I, your humble writer, am in fact human

Over the weekend I was encouraged to think about what I’m “proud” of. This may surprise you, given that this newsletter is regularly acerbic, biting and contrarian — but I do have feelings and am, in fact, human (it surprises me too).

I started writing this newsletter a year ago in its current format — since then it’s tracked just under a million views, has about 9,000 readers and I’ve corresponded with people from all walks of life — from CEOs to farmers to left wing radicals to scions of society. I never thought it would be this popular — remember, the initial audience was about 300 people.

I am not a normal finance person. I’m not in the habit of wearing a vest, or RM Williams, or suits. My hair is uncouth and spirals everywhere. I don’t “fit in” to a gaggle of people from PWC or Goldman Sachs. Early in my career, I felt like an alien talking to people with clean-cut haircuts, sporting interests and BComs1. I’ve encountered both encouragement and hostility from the world of finance — we New Zealanders love to “fit in”, we don’t like a “moaner”2 and we adhere to the crowd perhaps a bit too much. On the other hand, some people (you know who you are) have been very supportive and encouraged me on my journey.

I am proud that I have perhaps, in some small way, paved a way forward for more finance “non-normies” like myself. You can come from a small town, and you can think differently, and you can succeed — in fact, I think there’s a lot more value to varied viewpoints that the homogenous whole that so often sinks NZ business. Occasionally someone on the street recognises me — from my TikToks or this newsletter. I hope that I am somewhat encouraging, and the future generation of people who work within this extremely weird field3 can further the very small things I have done.

Anyway — that is enough sincerity. Let’s talk about this year.

Stocks of note from the year - NZ/Aus edition

Arvida probably the deal of the year — traded at 1.00 or so, sold for 1.70. At the same time I think this indicative of the real winners — private equity at the expense of our exchange. If you take any listed NZ company with a market cap of under, say, $500mn or so, there’s a strong likelihood it trades at some kind of discount. Oceania perpetually trades at a discount to NAV; AoFrio is chronically undervalued due to size + lack of liquidity; Sky TV trades at something like 2.0x EBITDA or so 4. This state of affairs shouldn’t be much of a surprise — companies regularly leave retail shareholders in the ditch (think of Synlait, Fletchers, etc…) or suffer from management who appear totally disconnected from reality (again, Fletchers until recently, Warehouse, Spark, etc). If you were an alien looking in you might reasonably draw the conclusion that many NZ companies are in some kind of reality show — like children playing “shops”. But look — let’s talk about went well (and less well). Arvida was a great deal for shareholders!

AoFrio — another one that has done well — +50% on the year. I still think the thing is undervalued and a potential acquisition for a larger player. IoT segment where the value is.

Droneshield — There and back again. Spoke to a guy last week who was still bullish on it — I am not. Rode the train of war, blah blah.

