Macro

Continue to be long uranium. See gold as ticking upwards due to geopolitical pressures. These are not the assertions of a genius: it's just stating the obvious.

NZ/AUS

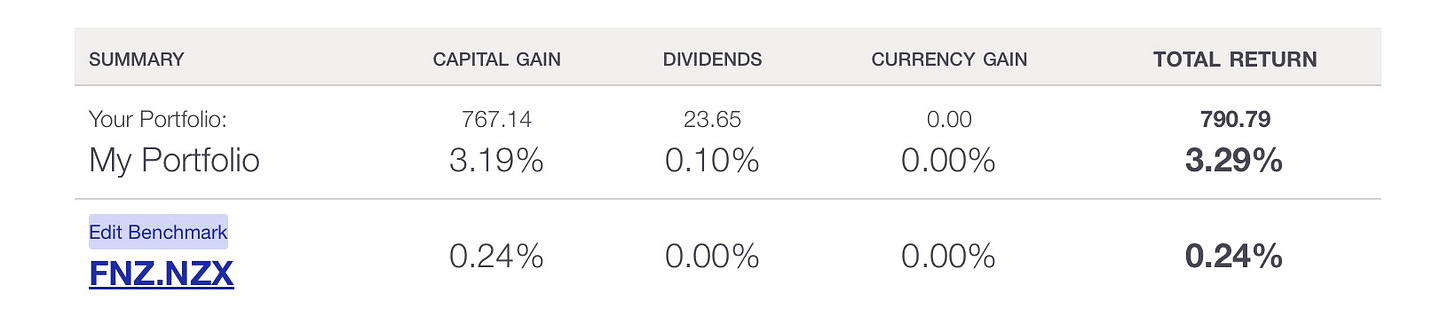

Changes to NZ portfolio

Sold the bulk of ATM, sold out entirely of FBU. Added to THL and bought some NZX and ARV. Total returns for the quarter so far below. We’re not convinced by China’s birth rate numbers and were happy to get out of a tragic commodity stock while the price was a little high (the A2 milk protein reminds us of magic beans). We feel FBU hasn’t felt the brunt of the bottom of the housing market yet — the NZ Herald will have you believe all is well in the property world but I doubt it. Like THL - best way to play tourism. And as for NZX…

NZX - “Skin in the Game”

