Reasons to worry and reasons to be cheerful

Why NZ is heading for a bad recession -- if we don't change our ways

It’s been a strange week in markets. Everybody was excited about Auckland Airport, though in retrospect (everything in retrospect) it felt like a foregone conclusion — airports have gotta raise capital least they go the way of Old Trafford, the Manchester United stadium.

There’s a little happening here at home — the Arvida vote next week, for one (again, feels like a foregone conclusion). In the Americas, the Fed cut by 50 bps and speculative stocks went even higher, which I think is the wrong conclusion to take from this — a 50 bps cut is the Fed admitting things are bad out there.

In a sense, the market is utterly divorced from reality in the current climate. I only shop at Farro, because I am insufferable and also have sensory issues — the bright jarring lights of a Woolworths is about as enjoyable to me as having my feet eaten by piranhas while enduring one of those flat earth people explain to me why the world is, in fact, flat. And Farro is different — the type of people who shop at Farro tend to be largely insulated from the economic downturn — they are well groomed and read Metro and wear natural fabrics and discuss politics at dinner, with vast goblets of Chablis, but never too much politics (am I ripping out myself here? I guess so!)

Which is to say, Farro caters to New Zealand’s burgeoning upper middle-class, which has largely been created from a 25 year bull market in property and the associated professional jobs with those (lawyers, accountants, consultants, developers…). You can probably work out the next question I have — I wonder, just a little — how comfortable are those Farro shoppers, really? The vast majority will have mortgages and expensive cars and children they need to send to St. Cuth’s or elsewhere1. And you know — that vast economic miracle — the rockstar economy — it’s not looking as good! You only need to survey the local hospitality sector to get a read — one prominent industry personality recently told me bookings were down about 30%.

I am trying to give you a nuanced picture here. Our last 25 years of economic gains were powered by i) net inflows of immigration ii) low interest rates and iii) a chronically constrained property market that, combined with a lack of capital gains taxes, made property a very happy vehicle indeed for people to put their money into.

I still remember Martin Hawes coming to speak at my school. It was just prior to the GFC, and I didn't like accounting or economics much — I much preferred history. The economic concepts they teach you at high school are nonsense (much like how free market nutters are nonsense — you’ll note those brave exponents of the free market are the first to come begging for a handout from the government when all goes kaput).

Martin said, basically, what you want to do is leverage. You want to find some debt somewhere very cheap (vweary vweary cheap) and you want to leverage that so you achieve more yield than your cost of debt. He wasn’t wrong — it was probably the first honest opinion in economics I’d heard at Waitaki Boys High School. Obviously the best way to do this, for a long time in NZ, was property.

I have written before that we are not in the same situation anymore. Second law of thermodynamics — everything has an end point. Entropy do be like that. So my mind goes back to the well-heeled denizens of Farro — how many of them are professionals that service, essentially, the property industry here in NZ? How many of them rely on the associated work? How many of them are simply corporates — remember a lot of big corporations are in fact cutting staff. And how leveraged are they, with their mortgages and cars and cost of their lifestyles? Polo lessons for little Tortellini and Saffron do not come cheap!

One metric might be KiwiSaver withdrawals, and I am going to steal a chart by Ella from interest dot co dot nz here — link — you can see that early KiwiSaver withdrawals continue to creep up. A bunch of those are for home ownership, but you’ve still got $35.9mn withdrawn in July alone.

