NZME finally releases a letter | Alcohol ain't the new cigarettes

Plus some pleasing news from Fever Tree plc

NZ

I see NZME has finally released both letters from NZME-king-to-be Grenon after BusinessDesk largely published the bulk of it (and other media outlets). Better late than never, I guess.

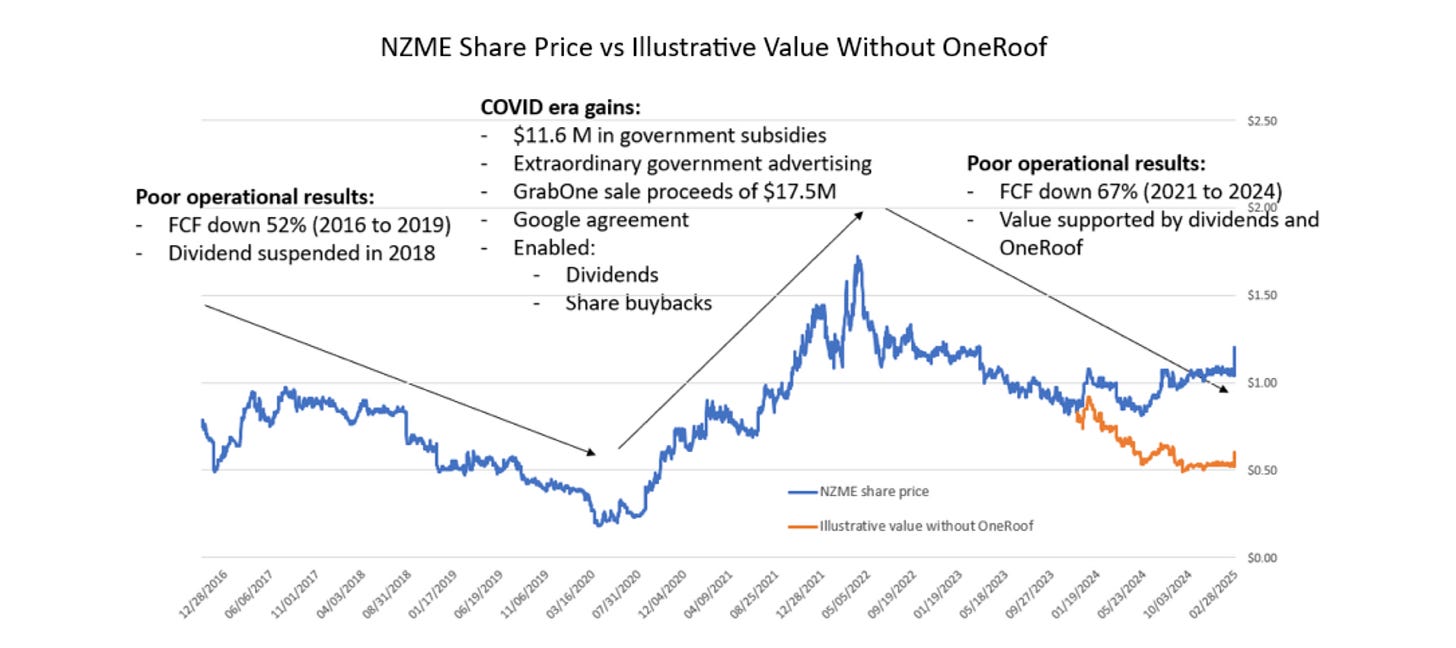

I think the best illustration of NZME’s “performance” is from Grenon’s first letter. It speaks for itself, I think.

A couple of points —

From all the hand wringing in the media there’s very little mention of journalism in the letters; it’s mostly focused on financial performance.

Many New Zealand companies are at-risk to a well financed investor staging a board takeover. If I were a billionaire activist investor (I am not), I would angle to do the same at Spark1.

With +50% support the NZME board “coup” appears to be done and dusted. Everything else is just noise.

