RBA - expecting them to keep rates the same. Aussie CPI still sitting at 4.1%…we expect rate cuts later in the year…not now…policy in-line with our mate JPow at the Fed — everybody is terrified of making the same mistake as the 70s/80s, and cutting rates too soon.

That being said, I expect when rates are cut the US will cut too aggressively — money printer go brr — this has been their style in the past.

Fisher Funds/NZX — per AFR - Street Talk understands TA Associates has entertained pitches from several investment banks over the past six months, but Macquarie Capital’s FIG team has elbowed its way to the top of the list. Should MacCap be mandated as expected, it would be tasked with finding a buyer for TA’s 33.9 per cent stake of Fisher Funds after six years of ownership.

We’re very interested in how this plays out — we have been engaging with the NZX board and mgmt for some time and we believe the value of the funds mgmt biz is unrecognised by the market. The partial sale of Fisher should establish some more comparable for what the NZX’s fund mgmt biz is worth on the open market or to the right buyer.

Estée Lauder — surged about +12% — beat earnings (88c vs 56c expected). The big news, though, was the company is planning to lay of 5% of its workforce — the surge is in spite of profits falling about 21% and net sales declining 7% to $4.28bn. China is still weak. I wouldn’t be cheering so hard — if mgmt’s main idea is to cut workforce then they’re out of ideas. Mgmt should just be admitting they overpaid for Smashboxx, etc, and looking to how rivals like Puig and L’Oreal have done better (buying quality like Aesop and not overpaying). EL paid a whopper of a premium for Tom Ford and then promptly sold the clothing rights to Zegna. Did nobody tell EL that clothing is the loss-leader that sets the tone and prestige for the rest of the brand? Did nobody at EL remember the 80s, where YSL was licensed out to every Tom Dick and Harry — pens, ties, perfumes, you name it…of course YSL’s brand value decreased dramatically and it was only in the 90s under Tom Ford, ironically, that the brand got its mojo back.

Anyway, unimpressed with a mgmt plan that amounts to “fire people”. Reminds me of Kendall Roy firing everyone at Vaulter.

EL still represents a 2% position in our global model portfolio — we are happy that the market is cheering on job cuts (we’re happy the stk px is up), but fundamentally mgmt has needs a “new broom” to make the changes required — beauty is more prevalent than ever, especially for tweens. See below

Just firing workforce is a Band-Aid. We prefer L’Oreal, which represents a 4% position in our global model portfolio — to be honest we’re wondering if it’s time to cut and run with this stock, but the fact that the Lauder family retains significant control over the co. keeps us invested…for now.

McDonald’s —Here’s the number the worries me — 3.4% versus 4.79% expected global same store sales growth. And here’s a whopper of a number - 0.7% for LATAM & Middle East vs 5.00% expected. Blaming “the war” and misinformation; though it is fact that McDonald’s donated thousands for free meals to Israeli defence force members, and it is a fact that there’s a large boycott movement (which targets MCD, SBUX, EL, etc). These are real issues for these companies — SBUX in particular is facing both unionisation efforts and a boycott movement. These are issues which effect earnings, as evidenced by those McDonald’s numbers…no view but same-store sales on a global basis declining isn’t good news…

War - what is it good for? Palantir apparently, which surged to $19 a share aftermarket as the software maker reported a 20% increase in revenue YoY…that little speccy we mentioned, Droneshield, trading at 0.59c (DRO.ASX).

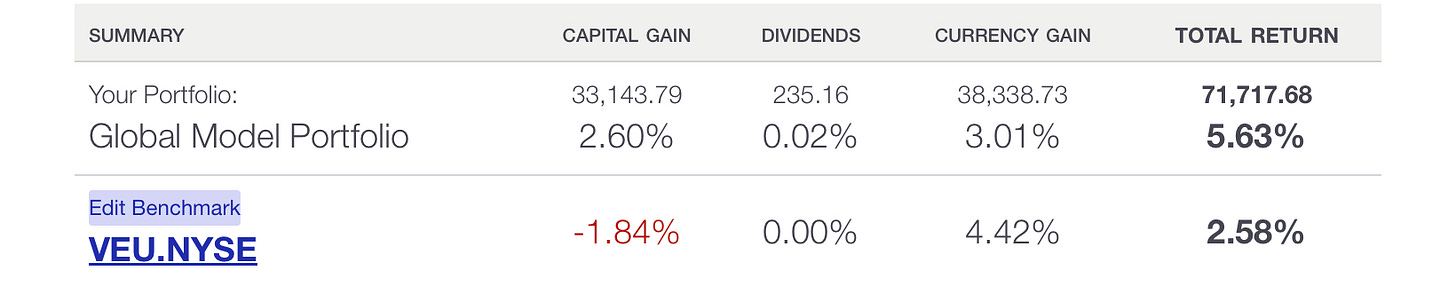

Global model portfolio - quarter to date

Checking in with China…how’s that recovery going?