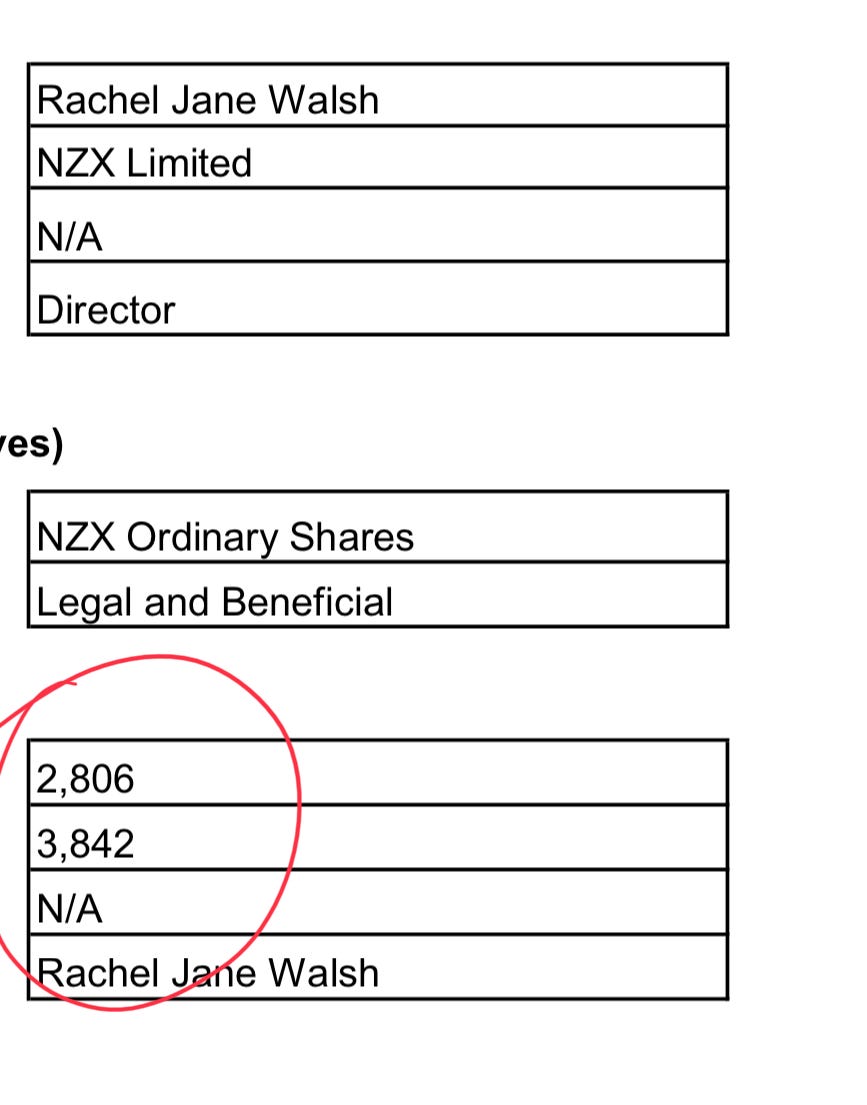

We’re always looking at D&O disclosures especially when they involve companies we are engaging with. Interesting to note that in NZX Limited’s last batch of D&O disclosures, several directors had very little skin in the game — the value of their shares might buy you one or two lunches at Prego or Gilt. Kudos to chair John McMahon for putting his money where his mouth is — he’s in for 250,000 shares of the thing. Kudos to Aldridge, ex Craig’s head honcho, for having “a few” as well. But as for the rest…Dame Paula holds a mere +5,000, while Rachel Walsh owns a mere ~3,300. Find the full list here. We firmly believe in the Charlie Munger maxim - “show me the incentive and I will show you the outcome”. We question how much skin in the game certain NZX Directors’ holdings give them, especially since total directors fees for FY22 were $460,000. We find companies do well when directors and management’s interests are aligned with shareholders and the company's — case in point, Don at Mainfreight or Arnault at LVMH. Our question is quite simple: do these NZX directors have enough skin in the game to be aligned with shareholders?

NZX stock has traded flat over the last five years in spite of building a world-class Funds Mgmt biz with ~$11bn in AUM. The stk price doesn’t reflect the quality of the co. There are several directors who have very little economic interest in what the share price does or what the underlying value of the company is. We understand the value of having independent directors1, yet we are great believers in incentives… we are curious what value has been added given the lacklustre performance of the stk price; like watching paint dry…

We think NZX limited is trading at a substantial discount to its value. While we are sure all board directors at NZX Limited have unique skill sets, we pose a question: why haven’t they put their money where their mouth is?

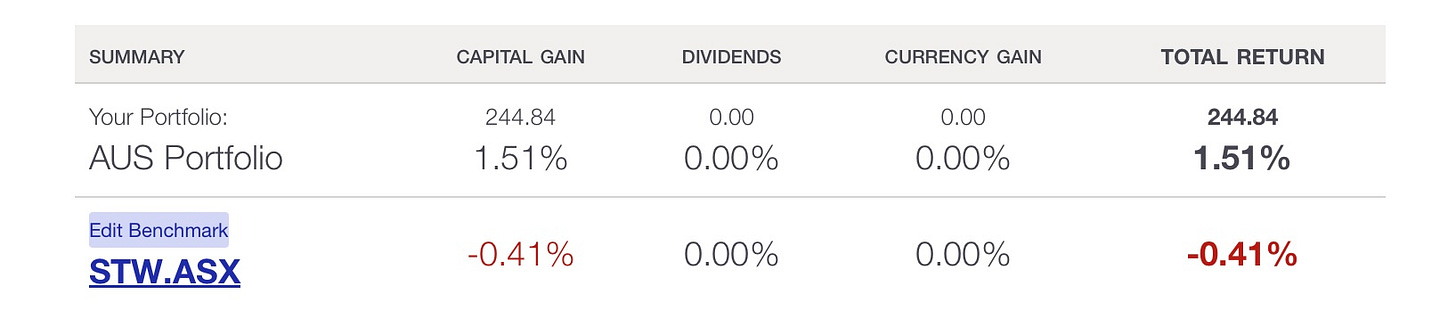

Changes to the Aussie portfolio

Bought DGL, CAT and DUR all on 31 Dec. Added URNM start of Jan. Sold out of DEM and AV1 — dogs. Performance for the quarter below. This quarter has only gotten started so let’s see how we get on. It’s good to trim the fat from time to time.

