NZME -- is it over rover? Plus: The Warner Brothers Thing

Some thoughts on M&A and debt/equity stubs

Home & Away

Noting NZME board rolling looks like a done deal (though it’s not over until the fat lady sings…). Likely +50% support for the Canadian Billionaire and co — particularly like this comment from Roger Colman here — “it’s over rover”. Yours truly quoted too — I think if it is the case that there is an overwhelming majority of shareholders in support of the board roll, then it follows that an orderly board transition could be best for the company and shareholders.

Again — the value in NZME lies within its radio assets and OneRoof. Remember there’s been a lot of pressure for Nine to sell its Domain asset (i.e. the Aus version of OneRoof)) to US company Co Star. If they do that they could face a +1bn tax bill; so perhaps buying OneRoof would be a better idea — and unlock value for NZME shareholders.

More M&A — Metro Performance Glass being potentially bid for by Aussie PE firm Crescent Capital. Was in a trading halt. One of my most recent refrains as of late is if you threw a dart at any NZX small or mid cap, you’d find a company that’s probably undervalued and ripe for a takeover bid. Metro’s board stupidly rejected Masfen and co’s bid — 18c per share — it now trades at 0.057c per share. So here we have another company ripe for takeover, with long suffering shareholders. You know, Oceania Healthcare trades around 50% of its NTA. Remember Arvida?

Finally, hard not to talk about tariffs — Trump threatened 200% tariffs on European wine and spirits — you read that right, 200%! As we’ve learnt with Trump, most of his tariffs are all bluster — obviously any kind of 200% tariff on European wine & spirits would mean a total halt to new European wine & spirits in the US1. Brown Forman up, European booze stocks down. Thesis doesn’t change — the song remains the same.

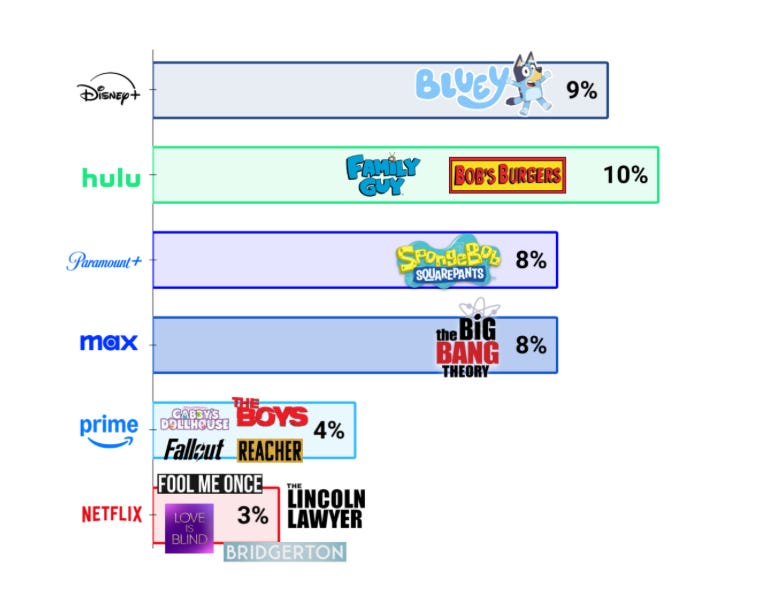

Cable Cowboys

Thinking about the streamers — the below shows watched at each streamer as a proportion of total streams — in other words, Bluey is insanely popular; Family Guy is still going strong, and for some reason people still watch the Big Bang Theory. It's interesting to reflect on how, in comparison, Netflix’s share of “most-watched” is quite the grab-bag — I read recently that Netflix is deliberately making television you can watch while you scroll on your phone, which is what Fool Me Once feels like2.

Which brings me to the streamers. Netflix has had a mega-run in the stock market (Bill Ackman at Pershing Square did poorly there — he took a 400 million dollar loss on the stock). The others have had less of a good time (I’m not going to talk about Amazon/Prime, because it’s such a tiny fraction of Amazon’s business it doesn’t bear mentioning). Disney stock is down about -10% YTD, while WarnerBrothersDiscovery is down -2%. I’m unsure if it’s worth talking about Paramount — at this point the sale of Shari’s baby seems so nebulous, so drawn out, that even the most ardent chroniclers of it — like the team at Puck — are sort of running out of energy3.

So what we’re really talking about is Disney (DIS) and WarnerBrothersDiscovery (WBD), and the one I’m most interested in is WBD. Here’s what I wrote a couple weeks ago:

Long story short — giant monolith formed by the merger of Discovery and the spun-out Warner assets of AT&T2. The big issue was debt. They’ve managed to pay off a lot of debt — the company’s leverage ratio of 3.8x adjusted EBITDA is on its way to a ratio of 2.5x-3x gross leverage. They’ve paid a stunning $19 billion dollars of debt down in three years

You have to think of WBD as quite a feat of financial engineering — it has been operating as a debt entity with an equity stub — so all the cash flow the entity generates goes to paying off debt. Now the company is at an inflection point — at ~2.5x debt/EBITDA there’s more cash to go around, which means the company finally starts paying out free cash flow. Bloomberg projects +$1.4bn in operating income for FY25, which is a far cry from this year’s $321mn. That’s the beauty of paying down debt.

