NZ

Rakon — I’ve stopped counting the days, but it’s been 115 or so. No word from Lorraine and co. It would be nice to hear something. A smoke signal or something.

Synlait Milk — down at 71c. Rekt. Needs China to come on over, and that’s a harder ask than it looks. Managed to extend a $130mn debt repayment due on March 31 to July 15. Bright Dairy (China) has confirmed its support and advised it will provide a $130mn bridging loan if necessary. Lots of spilt milk here, lots of tears.

Mainfreight — great piece here on the slogans that the greatest trucking firm in the history of the world put on the dump truck asses of their trucks. I like the writer’s list of her top 10 Mainfreight slogans:

1. Your children need your presence more than your presents.

2. All children deserve to be loved.

3. Aim for the stars.

4. When you have more than you need, build a longer table, not a higher fence.

5. A truly happy person is one who can enjoy the scenery on a detour.

6. Take time to watch the sunset.

7. Life is 10% what happens to you and 90% how you react to it.

8. Always keep your word.

9. The secret to getting ahead is getting started.

10. The best is yet to come.

Aus

Droneshield — 80c as of writing! Likely due to the Israel situation (Israel struck Syria last night, escalating the conflict further). The gears of the military-industrial complex grind on.

Xero — looking capped out at $133. The technology is superior to those of US peers but it will be a long grind into the US market…capital intensive.

Duratec — still sitting at $1.20, unloved, anybody got some gruel for a poor boy? We like it…

URMN — Up +5.00% today. Look at the nuclear plants under construction below…supply/demand imbalance continues and there’s going to be more once those 61 come into commission.

The NZX got an AI company…sort of

We’re so back, baby — the NZX got an AI company. Sort of. I mean — it has AI in the ticker (“BAI”).

It’s called Being AI, Tone. It’s the future. You gotta understand that. This AI jazz — it ain’t going away. They own a school on the North Shore and a mailing company. They have a consultancy firm. You gotta get into it, Tone.

Here is the NZX document if you want to try and parse it — god knows I have. The business (reverse listing, via the formerly named Accession Capital) owns a mailing business, a school on the North Shore and three very vague start-ups. I’m not making up the school part. Here; look.

It’s a pretty expensive school! I don’t know how much Kings charges — I know St. Cuth’s charges an arm and a leg. But it’s up there.

I don’t know how “AI” and schools go together but ok? It makes money (about ~$525k in EBITDA in ‘22) and has Elon Musk displayed prominently on its website? If we know anything, it’s that Elon Musk Market Theory is a real thing (see: Dogecoin, Tesla, etc). Matt Levine wrote today1 (half jokingly) that maybe there are three eras of finance — i) the majority of history, where Excel didn’t exist and the fin statements of companies were inaccessible. ii) The 1920s onwards — where fundamental analysis dominated and iii) maybe three or four years ago where sentimental and mass psychology has dominated?? Dogecoin might not have any cash flows but it doesn’t matter. So, I mean, maybe having Elon Musk embedded in a video on your website is a good strategy? I don’t know.

The other cash generative aspect of the company is Send Global. They operate a legacy file management system (actual physical files) File Corp, and they offer physical mail services via NZ Mail. For an AI company these are two fairly old school services. That’s not a criticism. For FY ‘23 the company pulled through revenue of ~$41.8mn and normalised EBITDA of $2.8mn. I don’t know how you value both a school and two old-tech companies; but sure — ok. So where’s the AI?

It’s all very vague. Their website is not helpful. It looks like this:

“We’re helping create a new state of being"?? OK. There is an article about the 4 day work week?2 I don’t know, you guys. I don’t get it. Being Ventures is essentially a listed VC fund within a listed co with a school and other stuff. Maybe they’ll make some good investments. Hard to know. What does the consultancy do?

Being Consultants Limited is expected to be a cornerstone of our operations, equipped with a world-class AI team from our partnership with Futureverse

What does Futureverse do, you ask? I don’t know. I’ll ask Chat GPT.

Futureverse focuses on developing the infrastructure for an open and scalable metaverse, integrating technology, content, and community through various innovative projects. It offers a platform where users can engage with AI-driven games, like a boxing game in partnership with Muhammad Ali Enterprises, which immerses players in the sport by allowing them to coach and manage their own boxer with an AI brain

OK. Personally, I would not be investing into a company that owns a school, a mailing business, a filing business and some nebulously owned “AI” stuff. But as a friend always says — you do you boo. As of today BAI has a ~$28mn market cap on the NZX and no volume traded.

