My Uber driver this morning said to me “it’s almost a ghost city, isn’t it?”

We were driving down town, to the HSBC building, and it was hard not to notice the distinct lack of people in the city centre. My driver said — “back pre-COVID, HSBC was one of the busiest buildings in the city. Now?” — he shrugged and said “not so much”. Had I heard of Longroom, he asked. I had indeed heard of Longroom, I replied. That’s quieter too, he said. And K Road — even K road is quieter.

We talked about how working has changed, and how he knows people who drive 2 hours to get to the city for their jobs, each way (for the math lovers out there, that’s 4 hours each day or 20 hours a week). We talked about how we live in a post-COVID world, and all the while we drove past empty “for lease” shops. It has been a sunny morning and there was something affecting about the whole thing — yes, Bitcoin might be at record highs, but out here in the real world things are looking pretty quiet.

Also — just saying — what is going on with Westmere these days?? More road cones than people!!

Like I’ve said before, we live in a time of extreme disconnects. $38.4mn was withdrawn from Kiwisaver schemes for financial hardship in October alone (per interest dot co dot nz — shout out to Ella, who doggedly chronicles each KiwiSaver month, like sands through the hourglass). Almost 4,000 people withdrew due to hardship (in the month previous, 4,100 withdrew due to hardship. It adds up).

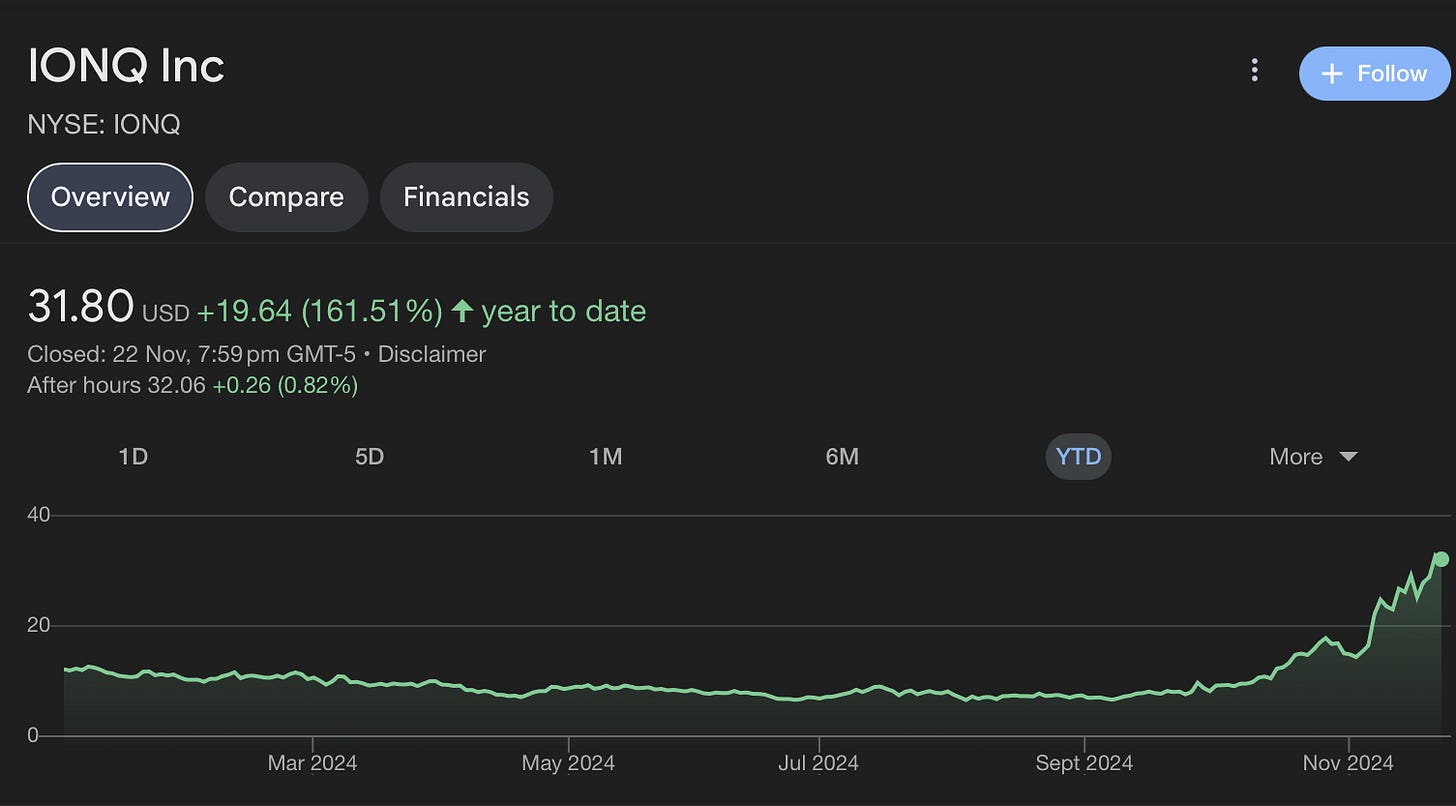

Meanwhile, we also live in a time where certain companies are being valued far above their intrinsic value. One example — IONQ, a quantum computer startup that is most likely a fraud. It’s had a remarkable rise since the “Trump bump”. Here's a good report published by Scorpion Capital on why the “quantum computing” startup is most likely a fraud.

