NZX Limited - A disappointing result

No other way to put it — we’re starting to lose faith in this company. Stock at 98 cents as of writing — sitting at +5 yr lows. Particularly striking was two sets of “operating earnings” released — see below —

NZX today announced operating earnings (EBITDA) of $40.1 million (excluding acquisition and integration costs) for the financial year ended 31 December 2023 – up 9.6%. Including acquisition and integration costs, Group operating earnings (EBITDA) for the same period were $38.9 million – up 10.9%

How can there be two sets of operating earnings?

What on earth is this? Operating earnings, and then operating earnings including actual costs like acquisitions, integration and restructuring. Those are real costs. Reporting both looks like trying to make a disappointing result sound better — “there, there, here’s a nice hot cup of Milo”. What is worse is that the first figure — $40.1mn — is reported as actual. See below —

Funds Mgmt — the “profit engine” of the business — saw EBITDA grow +52% on FY22, while EBITDA margin sat flat at 52%. FUM sit at $10.98 billion — +32%.

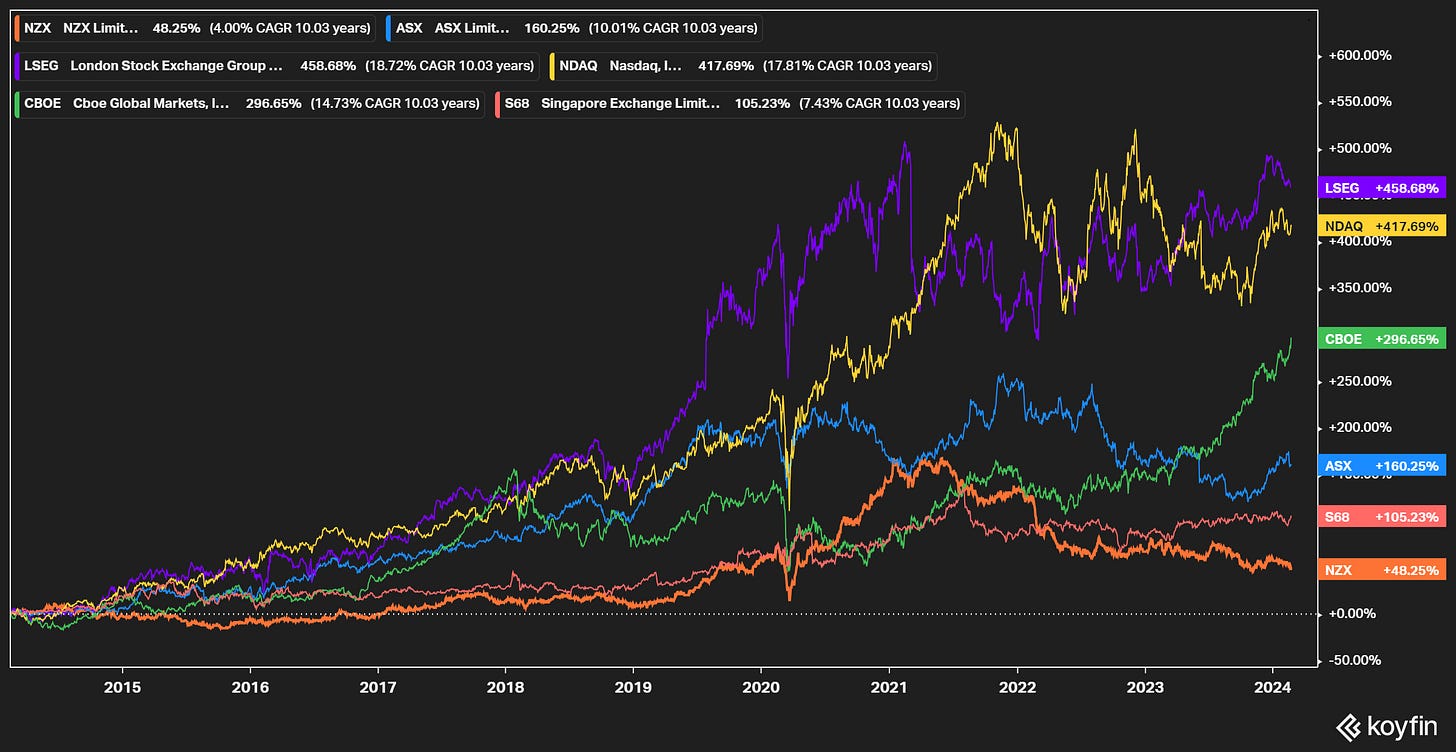

The rest of the result was mostly incredibly mediocre to well below expectations. There was a lot of blaming of “market conditions’ and “macro economic factors” — poor excuse since the NASDAQ has had a bumper year (NVDA is Taylor Swift for men at this point) and the Japanese stock market has just made record highs — the Nikkei 225 hit 39,098.68, taking out the Dec. 1989 peak of 38,916.

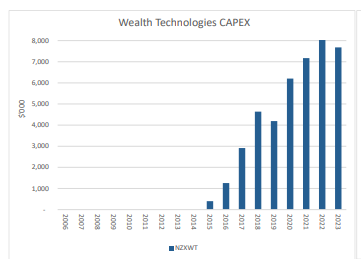

Changing our view to neutral and considering where to go from here — there is easier money to be made elsewhere. Management needs to up its game — quickly. Headcount of 339.6 — do they really need that many staff? Wealth tech continues to be a significant consumer of CapEx and is expected to continue to be going forward.