Oh, okay.

Has Nike still got it?

There’s a lot to like about Nike. The tick logo, for one. The slogan which appears in one’s head almost exactly after imagining the tick — “just do it”. It’s the undisputed industry leader and still commands net margins of ~12% and during Covid managed its inventory adroitly — whereas smaller firms like Doc Martens1 ran into supply chain issues and other firms took market share in the coveted athleisure space — I.e. Lululemon (I asked an unnamed correspondent where she shopped in the weekend — the answer was immediately “Lululemon”).

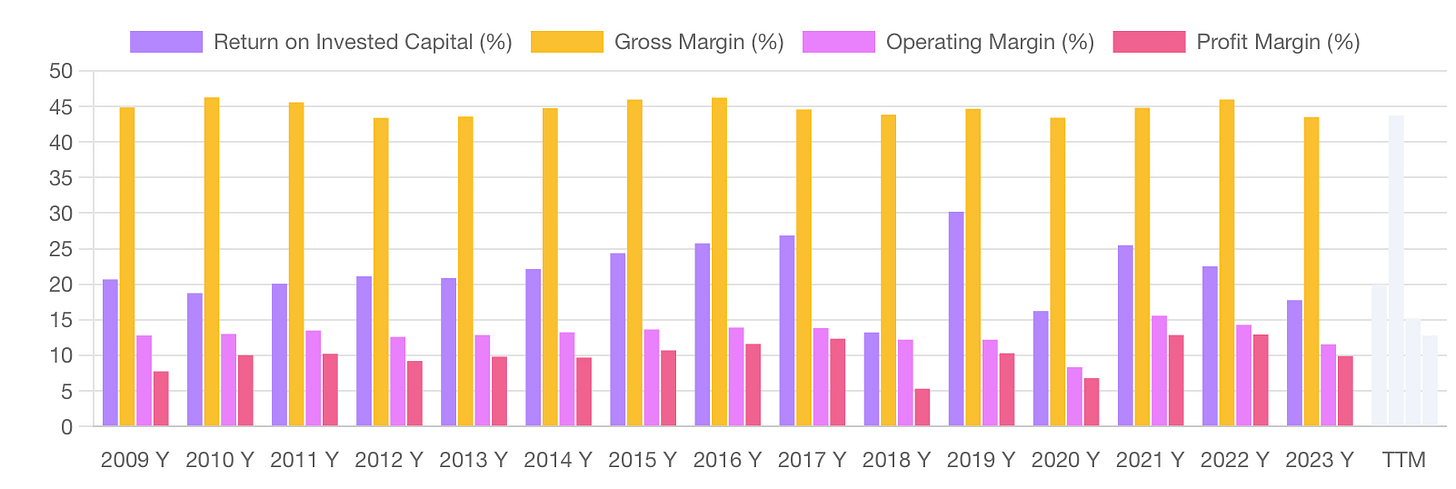

Anyway, article in BoF claiming the company’s in an slump. From a financial perspective it’s sort of a “huh?” moment — net income has grown at a clip of 19% per year for the past decade, while its fundamentals have been eerily consistent — even in the wake of the GFC.