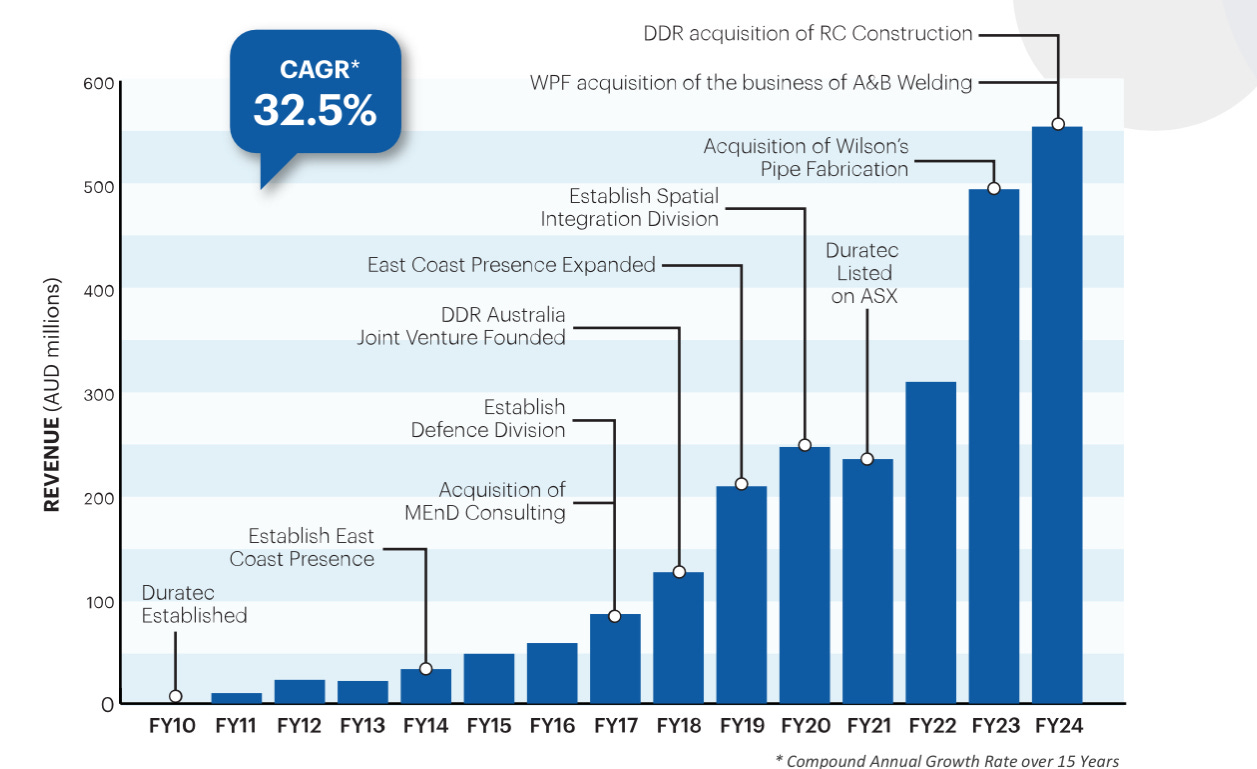

Duratec — My beloved “boring” stock also had a bit of a run up, to around $1.67 or so. Back in the $1.30 or so zone now. It is not glamorous and it is very boring. Note the impressive CAGR below…boring pays:

DGL — I’ve harped on at you about this enough — traded at 0.3x book at one point; boss-man Simon Henry bought more stock; is again, not a very glamorous company but value is value.

CAT — Catapult Group — 156% YTD! I wrote about this way back in November last year (!) here. November last year feels like a different time! Catapult is a good way to “play” sports without owning a sports team (alternatively, you can buy Atlanta Braves - BATRA - or Manchester United - MANU, etc). They make software for sports analytics — think of them as Palantir, but more sports, less defence.

Biggest eyebrow raises

SmartShares’ rebrand to “Smart”. Pointless.

Spark winning a pointless sustainability award from Deloitte. Spark stock is down 44% YTD. Perhaps they could work on making the stock price more sustainable??

Spark buying back shares at more than $5.00.

Being AI selling back its “AI Consultancy” back to the CEO of Being AI.

Being AI trying to acquire Solution Dynamics and Solution Dynamics saying “yeah, nah”.

Most Being AI stuff, tbh.

Please email me other suggestions — it’s been a doozy of a year.

China Stimmy

More stimmy announced in China — “appropriately loose”. Good for our luxury stocks, booze stocks, and basically any stock where discretionary income is important. On that note — Remy, Diageo, Brown Forman, Pernod all up…and ditto for the luxury basket (LVMH, Kering, etc). Remy in partic. has been slammed … China/Cognac tariffs… remember the value of their cognac stocks alone is around 110 euro p/share. Ditto the ‘premium’ segment of Diageo, Pernod, etc — as I noted y’day, some soft growth over in Europe, too… is the worst over, sweet prince?

I think the BCom is basically a useless degree — you would be amazed at how many people with BComs can’t tell you the most basic thing about valuing a stock.

“The New Zealander delegates authority, then forgets it. He has shrugged off responsibility and wants to be left alone. There is no one more docile in the face of authority. He pleads rationalizations, ‘doesn’t want to make a fuss’ or ‘make a fool of himself’, but generally he does what he is told, partly because everyone else is doing it, partly because he wants to be sociable and co-operate in a wishfully untroubled world. Only when things go visibly wrong does he recall his right to question the authority and change it. When he complains half his bitterness is that he has been made to complain because he hates complaint and can’t complain with dignity. Anyone who questions too often is a ‘moaner’, yet in new Zealand the moaner is common” — Bill Pearson, Fretful Sleepers

Finance is weird! It’s weirder the more you think about it!

Melting icecubes are still worth something