Oceania Healthcare still trades at a significant discount to NTA (and other NZX listed real estate companies)

Aus

Wisetech — Everyone’s least favourite director — Richard White — is back at the wheel and the stock is bouncing a little (87.91) as of writing. You may not like Richard White but Wisetech still makes money — my Bloomberg projects $233mn of net income for 2025, which implies roughly 31% growth. Noting Artisan Partners added end of last year, and Perennial Value Management added in late Feb this year. You don’t need a weatherman to tell you which way the wind blows…

MedAdvisor — Did you know this thing now trades at 0.98x book and 0.51x sales? Not investment advice but either this is very cheap or I am very stupid. Or both.

Fever-Tree plc

Some good news from a stock I like — Fever-Tree. Now, why do I like Fever-Tree? For one, the only other competitor they had — East Imperial2 went bust some time ago and the only real other competitor is Schweppes. Nothing wrong with Schweppes, but one comes mostly in a large plastic bottle and the other comes in a tasteful glass bottle and is preferred by a “certain type of consumer”.

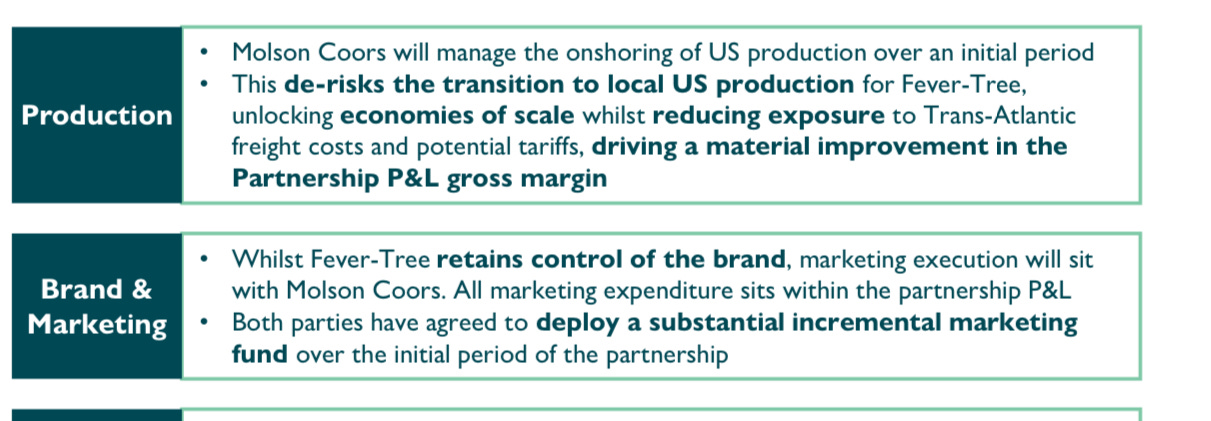

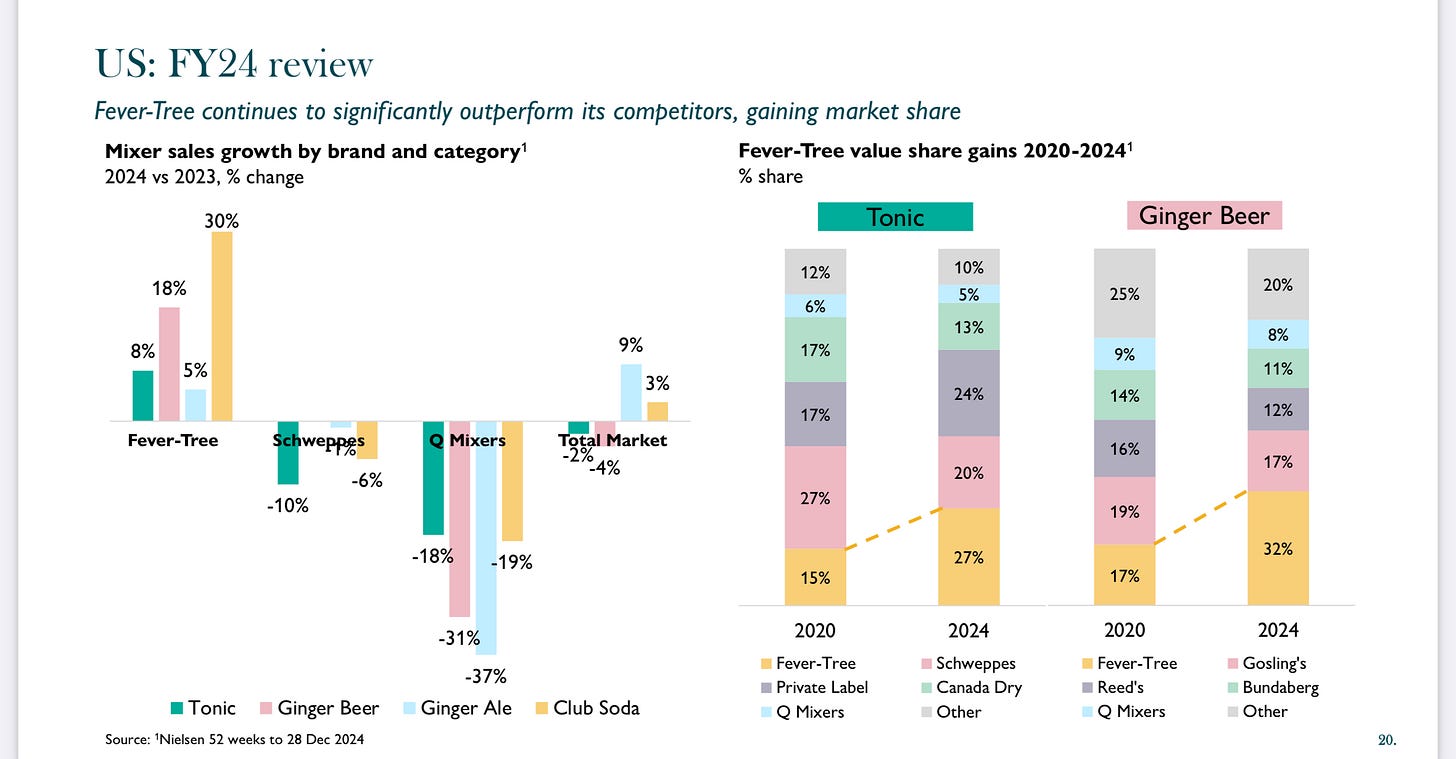

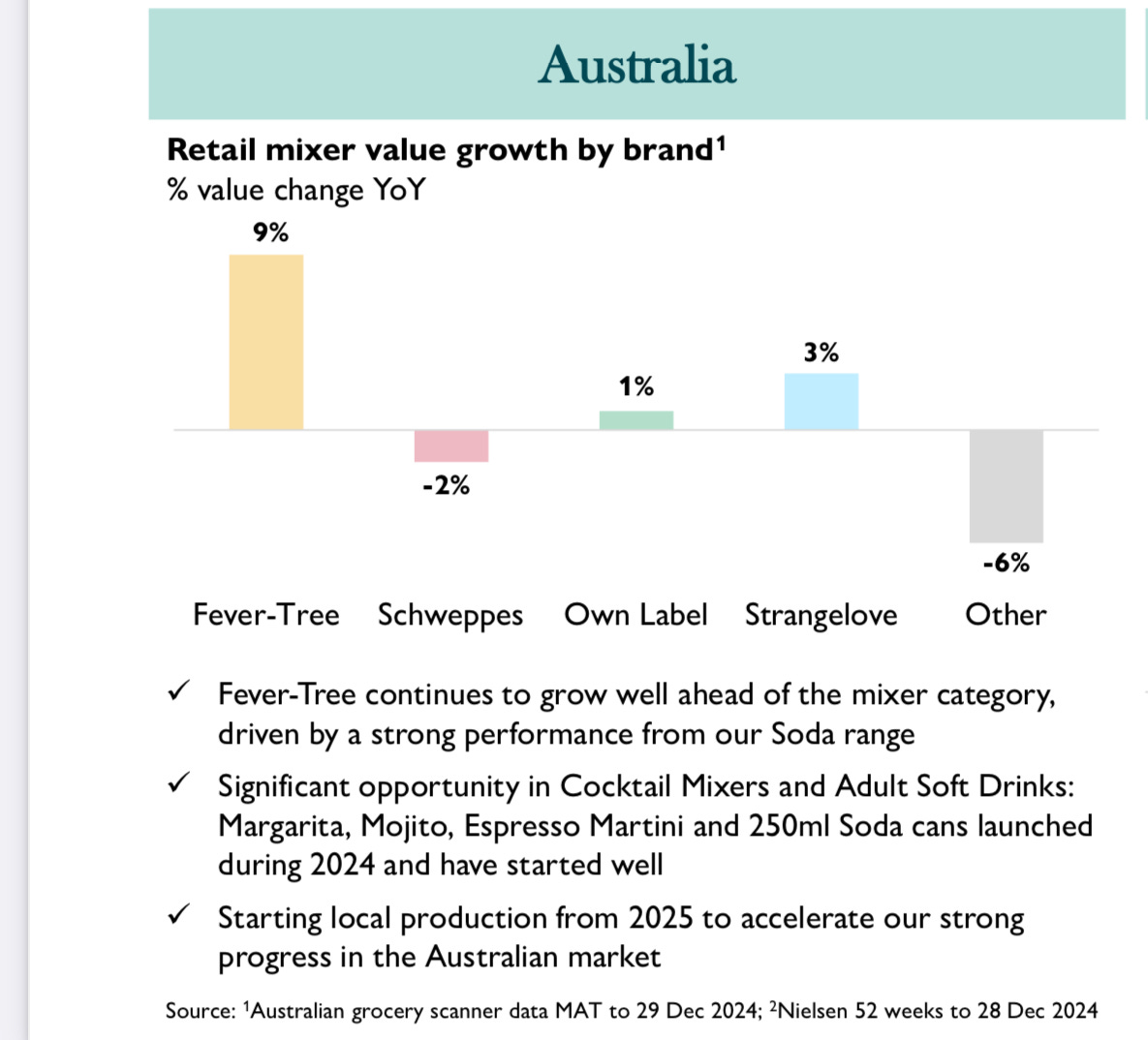

