Ch-ch-ch-ch-changes

Turn and face the strange

Ch-ch-changes

Don't want to be a richer man

Ch-ch-ch-ch-changes

Turn and face the strange

Ch-ch-changes

There's gonna have to be a different man

Time may change me

But I can't trace time — David Bowie, Changes

I’ve felt consistently stupid the last year or so, which is natural for me. I am always feeling stupid. If you are not feeling stupid, then you are probably doing something wrong — investing is an art first and foremost, and it’s as much dictated by people as it is by numbers. A brief (and incomplete) example of people buying things via emotion and not because of numbers:

South Sea Bubble 🌊

Tulip Bubble 🌷

Railroad Mania 🚂

Dot com bubble 💾

Bubble tea 🧋

AI bubble 🤖

Bacon bubble 🥓 (remember in the mid 2000s when everyone was obsessed with bacon? How very millennial)

This last year I have been into boomer low tech companies. I like them because they have easy to understand business models and sell things that are easily understandable. Even an idiot like me can understand them — that’s the trick. Diageo sells booze. It sells mostly spirits, which are higher margin. It owns a lot of brands that command a lot of mindshare. The same can be said for its peers. Ditto a company like McDonalds. You may not like McDonalds, but you can understand what they do — they sell an idea (McDonalds!) and license and sell the various things that owners need to make McDonalds McDonalds (this is the Coca Cola model, btw — they don’t make Coke; they market Coke and sell a syrup to bottlers. It’s much better to sell ideas and mindshare. Mindshare don’t need no inventory).

The last year I have eked out an OK return (our global model portfolio is up about +10.00%, whilst our private strategy we offer to wholesale investors is up +16.00% since inception four months ago). It isn’t the S&P 500, though, because I have eschewed tech — I detailed in my last email to you just how heavily very few securities have accounted for the S&P’s return — it’s basically the “Mag 7” (Nvidia, Meta, etc…).

I don’t care too much. The people I have alongside me, my clients and friends, understand exactly what kind of businesses I look for and why I do — they understand the method. Over time, family owned or founder led businesses outperform (there is a great Credit Suisse study which backs this up — email me if you want a copy). I can talk to you about the virtues of a company like LVMH until the cows come home1.

But of course I have felt stupid — you see Nvidia climb from a zillion dollars to a kadrillion dollars, and you go — shit, is there something I am missing??

Anyway — in the last few days the magnificent seven stocks have sold off — Nvidia lost the equivalent of one Unilever in a single day. Other stocks have sold off heavily — ASML, TSMC, etc — trade war woes, Biden/Trump tariffs, etc2. Y’day Crowdstrike broke the internet, and it wasn’t as fun as Kim K. I’m wondering if something is happening — I’m wondering if we are at a sea change.

Sea change?

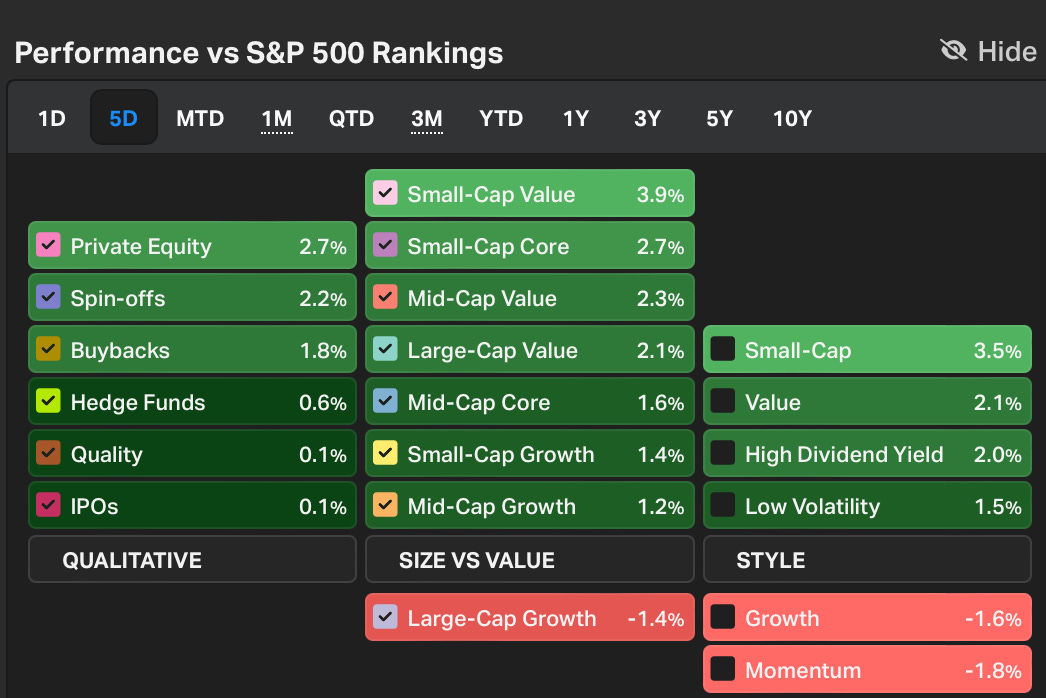

You can evidence of a sea change in the performance of various factors in the last five days — small cap value strategies have outperformed almost +3.00% versus growth; while growth and momentum style factor-based investing has sequentially declined. It’s return of i) the small caps and ii) value.