And yes, we also have Bitcoin sitting around $96,000. I don’t have to tell you of my position on Bitcoin, but I will anyway: BTC is a currency without any real utility, because it is so inherently volatile in price. The key concern with a workable currency is that the value of it needs to be roughly stable. That is, if you buy a loaf of bread for $5 NZD one day you should expect to be able to buy the same loaf for the same price the next day. But I have no idea what Bitcoin will be worth tomorrow, or in six months, or in a year, so the value of Bitcoin in my pocket as a workable currency is a giant question mark. By the way — that’s great if there’s upside (i.e. BTC go up!) but there’s just as much risk for downside. But it still figures: if I am a retailing pricing my goods everyday at the supermarket for BTC, then I’m gonna have a hard time.

It also figures then that Bitcoin is a highly speculative asset class (if it quacks like a duck…), without an actual utility versus other speculative asset classes (i.e. gold, silver, copper…). Of course, Bitcoin is now an institutionally backed speculative asset class, with the Norwegian Sovereign Wealth fund being a buyer of it (rather than considering institutions being buyers as an endorsement of legitimacy, I consider it a signal of spreading delusion).

This isn’t to say you can’t make money on BTC. Of course you can! But remember it is essentially a barometer of tech confidence, highly correlated to the NASDAQ (almost 1:1 at points). But given that correlation — almost as a proxy-to-the-NASDAQ — you can kind of consider BTC as a zombie asset class1, not quite enough on its own.

But here’s the thing — BTC does not care if I don’t believe in it. The market believes in it. BTC could conceivably move to $200k. Let me explain my reasoning.

Bonkers market logic ahead

1) BTC reflexivity theory

BTC is going up. It does not care what I, a monkey at a typewriter, think of it. It is going up regardless. It is going up even more because Trump implicitly endorses cryptocurrency. Trump endorsing it = US government endorses it = tendies for everyone.

Here’s the part that’s important:

+40% of Americans own Bitcoin or some other cryptocurrency.

Do you know what that means? That means STEALH QUANTITIVE EASING !!!

I.e Asset class go up, wealth of Americans go up, more money to be had. That’s QE! STEALH QE but QE none the less.

2) Tariffs are inflationary

There is nothing more to say other than tariffs are, inherently, inflationary. Cost of goods go up = inflation goes up.

3) Traditional asset classes are already inflated

The NASDAQ trades at +48x earnings. Nvidia trades at 55x earnings. Probably frauds like the aforementioned IONQ trade well above what they’re worth. A rising stock market with inflated asset class prices also means more wealth for Americans, which acts as a kind of QE too (consider the COVID stock market bump).

Tell me what you’re really saying, Eden

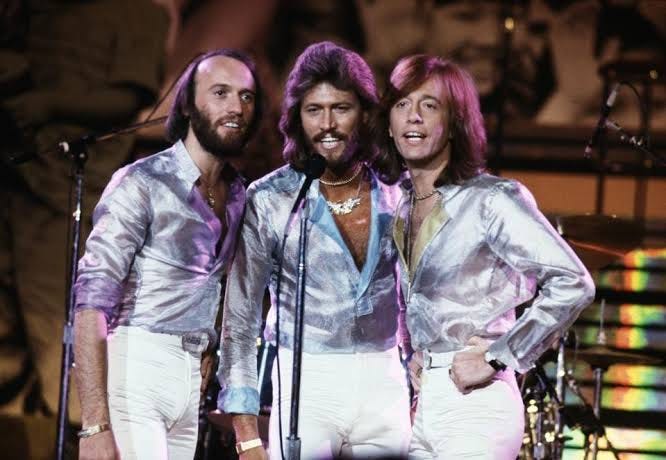

Do you remember the 70s? (I don’t, I wasn’t born). Here’s the 70s!

Ok, 1970s. Got it? We also had — wait for it —

Stagflation

US CPI is 2.6% today (+20bps from Sept). JPow’s done a good job of cutting it down. All the things above, though — you know — you’ve got implicit QE from crypto (remember +40% of ‘Muricans own some), you’ve got inflationary tariffs (this is simply a fact) and you’ve got asset prices that have created wealth — if only paper wealth.

That feels all a little stagflationary. If I were Trump’s pick for treasury, Scott Bessent (a smart ex-Soros guy, btw), I’d be fighting against tariffs as much as possible2.

NZ

Turners — Great result, NPAT +5% YoY in a tough market. I don’t understand the car dealership business (or the used car business) but it’s impressive how much these guys can eke out when punters aren’t running out in droves.

CHI — Raising $50mn at a ~10% discount to current stk price. Will run a bitumen import terminal for Fletchers. Channel has been one of those sleepy stocks that has done quite well and continues to perform. Not a bloodbath of a cap raise but just one that makes sense, noting our friends at Forbar underwriting here.

Waste Co — Late to this, but another acquisition — this time of Civic Waste Limited. I wonder why the co will start making money. It has not so far. See chart vs. index below.

Aus

Everyone’s favourite defence stock, Droneshield, sitting at 72c or so. Remember this thing was +$1.50 at one point. If you were someone who liked DRO at $1.50 surely you will like it here? Right???

WiseTech — Small earnings downgrade, resulting in quite a drop in the stock. Bit irrational — but what do you expect from Aussie fund managers? (In my experience, many Aus fund managers are a bit like the proverbial Mr. Market — ‘STRUTH THIS IS A STONKER OF A STOCK GET ON IT, to NAHHHH MATE MINRES IS DEAD, GET OUTTA IT — how to make money in Australia, IMO, is to go against the herd).

Yes, I know that Trump is crypto friendly. Trump trade! Trump trade! Trump trade!

He’s already argued, re: 20% tariffs — that they "were maximalist positions that would probably be watered down in talks with trading partners"