Serato (and the whole Tiny thing); Kering just keeps getting cheaper

And a little digression on the curse of the next Buffett

My Food Bag’s “Normalised” revenue —

You have to love “normalised” revenue with an asterisk —

Revenue of $162.1 million, in line with FY24. Within this, H2 revenue of $79.9 million, which is up +5.0% when normalised for differing trading weeks1 with FY24 H2, and up +1.9% on a half on half comparative basis

What’s the footnote, you ask?

H2 FY24 contained 27 delivery weeks based on where My Food Bag’s weekly delivery cycle fell, compared with H2 FY25 which had 26 weeks. For the purpose of this normalised comparison, we have ignored the final 27th week from H2 FY24.

Well then.

A long time ago I wrote about how My Food Bag was probably a short. I said it was probably worth $100mn at most. That’s when the company traded for $361mn. Turns out I wasn’t pessimistic enough — the current market cap sits just above $48mn. A great man I know says about Sauvignon Blanc — “give it to someone you hate1”. I think the same of My Food Bag.

Serato & the curse of the next Buffett

I note Serato, the DJ software, has sold a majority stake to Canada’s Tiny, a self-styled “Berkshire”-type buyer of small internet-based businesses. I hadn’t thought about Tiny or their founder, Andrew Wilkinson, in a while. He’s a colourful character who, as with many people, likes to trot out the story of his encounter with Charlie Munger. At this point I’ll post my favourite meme of all time:

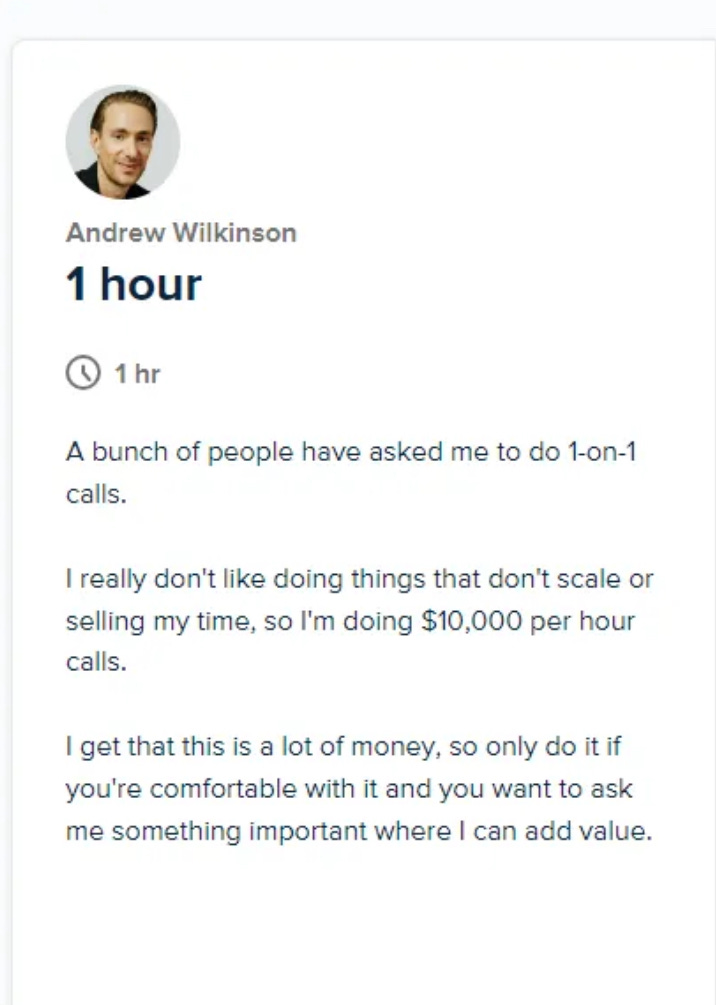

Anyway, there’s a lot of conflicting data about Tiny and Wilkinson, especially how Tiny calculates its EBITDA (in 2023, they used “step up” accounting to inflate EBITDA using a non cash item2. Andrew also charges $10,000 an hour to speak with him3: (If anybody would like to pay me $10,000 for an hour of my time, my door is open — we could go to Denny’s or McDonald’s perhaps and have a lovely cheeseburger). Tiny’s stock has not done that well:

This is partially what I call “the curse of calling yourself the next Buffett/Berkshire/etc”. Years ago, there was a man called Eddie Lampert. Long story short, he took over Sears, promptly made it very bad, and then spun-off the property side of Sears and that stock (Seritage Growth Properties) is down 92% since listing4.