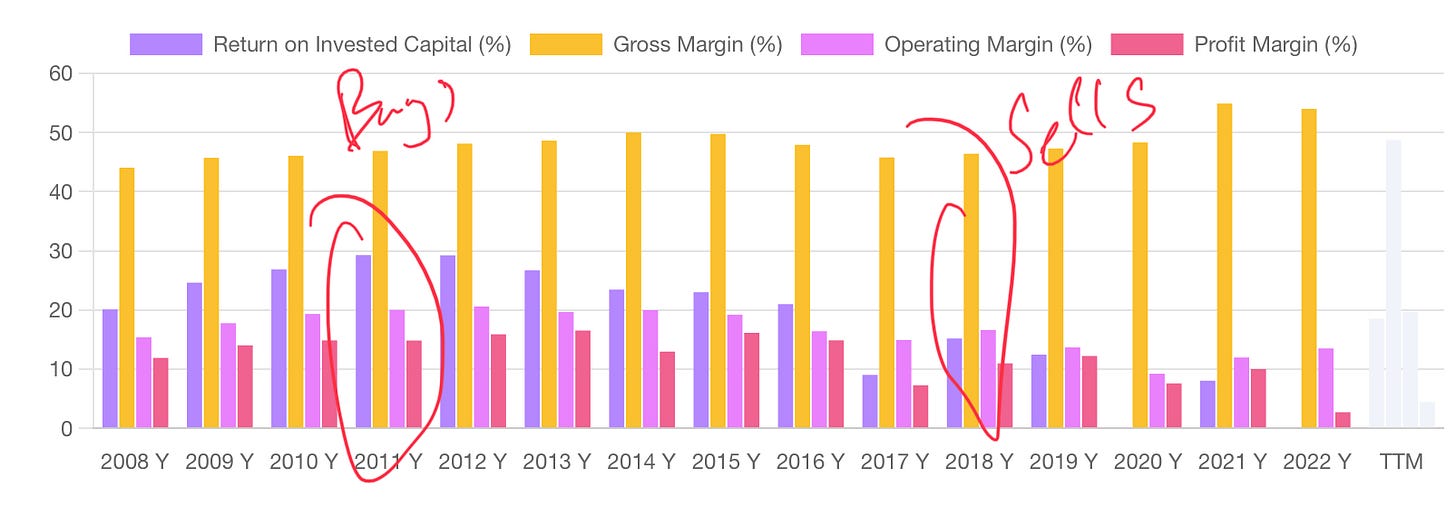

But that's not the problem, is it? If you looked at the financials of IBM during the 2000s they too looked really good; but IBM was cutting its cap ex and research spending like a madman with a samurai sword and increasing buybacks to bolster EPS. It’s a good trick, it even took in Buffett. Someone asked me what a value trap was the other day — IBM is the perfect example. Actually, let’s look at when Warren bought and sold IBM:

I mean, from a purely metrics based perspective, IBM looks like a pretty good company there. Buffett got in at about 12x earnings and in 2018 he exited the stk still was at 12x earnings. The stk price didn’t do much over the holding period and after that Buffett bought Apple, which worked out a lot better. Now for the fun bit of financial jiggery-pokery — in 2011 there were 1,163,000,000 shares of IBM outstanding — by 2018 there was only 829,000,000. In the meantime the research budget was slashed, and the company had to eat humble pie to come back from the fairytale land of performance-enhancing buybacks.

Anyway - Nike - in 2009 there was about $1.9bn shares outstanding and now there are $1.52bn of them. Feel familiar?