The US performed very well for the company — +32% growth for ginger beer and +27% for tonic — they are both number one in their respective categories. Rest of world say +22% growth — particularly in Canada and ‘Straya. A couple of slides from their presentation I think are relevant —

I.e. no tariffs! We love that. We also love less freight costs (don’t worry, my favourite freight company, Mainfreight, has a large operation in the US — if Molson doesn't use MFT’s services already, I suggest they do).

US growth very strong — taking market share away from the others; even Schweppes!

And finally, closer to home, Australia —

Again — we like local production because it means you get the product quicker (this is why the Coca-Cola formula of having bottlers all over the world works so well). We also like the demise of East India, because it gives more room for Fever-Tree to grow.

Revenue up +4% to 364mn, adj. EBITDA up 66% to 50.7mn. I think there’s a clear path for growth in both Australia + US (if I were Molson, I’d just buy Fever-Tree — what’s a billion quid between friends?). So, that’s the good news — the wonderful thing is because they’re technically a soft-drink maker they don’t need to worry about any bombastic tariffs threats (aren’t you tired of hearing about tariffs? I am).

But is alcohol the new tobacco?

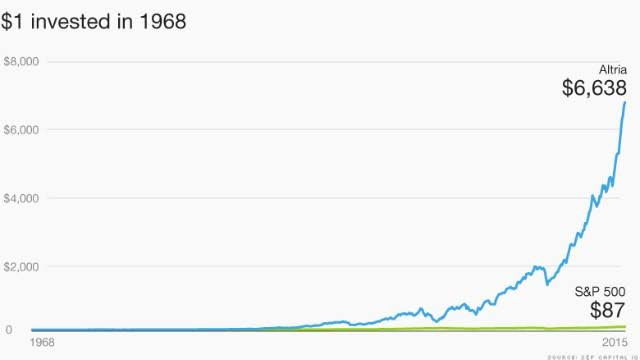

One of the things I find interesting is that a lot of people say “why do you like booze stocks so much Eden” and yet many of these same people are at the pub, or buying En primeur from Glengarry Wines. The short answer is — I like stocks that trade at multi-year lows with a predictable product. There is a fairly hysterical article in the FT wondering “Is alcohol the new tobacco?” To which I say, well, tobacco companies are absolute cash machines. The best performing stock in the S&P, of all time, to the best of my knowledge, is Altria:

(This doesn’t include spin-offs)

I know investing in tobacco is not fashionable (and yet, how many people do you see on the street vaping?). I know it goes against “ESG” and the scolds at public health slap you on the hand and say “gosh that is very bad for you!”. But the truth is that tobacco does generate tremendous profits — the net income margin for British American Tobacco is 39.1%. For those in the back, that’s for every $1 you sell, you make 39.1 cents of profit. There’s very few businesses with such fantastic operating margins — Visa’s net income margin is 56%. If I owned only one stock forever, I guess it’d probably be Visa.