It’s no surprise that John “Darth Vader” Malone sits on the board of WBD, and is a significant minority shareholder4. He’s probably the best financial engineer of his time — a chronic dealmaker, often with frustratingly complicated ownership structures (for instance, Malone also effectively controls Formula One — yes, the sport — via Liberty Media Formula One, which is a listed tracking stock5. It was an audacious bet to merge Discovery with Warner — especially because of the debt burden — but now we are finally starting to see some kind of payoff, after massive cost-cutting and being universally hated by Hollywood. Here’s a couple of catalysts that I find interesting:

Spinning off the cable assets.

WBD owns a bunch of linear cable assets, which are like a melting iceberg that continue to shrink in the cash they produce. The board has said they’re going to spin ‘em off into a seperate entity (much like Comcast is planning to do with theirs). By doing this you get rid of the iceberg, and you can shift some of that debt to the new company.

2). Max, their streaming service, is growing a lot faster than people expected.

In Q4, Max added +7.2mn subscribers, bringing their total subscriber base to 110mn. That’s a faster rate than Netflix for the same quarter. Remember that Max has HBO plus a whole lot of other things (including, yes, The Big Bang Theory). There’s a lot of runway for growth — Netflix has +300mn subscribers. The Max streaming business is solidly EBITDA-positive now, making $409mn in adjusted EBITDA in Q4 (well ahead of Wall Street estimates, which were in the $200mn range).

The debt burden lessens, creating more cash flow.

See above.

You know, the stock was at $5.00 at one point. It sits around $9.89 right now. It’s hard to ascribe a value to it because the question is: what does the spinco (the linear assets, the melting iceberg) look like; and at what rate does the streaming business grow, plus the debt gets paid off. Deutsche Bank has a price target of $14.00 for it — it’s really a question of projecting into the future (all investment is) and how confident you are about that. Certainly, Zaz and co at WBD have proven they can engineer the company — against all odds — to pay off huge amounts of debt. And they’ve proven that Max as a streaming service can work in a crowded market. Perhaps confidence is not misplaced.

Fashion corner

I put fashion here because I know not all of you love fashion, though I note that stocks like Hermes and Brunello Cucinelli continue to do just fine — Brunello just saw operating profit grow 13% in 2024 and expects sales growth of +10% over the next two years. Not too shabby.

Two big things — Demna has been appointed creative director of Gucci, which feels about right — he grew Balenciaga by leaps and bounds, so let’s hope he can do more at the house of G6 — the big story with Kering (the Gucci and Balenciaga parent company) is that their current net margin is around ~15% — historically it’s 25% — re-rating that, and more sales, means the value in the stock will eventually be recognised.

LVMH — Bernard Arnault is about to try and raise the age limit of LVMH’s chairman of the board and CEO of the company to 85. Obviously, Arnault has no intention to retire (he’s following Buffett’s advice!)

Finally, Saint Laurent’s show which closed Paris Fashion week felt like a statement of things to come. It felt a little 80s, a little sexy, a little depression era chic. It got very good reviews. Kering also owns Saint Laurent, and I think it’s clear that Saint Laurent will eventually rival Gucci’s importance in sales for Kering — Saint Laurent accounted for 2.9bn EUR in revenue last year — I wouldn’t be surprised if we see it hit 5bn in a few years.

Obviously parallel importing will survive…

I’d assumed Harlan Coben, who wrote the novel of Fool Me Once was some kind of AI-generated author. There’s a bunch of adaptions of his work on Netflix — they all begin with “Harlan Coben’s…”, and they all have the unerring feeling of a particularly strong sedative.

Long story short — Trump is suing CBS over their edited Kamala interview; CBS is owned by Paramount. The irony is that Paramount’s perspective buyer, David Ellison, has a massive Trump-donor dad — Larry Ellison.

He is also the second largest landowner in the US, owning 2.2mn hectares of American land — you can think of it as owning roughly the size of Rhode Island.

Here’s where it gets complicated — a tracking stock is, per Liberty: “…a type of common stock that the issuing company intends to reflect or "track" the economic performance of a particular business or "group," rather than the economic performance of the company as a whole. While the Formula One Group and Liberty Live Group have separate collections of businesses, assets and liabilities attributed to them, no group is a separate legal entity and therefore cannot own assets, issue securities or enter into legally binding agreements”. Still with me?

It’s worth noting here that the tracking stocks used to be even more complicated, before Sirius XM was spun off as its own entity, and did the same with the Atlanta Braves. The web Malone controls or has influence over is vast.

And I’m not talking about Glassons