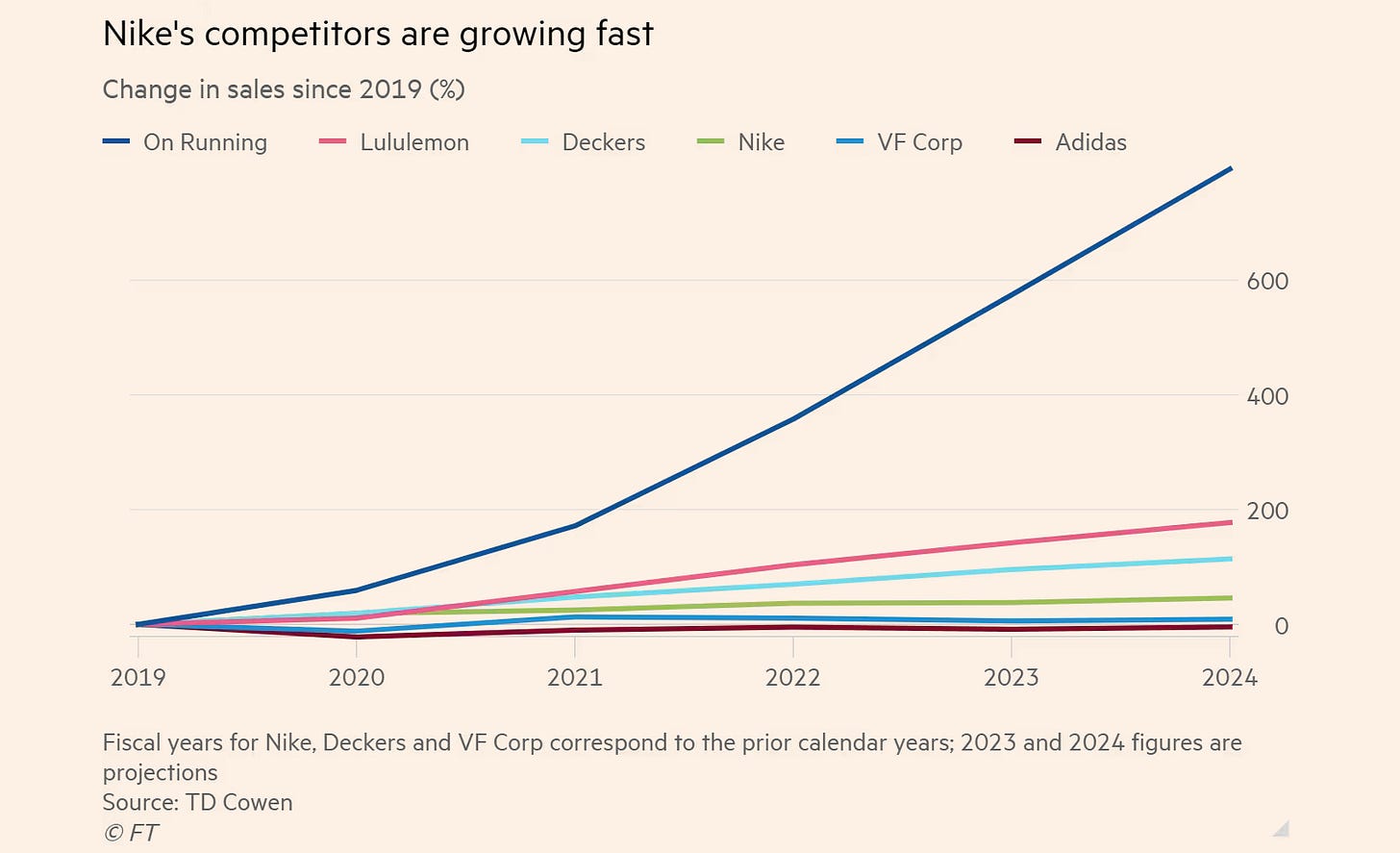

Here’s where they diverge — Nike hasn’t cut its advertising budgets, or slashed its capex. Those growing numbers you see on the screen before you aren’t some hocus pocus — they’re real. But Nike still has a problem. It’s the problem plaguing Disney too — a lack of creativity. Since John Donahoe’s appointment of CEO in 2020 a lot of the key creatives behind what made Nike a global brand departed. Uh oh. The piece goes on to say that Nike’s over-relied on rereleases of vintage models of shoes and has been lapped by smaller competitors (every cool girl I saw in Paris was wearing Asics).

And look — Nike’s keep selling and beating earnings estimates healthily. That’s because the continue to be a well managed company and those stock buybacks make sense — or do they?

Here’s another chart from the FT a few weeks ago. Nike’s been running to catch up — On Running in particular received a boost when Roger Federer invested in the company. And of course, Lululemon is the clear winner — heads and shoulders above rivals.

I’m always thinking about “reversion to the mean”. Nike continues to be a good company, but does it have the same growth prospects it once did? Should they be looking at acquisitions, rather than buybacks? Adidas had the whole Ye fiasco which torpedoed their results for a while, but that was temporary. Remember — Nike’s success initially had so much to do with Air Jordans. You can see from the Federer endorsement how much that factor contributed to On Running’s run-away results. Still like Nike as a company, but when there’s smoke…

On Paramount

Quote from an unnamed exec — care of the always excellent Puck.

“Studio executives literally stop working when a company puts itself up for sale. Paramount gets more and more damaged every day. No one wants to bring projects there because if a new team comes in, usually the new team writes off almost everything in development. Shari has to get a deal done soon or she will damage the value of the studio.” —Another executive

Briefly noted

Today’s FT - have we reached peak MBA?

Private Equity — “US private equity firms are rushing to take advantage of lower borrowing costs by loading debt on their portfolio companies and using the cash to pay dividends to themselves and their investors.” Link. Shades of Thames Water?

Ozempic sag is real — long AbVie, the owner of Botox and Juvéderm? Also starting to see the first of many Ozempic-related lawsuits…we continue to be long CSL

A loving tribute to Indiglo on The Verge.

I note there is a new Christian Louboutin store on Queen st (AKL) and have yet to see a single soul in it…just sayin’’

I have told you this before but Docs was my worst investment idea ever — and looking at Birkenstocks I'm surprised to see the stock has kept afloat; it’s actually up 11% in the last three months…it’s something I’m watching with interest. The other shoe listing I should tell you about, of course, is AllBirds, which was a disaster— they make comfortable shoes though.