My point is — waving your hands about and saying “oh no! Tobacco!” belies the economics of it. The tobacco companies are doing very well, thank you very much.

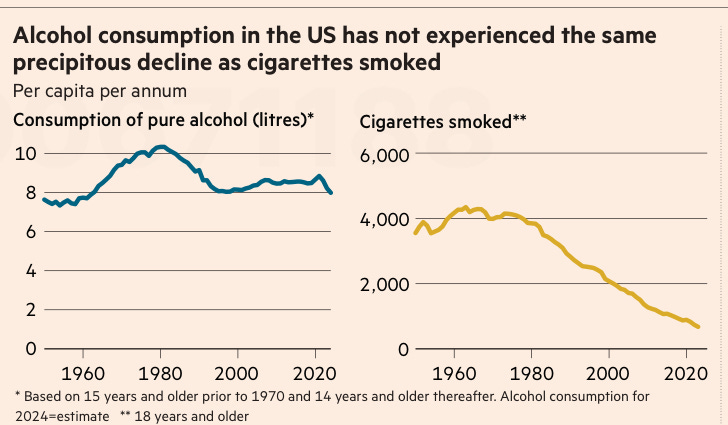

And yet, here are the facts with regards to alcohol — per the FT:

It will come as no surprise that cigarette smoking has been replaced by vaping. To paraphrase Oscar Wilde, news of nicotine’s demise has been greatly exaggerated.

This is not saying to invest in tobacco stocks3, but my point is that human habits don’t change. They merely evolve, but the song remains the same.

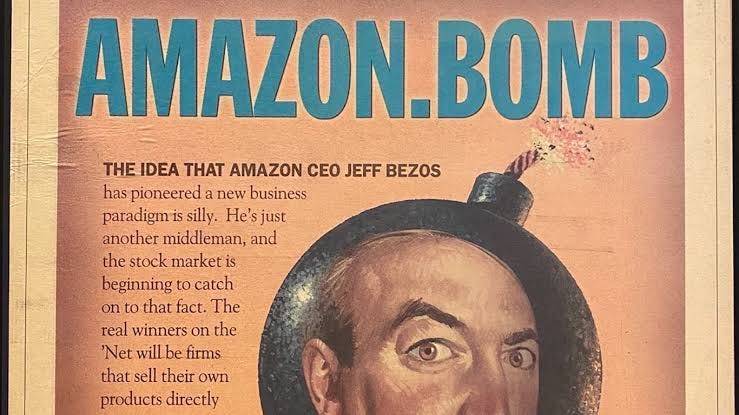

Anyway, here’s Jeffries analyst Ed Mundy saying: "During my 20 years of covering the drinks sector, the degree of investor questioning around alcohol has never been more prominent”. When analysts start saying things like that, full of doom and gloom, that’s my sign to buy — here’s a headline where Amazon was declared a “dud” (31 May, 1999):

Here’s a headline from The Atlantic (18 Nov 2022)

And here’s Barrons, just this year:

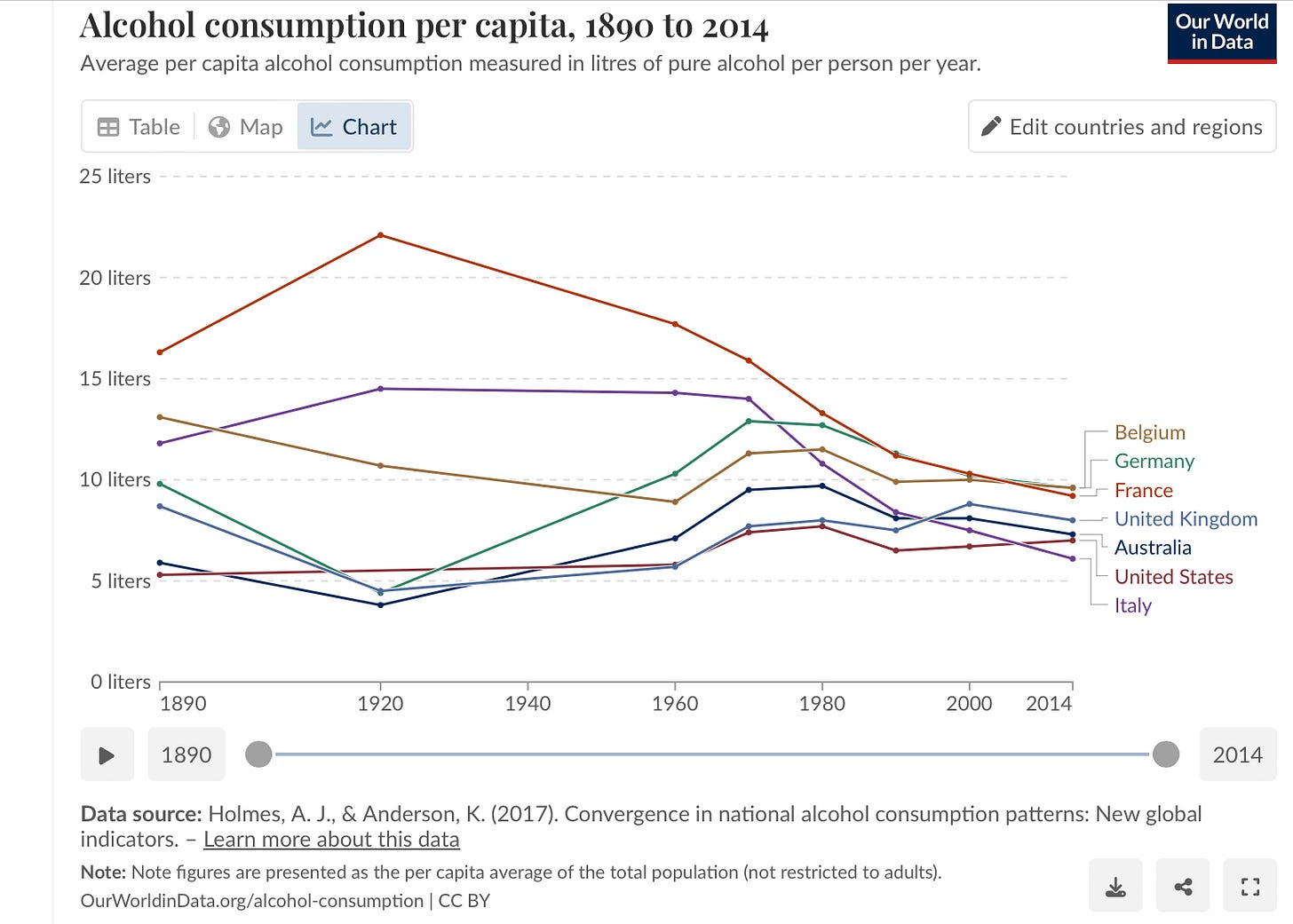

To be fair — alcohol consumption is declining. But it isn’t declining at a rate that calls for any kind of alarm. Most of the companies I follow — Brown Forman, Diageo, Constellation, etc, reported largely flat sales. It’s also instructive to look to history —

In other words — alcohol consumption has largely normalised in the last few decades. There’s still cause for worry — I think wine4 is one area of concern, and Cognac is another5 — both industries need to think about how they introduce younger drinkers to their product. This is why I largely shy away from wine (and why Constellation is selling their wine portfolio). “Evergreens” like Guinness (a Diageo brand) and Jack Daniel’s (a Brown-Forman brand) are predictable.

Once again — a bunch of ratios for ya’ll:

Brown-Forman: 18x fwd earnings

Pernod: 12x fwd earnings

Constellation Brands: 13.25x fwd earnings

And so on… these stocks trade like they are discount retailers in biddlybunk Ohio. They are not. There’s the issue. There’s where value lies. Cigarettes never went away; they became vapes. In my opinion, I don’t see booze going away anytime soon either.

