Happy Monday and hello world, we’re back at it again. Enjoyed an Ardbeg tasting at the inimitable Glengarry Jervois Rd, loved the Ardbeg 19, and the v rare 25. Not something you’d drink every day perhaps, which made it all the more lovely.

Remember that Moet-Hennessy owns Ardbeg (MH in turn is owned by both Diageo and LVMH — daddy Arnault has his fingers in a lot of pies). Most LVMH insiders will tell you that while Arnault and co have turned around watches, and while fashion continues to pump (excl. China…more on that below), the booze segment is probably the biggest challenge they have right now. As I wrote to you on Friday last week, I’m not concerned too much about that — people are always going to drink (and think of the marketing MH got at the Paris Olympics…). But practically speaking, while Arnault has thrown his children into most of the divisions by now, none of them have worked in the MH/liquor space. MH CEO Philippe Schaus is resigning (or rather, was kindly shown the door…) so there is a spot for an Arnault spawn, should they accept. That’ll be a proper test of mettle in Arnault’s on-going ‘Succession’-like drama.

Also worth turning our minds to whisky for a moment — shame to see Waterford entering liquidation. Waterford was run by Mark Reynier — i.e the genius behind the revival of Islay’s Bruichladdich distillery. This NY’r profile of Reynier and Bruichladdich is a must read…

Even Shiseido isn’t immune…

For a while Shisedio looked like an outlier in listed beauty stocks — L’Oreal and Estee have had hammerings (especially Estee, as we know…), but Shiseido had the upper hand, because they were smart about which brands they acquired — they own Dr Dennis Gross, Drunk Elephant, Tatcha, etc. The three I mentioned are big with Gen Z and best selling products at Mecca. Yet even then, the recession wrecking ball waits for no man — the co just downgraded its profit forecasts for the next two years, citing a +20% decline in China sales. If this tale sounds familiar, it’s because every other luxury company or beauty company (hell — even Starbucks) has cited China slowdown as a reason for a marked decline in sales.

I guess — one read-through is that China is obviously faltering. You can see it in lower exports of iron ore from Australia, and you can see it from lower consumer sales basically the whole way through — from “staples” like Starbucks to aspirational luxury.

My point is (and you will be sick of me saying it) — there’s a recession, and here’s some very obvious evidence of said recession.

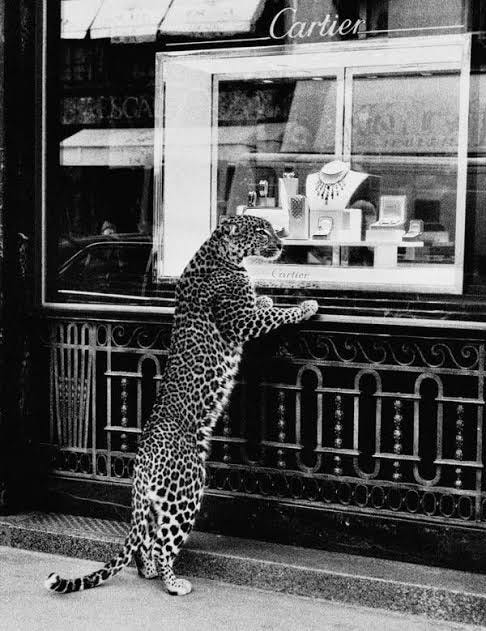

Also interesting to note Richemont is willing to sell underperforming brands — Miss Tweed reports here. Richemont’s portfolio is a grab-bag of whacky assets, heritage brands and the crown jewel of Cartier. Cartier’s a fantastic business — Arnault would probably buy it1 , but I doubt such a deal with survive regulatory scrutiny. A merger between Kering and Richemont might be a meeting of equals. Right now, though, I suspect we’ll see the whole company sold off for parts over the next few years — luxury is at the bottom of the cycle; I don’t see any tremendous M&A happening until consumers start spending again.

NZ

BAI — Everyone’s favourite AI business selling its “AI Consultancy” back to CEO David McDonald. The AI side of the business generated just north of $100k. Go figure. Now the business is a mailing co, a filing storage co and schools (?)

Aus

Noting WiseTech cofounder Maree Issacs has sold her remaining stake in the co to fellow cofounder Richard White, per the AFR. $285mn up front then payments every quarter for the next seven years. ‘Struth. Always worth noting when a founder (White) is buying more shares…remember when S Henry did this at DGL recently…

I would also — “I would if I could…”