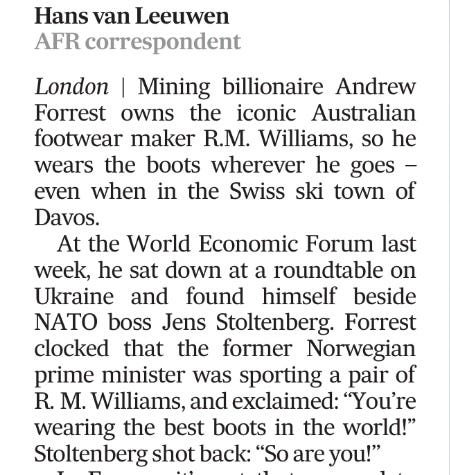

RM Williams takes on the world

Small snippet from the AFR - RMs are ubiquitous amongst antipodean corporate cowboys who have probably never seen a tractor or milked a cow…walk into the PWC building in Auckland and throw a dart and you’ll no doubt find a boy wearing his RMs…bet he went to King’s too…Forrest is hoping on opening stores over on the continent. 'Struth. Best of luck to him. Have a feeling it’ll go well.

How to make a 33,000% return on your money

Sometimes people ask me — Eden, where is the value in handbags? And then I show them this graph, which blows most other companies out of the water:

LVMH have had a similarly stellar run — though “only” roughly a 5,000% return in about the same time period. Underachievers! Arnault and co have built probably the most efficient assemblages of fashion houses in the world - whereas rival Pinault at Kering has been buying talent agencies (not with Kering’s money, but of course the two are intertwined like Thatcher and Milton Friedman) — Arnault has quietly built an empire that covers every aspect of the luxury train — beauty via beauty lines and Sephora; leather goods; quiet luxury at Loro, cognac and champagne at Möet-Hennessy, etc.

Anyway — here’s your proof in the pudding. LVMH reported full yr results of €86.15bn, or organic growth of about +13%. Recession, what recession?

If you’ve been reading my missives from Paris you’d know that I keep telling you people are spending. Spending large! Of course Paris is not a proxy for the rest of the world but when you go, ok, there’s a thirty minute line outside Chanel, you kind of get the idea that the 1% have got plenty of fuel left in the tank…

Anyway. LVMH shares gained ~12% as did CDI. CDI is the stock that owns Arnault’s controlling stake and trades at a multiple discount (20x vs 24x). Prefer CDI but remain buy-rated on both.

Bigger question — when does luxury fall off? This is a trick question. Luxury evolves, it doesn’t fall off — take a look at the following chart, which is an index of secondhand watch prices

Basically, money printer go brrr and crypto go brrr and then quite a marked drop-off. Blue line is the total index. Yellow is — take a guess? Rolex? Patek? AP?

No, ladies and gents — that yellow line which has proven resistant is Cartier. From observation (old French money is very discreet) and from these stats, I wonder if the era of the “big watch” is over and we are entering an era of more subtlety. Cartier is owned by Richemont which we also like as a buy.

Puig - the quiet achiever

Great piece in the FT on Puig, the little-known family owned beauty business which recently acquired Dr Barbara Sturm (if you don’t know what that is, ask your girlfriend or wife; if you want to make her happy on Valentine’s Day, buy her some2). They also own Dries van Noten and Byredo — big quality names. We watched the group with interest over the years, and speculation over an IPO interests us — we have a firm rule never to invest in an IPO, but when the price is right…we cut our position in Estée Lauder after several disappointing quarters (it still figures, but we used the cash for L’Oreal instead). Puig is clearly a canny acquirer worth keeping an eye on.

More, more luxury — Galliano signals a mood change

I know most of you come here for stock advice but luxury is inherently linked to capital, and luxury companies often have spectacular margins. John Galliano’s show for Margiela at Paris Couture Week was nothing short of spectacular. The show received a standing ovation for five minutes. I think this signals a vibe shift here — expect a shift from total “quiet luxury” to something softly decadent…the other houses are playing catch-up now, and Gucci-owner Kering is being left in the dust (hence why it trades at just 13x P/E…). This collection will filter down to lesser brands, to Zara, to H&M…just watch. In six months time you will be seeing echoes of this everywhere. Full video below…

Letter of the week…from the AFR

Well, quite.

As per FMC Act 2013 274 (2) you become a SPH holder when you control 5% of the economic interests of the company…with 324,205,366 shares on issue, Dame Paula and co fall well short of breaching any independent director listing rule, either via the NZX’s own rules or those outlined in the FMC Act

Fun fact - Strum’s husband was at points acting as Johnny Depp’s lawyer.