Look, I think it’s oversold, but also I think the management needs to go.

What would Chloe Swarbrick say!

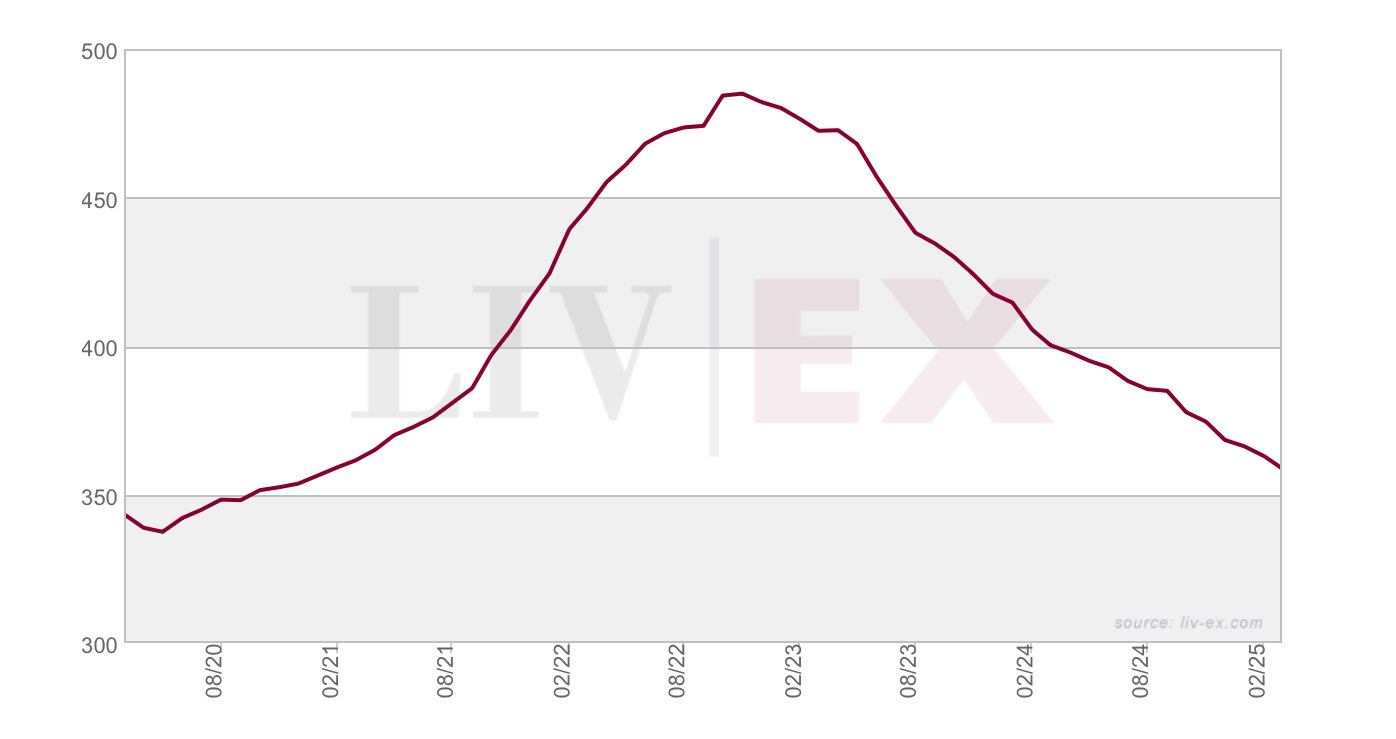

Note the Liv-ex 1000, which tracks the top 1000 “fine wines”. It’s clear there was a boom, and now a degree of normalisation. I have been saying this for a while but if you are going to sell wine to millennials and Gen Z, you can’t rely on stuffy dinners and staid presentation — to sell anything that is luxury you need experience and you need romance — that’s key.

When we’re talking about Cognac we’re really talking about Remy — at this point Remy trades at a p/b of 1.22x —for a brand that has strong value that strikes me as a severe discount; Remy now needs to reposition its brand for a new generation — this will take time.