Disappointing. We have had discussions with management previously which had us feeling more positive about the company — we think now there is a strong activist or acquirer case to be made, as NZX has consistently underperformed peers — it has well underperformed every other peer, as can be seen below.

There is perhaps opportunity in buying at 98 cents but a catalyst would be required to move the price up again — change of management, divestment of the FUM business (in part or in whole), sale of the exchange to the ASX, etc. This should be on the table given significant and sustained underperformance.

ARV — Trading at a 50% discount to NTA. They received a NBIO for $1.70 per share in December — management declined — they never announced the NBIO to market until rumors circulated of an acquisition approach.

Regardless of the valuation that the board ascribed to the shares in December we think it’s incumbent upon the board to reconsider the acquirer’s offer — especially when retirement stocks (even the golden child — Ryman) are all trading at a heavy discount to their NTA after reporting disappointing results, with the exception of SUM. We don’t doubt that ARV’s NTA is $2.00 per share — the questions we ask are i) how likely is it to get back there, especially in a higher-for-longer interest rate environment) and ii) consider this especially as the market has discounted more ‘premium’ operators and iii) given all this, is an offer of $1.70 per share rather tasty? Buying it at $1.00 today gives you a 70% return on your investment if acquired…given market conditions, we think this looks like a good offer — the board should reconsider.

RAK watch — Radio silence from the board. We are well into 6th week of silence. We think it’s a little disappointing — the board issued a very “boilerplate” statement on the 18th of Jan. Very different to the NBIO offer Comvita received yesterday — where the board wrote

The Board has decided to provide further access to confirmatory due diligence information with a view to determining whether the NBIO may evolve into a formal proposal that might be in the best interests of all shareholders.

Rakon, in our view, should have made similar disclosures as to whether due diligence was being taken. The boilerplate statement on the 18th of Jan said very little and obviously has sewn seeds of doubt in the market. Shareholders don’t know what is happening.

AIA — Still solid — higher than expected retail revenue of $90.3mn and FY underlying NPAT of $260-280mn. It’s a better way to ‘own’ tourism than Air NZ…a friend of mine and I used to talk about AIA, and I’d say “look at the multiple!” and he’d go “yeah, but it just keeps going up…”

Speaking of what goes up — NVDA

Nvidia only goes up

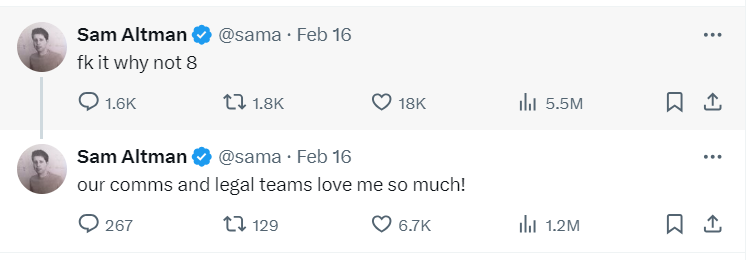

I don’t know what to say here! The price you pay for fwd sales is a function of growth, margins, and so on. Right now consensus sits at $100bn in sales. That’s $40bn more than their most recent results. Great expectations indeed. I don’t have anything to add to the discussion other than when you get Sam Altman suggesting raising 7 trillion for OpenAI then maybe, perhaps, we are in a bubble. You heard the number correct — 7 trillion dollars.

And then he said, why not 8?

Can you spell b u b b l e?

Oh, Mike Ashley

I write about Mike Ashley a little bit here — there is a famous law case involving him which is one of the most entertaining bits of case law one can read1. Anyway, his Frasers Group was margin called for $1bn. Relates to a dispute over the acquisition of shares in Hugo Boss in 2019, where Ashley used Saxo Bank to acquire a position via Morgan Stanley. He was then margin called without warning. Anyway — he is accusing MS of snobbery.

Appearing on the opening day of proceedings at the High Court in London, the billionaire said Morgan Stanley sought to force the UK retailer out of a position it held in German brand Hugo Boss and said the demand for collateral was “completely unbelievable”. “You might as well have said a nuclear bomb has landed in Slough,” Ashley told the court on Wednesday.

Ashley is famously from working class origins (no Eton or Harrow for him) — his case revolves around saying MS engaged in “lawfare” and basically didn’t want him to have a position in Hugo Boss (I hardly think Hugo Boss’s reputation is clean — they designed the uniforms for the losing side of WWII). MS on the other hand, says Ashley is full of “wild allegations of bad faith and irrationality”. Interesting times! Maybe MS were being snobs — after all, this is the man who had a drinking competition…

Ashley, the former owner of Newcastle United Football Club, is among the City’s most colourful characters. He once held a drinking competition and vomited into a pub fireplace to “huge applause from his management team”, according to a separate lawsuit he successfully fought in 2017 over allegations he owed £14mn to a Merrill Lynch banker.

The Warehouse

I almost forgot to mention…The Warehouse — they became their own bargain with an awful set of results yesterday — but my favourite bit is the sold Torpedo7, the outdoor brand, for $1. They paid $52mn for it. I mean.

My favourite thing is that they spent millions of dollars with Mckinsey and Mckinsey even promotes it on their website as how they ‘transformed’ the company. Link. They transformed it the wrong way.

It’s sad to see The Warehouse in such a state — a long time ago it was a well run company with Tindall at the helm, based on a kind of hybrid of Walmart and TJMaxx. Now it doesn’t seem sure what it is.

https://www.bailii.org/ew/cases/EWHC/Comm/2017/1928.html