Tariffs, small town economies and what a Trump victory means

In which I ramble while landing on one or two good points

There's an evenin' haze settlin' over the town

Starlight by the edge of the creek

The buyin' power of the proletariat's gone down

Money's gettin' shallow and weak

Where the place I love best is a sweet memory

It's a new path that we trod

They say low wages are reality

If we want to compete abroad

- Bob Dylan, Working Man’s Blues #2

There’s an old Chinese curse that goes something like “may you live in interesting times”. I can’t help but think that we’re living in interesting times. Everywhere there are signs of recession -- from luxury spending pulling back, to filings for bankruptcies and insolvencies in NZ restaurants and cafes sitting at record highs since COVID. On the other hand, the US market paints a different picture -- despite a slightly weak earnings season in the big conventional tech companies (your Googles, your Microsofts, etc), the more speculative stocks have continued to surge: Palantir, the large government and enterprise platform, had record earnings and has surged about 141% YtD. It’s now a $100bn company. I wrote up Palantir early in my career as a young analyst -- back then it traded around $9.00. It’s now +$57.001. Gosh!

Now Trump is president-elect, so we are seeing an unprecedented surge in the US stock market (“stocks go up”). In particular, it’s worth looking to Tesla, controlled by Trump-ally Musk -- that’s up about 14% overnight. The most interesting thing about all this is the much-talked-about tariffs, which threaten to have an impact that is felt far and wide (consider than local companies, like Fisher and Paykel, have about 45% of their production in Mexico…)

If you are playing poker and you don’t know who the patsy is, then you’re the patsy. The millions celebrating tariffs would usually be the patsy here, because they’re the consumer. Those tariffs are going be passed straight onto them -- I will explain why this is a mistake -- and who the real patsy is.

There’s a trade-off with tariffs -- no less than Keynes argues for tariffs when unemployment is high, because imposing said tariffs preserves or creates employment where there otherwise would be none. This is hard for the ruling class of America to consider, because they haven’t the faintest of what it means to be an unemployed steel worker. In other words, the current capitalist “lever” of passing on prices to the consumer might not work so well -- at some point, the levy’s gonna break. If you are a white collar worker you probably can’t grasp what it is to be unemployed in a town that relied on one or two industries. Tariffs are a net benefit to towns like that.

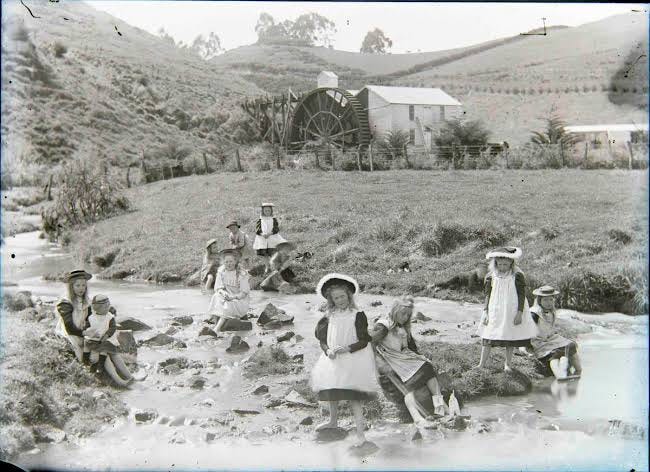

Clark’s Mill, Oamaru

I grew up in Oamaru, which originally had three major industries. The mill, the meatworks and the wool industry. There were multiple mills all producing fine flour and multiple enterprises spinning wool into yarn and textile. There is no more mill, though a fine waterwheel (that still works) can be found, preserved by a historic trust. There is no more wool production, and the last wool wholesaler, Stu Cato, retired some years ago. I used to walk through Stu’s Oamaru stone warehouse, followed by his small terrier. It smelt like lanolin. There is one remaining meatworks -- though the meatworks in the neighbouring town, Timaru, was recently shut down. When you watch a town like this fall into a sleepy stasis like this, with practically no social mobility or way forward for many residents, then you understand why tariffs are perhaps desirable -- and you also understand why blue collar workers, whether white, Latino or African-American, voted in Trump (it’s worth noting Kamala underperformed in every demographic, including Gen Z, where she only marginally outperformed Trump…)

OK then. If we accept that tariffs are coming -- and they are, that’s the reality -- then who is the patsy? I put forward it isn’t the consumer -- it might be for a start, but the reality is, the consumer is already stretched pretty tight. There’s only so much you can stretch ‘em.