While the tech companies have been selling off (again I remind you of reversion to the mean — can you really be surprised that companies trading at 40x + earnings revert to lower than that?), the boomer companies are staging something of a comeback. It’s subtle, but it’s there. Elliot took a big stake in Starbucks, for instance. The stock jumped +6% on the news. That isn’t in itself big news, but Elliot’s hunting ground tends to be undervalued companies that need a fire lit under their ass — it’s a sign that Elliot is seeing value in boring boomer businesses like Starbucks.

Ditto WarnerBrothersDiscovery (WBD) — the stock is up +18% in the last five days. WBD is saddled with debt like none of your business (+$40bn). WBD also owns a fantastic library of content (including HBO, etc). If they can pay off debt eventually the debt portion of payments convert to cashflow.

My point is: boomer companies aren’t entirely dead! They are still selling things! And maybe — just maybe — we’re starting to see a sea change.

Slowly at first and then all at once

Eventually you get what you are owed in life. Stocks do, too. Stocks are businesses. A company like Nvidia trades at +65x earnings — it can feel unsustainable because the earnings the company needs to make must compound so fast. I’m going to haul out a graphic I really like and have shown you before. It is of the multiples of companies as at 1972:

Some of these companies were fantastic — McDonalds, for instance, had double digit earnings per share growth for the entire decade, but the stock would’ve only lost you money in that time. It doesn’t matter if it is a good business if you pay too much.

I’ll repeat that last part.

It doesn’t matter how fabulous and wonderful the business is if you pay too much.

(All your money is made in the buying!)

I got into investing by being a loser child who preferred to go to Whitcoll’s than the Caroline Bay Carnival and buying The Warren Buffett Way, which (little did I know then!) impacted me a lot because now I write to all of you and occasionally agitate CEOs — it’s a fabulous life.

The main thing I took from that book was that the way you value a business, basically, by taking all its future cash flows from now until judgement day and discounting that by an appropriate amount. And remember there is always judgement day for a company — future cash flows do not increase forever; if anything, they either stagnate or dwindle at some point3.

The market is a device which tries to determine how much the future cash flows of a company will be. It does not think until judgment day; in general I think it works in 10-20 year periods — this is very much a vibes based thing — the market thinks in decade-long vibes.

It’s too hard to calculate the cashflows of a company in centuries, and there’s survivorship bias to factor in (i.e. you only count the companies that survive, and don’t drop off like lemmings). If you’re factoring in a decade or two and a company trades at 60x earnings, you are factoring in remarkable growth over a relatively short timespan. Reversion to the mean is common, and almost inevitable.

In other words, the boomer businesses have experienced a period of underperformance, where their future earnings have been discounted too rapidly. On the same token, the tech businesses have experienced their future earnings growth rate overestimated by the market. Sea change.

Where I am looking from here

I am sticking to my guns. I still like high quality businesses that make things I can understand. This includes, but is not limited to, McDonalds, Starbucks, Dominos, Diageo, Pernod Ricard, Rémy Cointreau, Lululemon, Kering, Visa, Mastercard and more. It also includes things like Exor N.V, Bollore, Essilor, and so on.

I do not like capital intensive tech businesses. Tech used to be CapEx-light, but this is increasingly not the case as AI and cloud compute requires more servers, more data centres, more energy — CapEx is a real cost — and it has ballooned for tech giants. See detailed below:

I think it is unlikely we will see the fat margins that MSFT and co used to report. Alphabet used to be a search business (Google) with a giant ad engine tacked on — it is increasingly a CapEx heavy company, with server farms and data centres tacked on. It is necessary, but remember that replacing computer equipment for high performance data centres is a matter of adapt-or-die, rather than a sleepy metal workshop in Biddilybop Diddlydee Idaho needing to replace a machine every 20 years.

However, I think it’s fairly likely that Diageo continues to sell Guinness and that McDonalds continues to be a near-miracle — you can get it anywhere in the world, and it tastes the same everywhere. I think it is fairly likely that Dominos continues to sell pizza and Visa continues to process an astonishing 720 million transactions per day. I am certain that people will continue to desire status, because most people are quite simple creatures — Kering, LVMH, Richemont and Hermes will continue to benefit. If you are buying these things well off their typical capitalisation you are ensuring yourself a good margin of safety4. It is not glamorous, but it makes sense to me.

I often wonder if my colleagues feel about LVMH like how Buffett did with Charlie in his joke about Costco:

“Charlie and I were on a plane recently that was hijacked [and] the hijackers picked us out as the two dirty capitalists that they really had to execute. But they were a little abashed about it. They didn’t really have anything against us, so they said that each of us would be given one request before they shot us. They turned to Charlie and said, ‘What would you like as your request?’ Charlie said, ‘I would like to give, once more, my speech on the virtues of Costco — with illustrations.’ The hijacker said, ‘Well, that sounds pretty reasonable to me.’ He turned to me and said, ‘And what would you like, Mr. Buffett?’ And I said, ‘Shoot me first.’”

One of the things I find most hilarious is the free market idiots — yes, the free market! The free market that is protected by tariffs! The one that bailed out businesses in 2008! I have less than zero respect for the Chicago school of economics

I’ve been reading Dangerous Muse: The Life of Lady Caroline Blackwood. Caroline Blackwood is one of my favourite people — snarky, dark, an ineffably good writer (and flawed — she was a boozer — they used to say “if Caroline opened a bottle of vodka, there was no point putting the lid back on”). Her books are underrated — Great Granny Blackwood in particular is stand-out. Anyway; Blackwood was a Guinness; whose regular trust fund cheques came in part from the brewing fortune — Guinness now makes up a tiny portion of the family fortune and the brewery probably hit its peak in the mid-20th century — from now until judgement day indeed…

As I put it, a “margin of being wrong and an idiot”