Anyway; not to say that the Serato deal is bad — they are a good company! It’s probably the best deal Tiny has made! But also, you know, Tiny and Wilkinson are interesting ones — here’s the bit of the deal that’s interesting to me:

(i) the issuance of 29,360,452 Common Shares to the Sellers having an aggregate value of US$23,600,000 (the "Completion Shares"), and (ii) the payment of up to US$42,400,000 in cash.

Of course they are paying partially in shares — just look at how they’ve diluted shareholders over the years!

What’s another 29mn shares issued between friends? (Berkshire has rarely issued any new shares — see below5). Is Tiny really the new Berkshire Hathway?

Kering, an ugly duckling or is there value there?

Now onto luxury (again) — Kering is trading under the 200 EUR mark, at 190 EUR per share. That’s roughly 1.57x price/book and 1.4x price/sales.

Remember — Kering not only owns Gucci, but also Bottega, Saint Laurent, Balenciaga, McQueen, Brioni, Boucheron, etc. It is not a one trick pony. Mr. Market hated Demna’s appointment to Gucci, which I think is a little bit misguided — Demna’s couture at Balenciaga was top-notch and I think it’s a mistake to think of him as only a ‘street style’ guy.

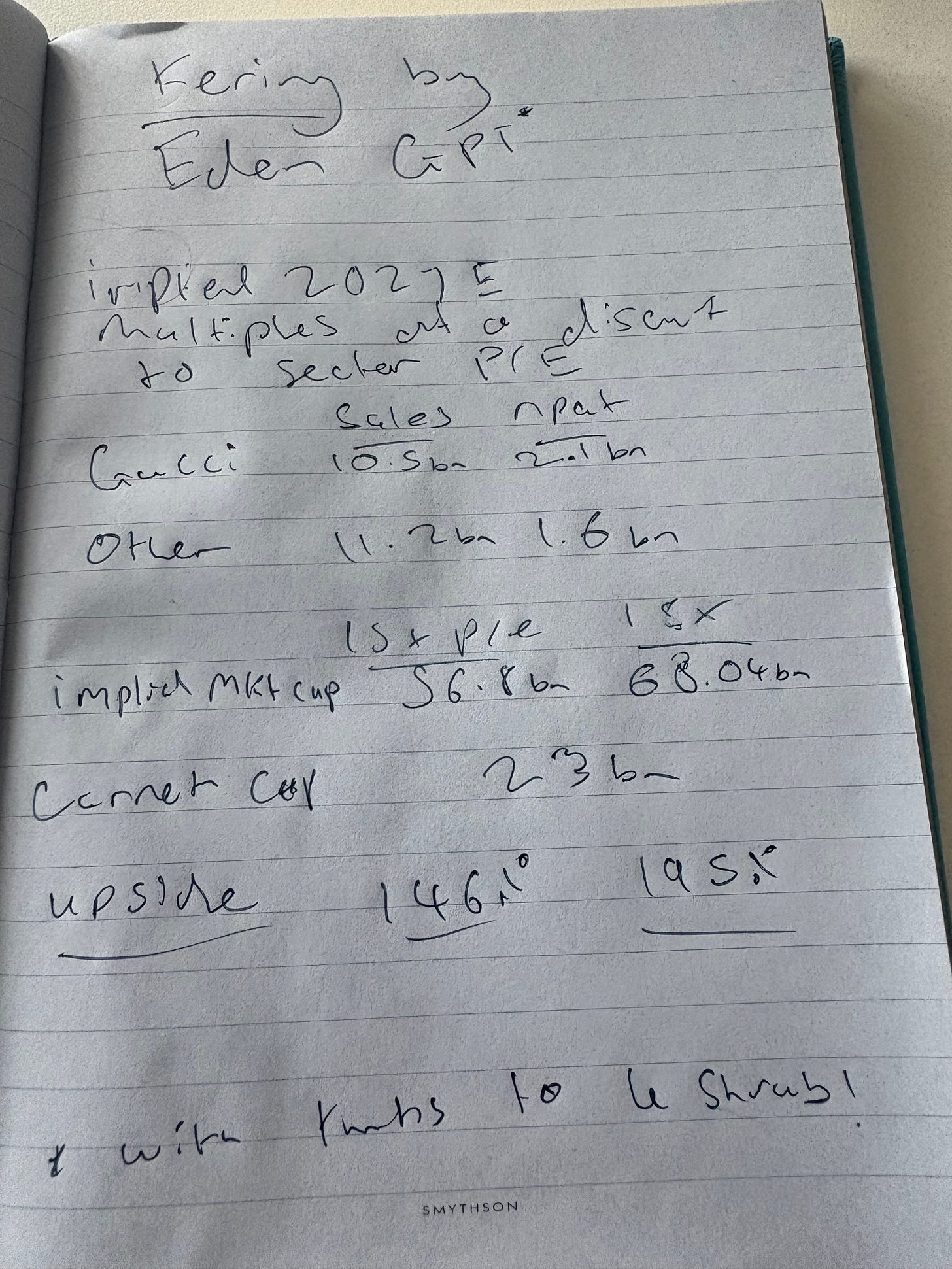

But let’s talk numbers, provided by Eden GPT — if you project out earnings to FY27 and assume Gucci grows at ~10% and other houses at ~5% (very conservative, btw, considering how much Gucci has already pulled back in terms of growth and how Bottega, Saint Laurent continue to either grow or sit relatively flat).

Anyway, let’s also assume the company continues to trade at a fwd discount to peers. That implies a +146% upside at 15x earnings to the current stock price. There’s a lot of rope to be wrong there — even a 50% re-rating is quite lovely, and doesn’t take any kind of “moonshot” to find yourself there.

Now, you need to remember that fashion isn’t about yesterday, it’s about the now, and the market is at a perpetual disadvantage to fashion because they are looking at yesterday’s numbers. In other words, fashion is like an even more bipolar version of Mr. Market — today’s trend is today’s price; unfortunately tomorrow’s trend is never priced in.

Now, I don’t have to do a lot of heavy lifting to remember that all of Kering’s houses have been fairly fashionable throughout time. Nor do I have to do much heavy lifting to remember that Gucci did incredibly well and then it did less well (a trend throughout Gucci’s history). I actually made a very good infographic recently, backed by 10,000 AI GPUs, which asserts this:

i.e. Gucci is cyclical, and tends to go from terrible designer to great designer. The trend infers a “great designer”, given Sabato’s underperformance. Demna already quadrupled Balenciaga’s sales. It doesn’t take a great leap of faith to think he’ll do well at Gucci — the cynicism is overblown.

Point is, if you assume — even at limited growth — that Kering and its houses continue to grow modestly, then you are looking at a company that trades at a severe discount to peers. No, Harry Styles isn’t wearing Gucci — but remember that Styles and co aren’t the primary drivers of growth, it’s much bigger than that. And remember that Pinault’s family office, Artemis, owns CAA, one of the big two talent agencies — it will be no surprise that Zoe Kravitz, seen below, wore Saint Laurent at the Vanity Fair Oscar’s party, and that Kravitz is represented by CAA.

In other words, there’s a clear symbiosis between Kering owning these houses and the Pinault family office owning CAA. Expect to see more Kering houses on the red carpet, in magazines, etc. That’s a lot of free publicity. (And here’s Lauren Sanchez with a Balenciaga coffee cup — I wouldn’t call her a style icon, but…)

Bottom line — there’s a lot of overblown fear here (and yes, those Trump tariffs aren’t helping). With so much potential upside, it’s hard to not see Kering as “value”6.

Odds & ends

Enjoyed this piece about Mecca’s new mega store.

Loved this archive piece from VF on Karl Lagerfeld, from 1992.

This NY’r piece on the six figure nannies of Palm Beach is a great read.

Or use it as drain cleaner!

A good explainer on “step up” accounting, for the nerds: https://investingideas.co/2024/10/30/how-a-gain-on-step-acquisition-affects-net-income-under-ifrs/

Honorable mention to Boston Omaha Corp, which shamelessly plays on former CEO Alex Rozek’s connection to Buffett — he’s his great nephew. They have a motley collection of billboards, broadband, and insurance. The stock hasn’t done well.

You’ll note that there’s been a lot of buybacks as of late. The other interesting thing here is Dexter Shoe company, which was probably Buffett’s worst mistake ever — he said:

“To date, Dexter is the worst deal that I’ve made. But I’ll make more mistakes in the future — you can bet on that. A line from Bobby Bare’s country song explains what too often happens with acquisitions: “I’ve never gone to bed with an ugly woman, but I’ve sure woke up with a few.”

In real terms, the 25,203 shares Berkshire paid for Dexter are worth about $20bn now. Dexter is worth zero. As Buffett said “As a financial disaster, this one deserves a spot in the Guinness Book of World Records.”

Do your own research. Not investment advice.

Great edition Eden, except there’s no way you’d go to lunch at Maccas….