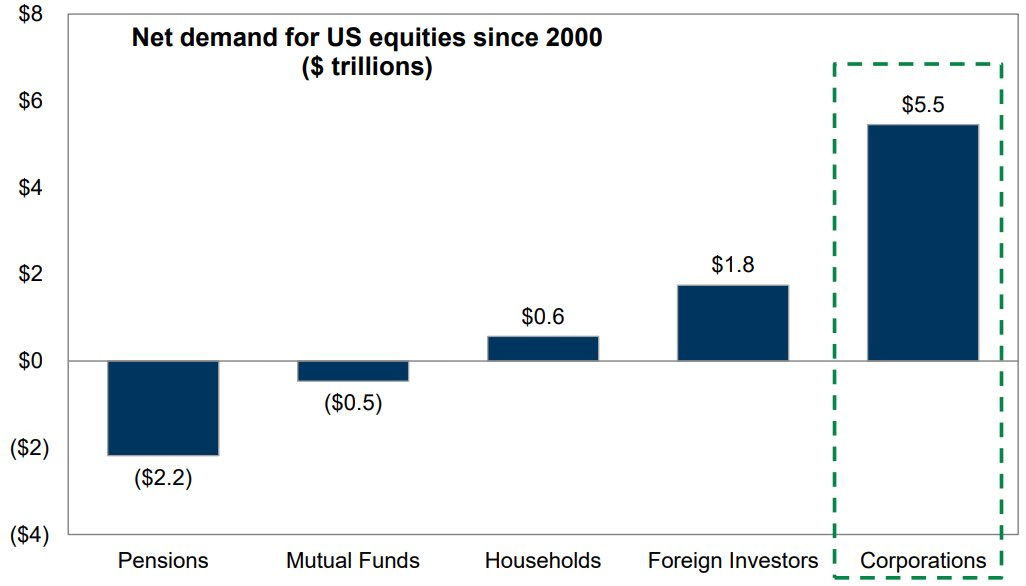

What keeps mankind alive…buybacks

Courtesy Goldman Sachs… $5.5 trillion in buybacks since 2000. Everything else pales in comparison. Apple alone has spent $523bn buying back its own stock since 2012. Astonishing.

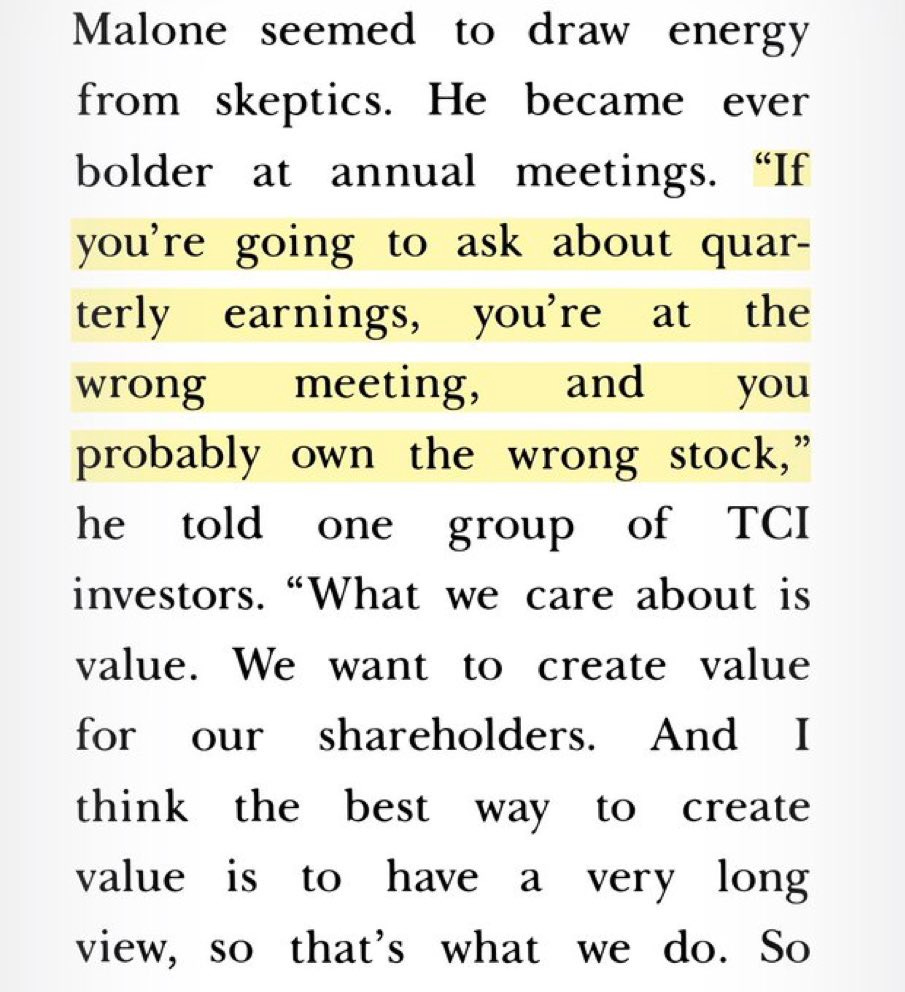

John Malone on quarterly earnings…

We love you, John. You’re the cable cowboy of our dreams.

https://www.bloomberg.com/opinion/articles/2024-04-01/trump-media-s-business-doesn-t-matter?srnd=undefined

Look, in 1932 Bertrand Russell called for a four hour work day (link) and posited that machines would lighten man’s load. Obviously this didn’t occur — people are more hooked on work than ever — mobile phones mean that we are forever tied to our work; desk or no desk. I am doubtful of AI’s benefits here. Capital inherently demands blood sacrifices.