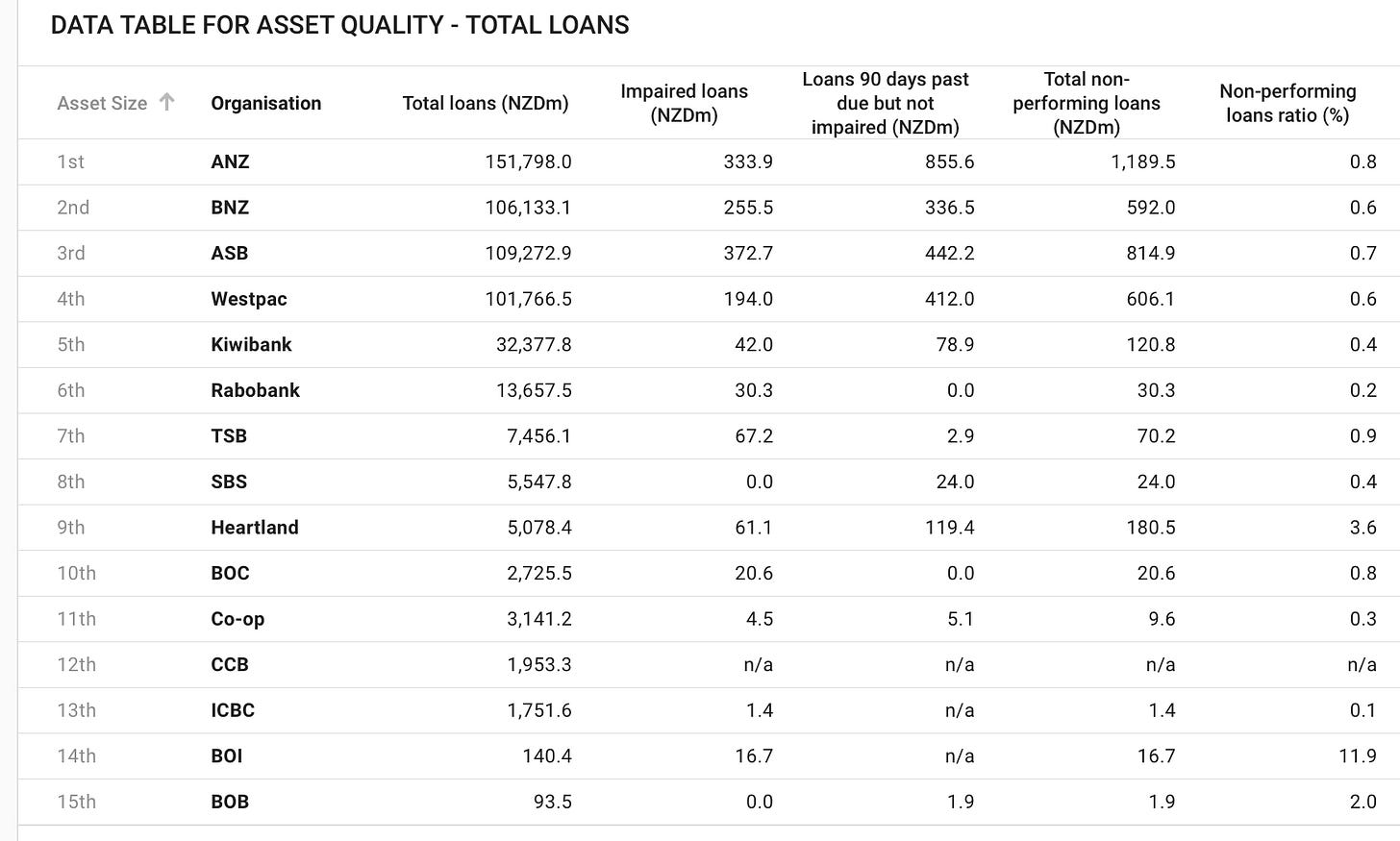

You can also get some idea (though again, not much of one) from the Reserve Bank’s bank dashboard. It’s not enough of a picture in my view — but those impaired loans and non-performing loans do keep ticking up.

What about retail spending during the June 2024 quarter in NZ? Well, OK then:

spending in the retail industries decreased $740 million (3.7 percent)

spending in the core retail industries decreased $410 million (2.3 percent).

Per category:

durables, down $151 million (3.2 percent)

fuel, down $98 million (5.7 percent)

consumables, down $92 million (1.2 percent)

hospitality, down $82 million (2.1 percent)

motor vehicles (excluding fuel), down $61 million (9.8 percent)

apparel, down $38 million (3.8 percent).

NZ, in other words, is not in good shape. If you go to any of the other supermarkets you will note that the value brands are selling a lot more. You will also note that many people are really watching what they buy — it can be a sobering experience to be at the checkout of a Pak n’ Save.

But what of the Fed’s 50 bps cut? After all — the US is not NZ. Surely, then, surely we should be celebrating?! Should we break out the champagne?! C’mon guys — USA! USA! USA!

I mean — credit card delinquencies are on the rise:

But it’s ok, right?!

And here’s Dollar General’s CEO (I know I’ve quoted this before, but it’s worth reminding you):

“The majority of them [our customers] state that they feel worse off financially than they were six months ago as higher prices, softer employment levels and increased borrowing costs have negatively impacted low-income consumer sentiment,”

And here, you know, is the P/E multiple of the S&P 500 (rather than a magical group of stocks that only go up — as some charlatans who say “JUST BUY AN INDEX” will have you think — the S&P 500 is merely a group of the largest 500 American companies that happen to be listed).

It’s elevated, folks. That’s since 1880 or so, by the way.

Don’t cry into your pillows just yet!

Under the hood I think there is still good buying (you must be thinking — can you believe this guy? Telling us a story of doom and gloom and now he’s saying it’ll be ok? The gall of it! Get outta here!!)

There is good buying in things like luxury and booze (you can buy CDI, the Arnault’s holding vehicle, for about 17x earnings). I’ve said all this before — it is not new. There is always good buying in “toll booth” companies, like Visa, Mastercard, S&P, etc. There is extremely good buying in mispriced situations like DGL, the chemical goods, freight and storage company (on Friday, it traded below 0.3x book… even if you discount to tangible book, it’s so cheap…!)

There’s always value to be found, but it isn’t found in the tech darlings we all know and love. I have no special edge on the tech companies and no more knowledge than anybody else — frankly, they are covered by so many analysts that you might as well “break your fiddle over your knee”, as Fritz Kreisler said when he saw the young Heifetz play.

As for NZ — I am still worried — frankly I do not think Luxon has what it takes to engineer meaningful economic policy (another road? Another highways? Bobby D might say…how many roads must a former Air NZ walk down, before he finds another plan?)

I will beat on the same drum I have beaten on before (the poor drum). The only way NZ moves forward is innovation and a willingness to take risks. We must discard our colonial subservience and hesitancy to break the mould. Every so often, I hear people say “you know, we split the atom! We gave women the vote!” — my answer is always — that was decades ago.

To do this we must embrace an attitude of bravery and be unafraid of what others think. We cannot do the same as before, because as great as the property bull market has been for 25 years, we cannot expect it to continue — nor is it a good thing — we wonder why our cousins across the ditch are so rich. It’s because they’re doing stuff.

More Xeros, more Rocket Labs, more inventions, more risk. We are capable of this. Otherwise, I fear we will see more of an economic downturn than say, the USA, which risk is rewarded and a part of the culture.

For readers outside of NZ (or Auckland), Farro is like Erewhom crossed with Whole Foods, while St. Cuth’s is a very expensive girl’s private school. Or as the toffs in the UK say, a public school.