its revenue has stalled at ~1bn for the longest time1. I remember talking to some Blackstone bankers a few years ago who sold the brand to Capri (I’d just finished writing about Ferragamo, and Blackstone owned a ~20% stake in Versace that they paid €210 million for). They were like — we overpaid, and frankly, we’re not sure if Capri can make it work either.

Of course, Versace was a pretty dumb move for Capri in the first place — it doesn’t really fit into their “mid-range fashion” brand. Prada hasn’t really been able to make external company acquisitions work in the past, but I wouldn’t rule them out here — likely other acquirers could be Puig or Kering.

A L’Oreal idea

L’Oreal has tended to execute better than its hard-struck rival, Estée Lauder, but that doesn’t mean its stock hasn’t trailed off in the last year…

So I was interested to read this, about Urban Decay’s recent campaign featuring new rap star Doechii… (care of the always excellent Line Sheet):

Elsewhere, Urban Decay used Doechii’s music video “Denial Is a River” to highlight their Face Bond Luminizer; a win-win for both brands, which let the rapper/singer/songwriter feature her music in a beauty campaign while pushing the product to Doechii’s audience. MAC cleverly “leaked” “nudes” on social media, complete with “sensitive content” warnings, to draw attention to 20 shades of natural shades of lipsticks. (A riff on the 40-shade foundation drop pioneered by Rihanna’s Fenty.)

Ditto for Estée Lauder owned MAC — that’s smart marketing and a soft step in showing that the troubled company is starting to think differently and engage consumers in a fresh way. Now, if you thought L’Oreal’s chart wasn’t pretty, just look at EL’s:

Noting plenty of options activity on EL (calls at $75)…remember the Lauder family still controls EL, and they won’t be loving a low stock price…management will be under pressure to turn the company around (or else…)