Perhaps the patsy, then, is the multi-nationals who have off-shored for the past few decades. To say those multi-nationals should be concerned is an understatement. If you are a traditional multi-national -- let’s say Nike -- then you produce your shoes in China, and then you ship ‘em wherever they’re off to next. You probably have a lot of your back office work done somewhere cheaper too (even JP Morgan uses India for a lot of its back office work!).

Well, if you’re looking at paying 20% more on those shoes coming from China, then you’re looking at much smaller margins on your shoes, or increasing prices to your consumer. But hold up -- you’re Nike. You’re already going through a time. You are selling less shoes. Your consumer is already somewhat alienated. Increasing prices is not going to increase demand. Let’s say you can pass 5% of the cost to your consumer -- that’s still 15% or whatever you need to eat. Ouch.

We have already seen the impact of tariffs with our old friend, Cognac. China imposed tariffs on Cognac because of Europe’s tariff on electric vehicles coming out of China. Now Remy stock trades for about what a cheap hotel room in Berlin would cost you -- about 61 euro. Remy is worth +100 euro on its Cognac stocks alone.

The lesson here is that tariffs do matter. If you have pricing power (Hermes…) you will be just fine. If you are a multi-national, you may need to curb your enthusiasm. It just may be that big corporate and not the consumer are the patsy here.

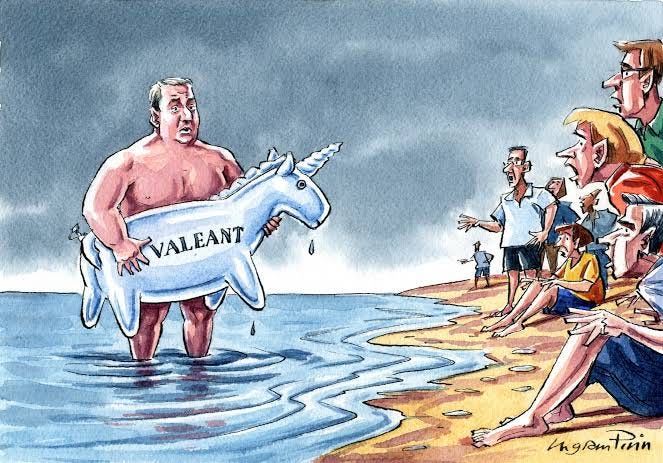

But this is a vibes-based economy, remember. Regardless of tariffs, Trump has a “vibe” of “stocks go up” -- so stocks go up. Like Paul Tudor Jones says, don’t try and fight against the market. If the market is telling you something, listen. Equally, I would caution against assuming it will be like this forever -- if you don’t expect those tariffs to impact the big money-earning components of the S&P 500 (Apple, anyone?) then you’re a patsy. Equally, remember those blue-collar workers are shopping at Dollar General using maxed out credit cards. You can ride the tide but you don’t want to get caught out when it comes in and you’re nude.

Nobody wants the tide to go out…

It is worth thinking about the yen, which fell last night during the polls. I think the yen has more room to fall. Think about it -- Japan has very high debt to gdp (251%!), an aging workforce, and low interest rates (0.25%). If the BOJ increases interest rates, it suddenly needs to service its debt at much higher rates. In addition, the BOJ already is spending billions in foreign reserves to stabilise the yen under the 160 level. And finally, the low interest rates are a good thing for companies like Toyota who mostly receive in dollars (not to mention how much of a good thing they are for tourists!)

Japan, then, is in a pickle. Raising interest rates too much triggers increased debt payments (much of my time at the moment is spend reading about the Asian financial crisis…). While interest rates remain low the US dollar will inevitably creep up against the yen, as sure as the sea eroding a cliff top. Japan has finite foreign reserves, and each time it intervenes it spends some more of its firepower. For those asleep at the back, what I’m saying is the yen will continue to be weak.

In the background there are still stocks which are materially undervalued. These are like a coiled spring that will eventually release energy. We saw that a little with DGL in October -- as I’ve written before, DGL traded at less than 1/3rd than book value. It’s a “work out” that relies on reversion to the mean. Many of the stocks we are buying now are structurally undervalued luxury or consumer stocks. You look stupid for a bit, and then you look less stupid.

It’s all gravy in hindsight, but when Palantir kept dipping and looking less like a sure thing I felt very stupid indeed. Around the same time I was long Meta — another thing I felt stupid about. Meta and Palantir have done well now. I am still waiting for Doc Martens to do well. I continue to wait. The truth with investing is that it is mostly waiting. It’s less Wolf of Wall Street more Wolf Hall (that is a joke for all the Thomas Cromwell-heads who read this, all four of you).