Rakon — 72c as of writing — a lot more buyers than sellers y’day. I have been writing about this thing for over a year now (!) but all you need to do is look at the overseas comps for the company — all its peers trade well over the multiples RAK trades at…

Nuclear — Noting the ‘big three’ — Microsoft, Google and Amazon are all committing to either commission new plants or recommission old plants — link. This is good news for uranium thesis bulls (includes me), because implies that uranium demand/supply imbalance will only be exacerbated more…see chart below…the last time this happened the price of uranium went parabolic…

Disney — James Gorman, the Aussie last seen as head honcho of Morgan Stanley, is Disney’s new chair. Great — but issue still is — Hollywood needs more content that isn’t recycled Marvel superhero movies for children.

Kenvue — I've talked about Kenvue before (here) - it’s a spin-off from the Johnson and Johnson consumer division. Activist Starboard has taken a stake, claiming that the co has underperformed (for colour, Kenvue makes things like Band Aids, Tylenol, Neutrogena and Listerine). It’s good for the stock, but I’m not really that convinced of Starboard’s proposal (it’s a consumer goods company. Maybe some fat could be stripped out, but eh — who gets excited over that? Always dubious of ‘cost cutting’ — it never trumps actual growth or innovation and tends to be the hallmark of uninspired managers). We’ll see.

The trouble with Fletcher Building

I know, another Fletcher Building post. Buckle up.

I will be there (with my toolbelt on) on Wednesday. This whole saga has been ongoing for us since we sent a letter alongside the NZSA and Simplicity, calling for a board and management overhaul. Back then, Bruce Hassall was the chair and the “old boys club” of NZ finance was very upset how “mean” we were to Hassall and then-CEO Ross Taylor (it’s a hard knock life!). I note that Barbara Chapman and Cathy Quinn remain on the board, in spite of having presided over what only can be described as a disastrous few years (and, I’d argue, basically a bad run for a much longer time — it’s hard to remember a time when Fletcher was doing well).

I take issue with resolution 5 in particular - adoption of the renumeration report. It’s always peculiar to me when companies that have an objectively terrible run end up commissioning a report that’s about as understandable as the operating manual for a Concorde. But I’d like to first take a look at the nonsense ‘purpose’ the report begins with.

What on earth does it mean to “improve the world around us through smart thinking”? What does “simply delivered” even mean?! Presumably, most management executives would like to believe they have “smart thinking”. I am not sure how many of them would like to have, say, “dumb thinking”. With the exception of weapons manufacturers, kitten murderers and the like, I very much doubt that any company sets out to “harm the world around us1”. And finally, I don’t think anyone ever means to deliver something in a complex way. With all due respect to whoever wrote this report, I’m not sure if this is so much a “purpose” as so much a word salad nonsense verbiage.

What is the purpose of a company? I will give you a clue. It starts with “p”. It is a single word (and this may come as a surprise to the management and board of Fletcher Building). The word is “profit”. Now, you might allocate that profit differently so it doesn’t flow directly down the income statement (i.e. Costco, Amazon) but effectively you want the same thing — some kind of device which churns out profit. The profit then goes to shareholders in some way (it’s reinvested, or goes to dividends or buybacks, etc). Nowhere is the word “profit” mentioned in Fletcher Building’s “purpose” (how this is the purpose of a renumeration framework is even more mystifying — surely the purpose is to encourage board and management to make profitable decisions — which they have not done).

I will skip over “vision”, because nobody seriously thinks Fletcher Building is the leader in anything. This leaves us with “governance”, which again, is a little suspect — I’m inclined to believe the board has failed somewhat in governance given some very well reported issues.

The report gets worse from there. It’s astonishing how many words are used yet how little is said. There is all this talk of “long term incentives” and “short term incentives”. Here’s how Fletchers proposes to incentivise the CEO in the short term:

Group CEO and Functional Executives in Corporate: Group EBIT and trading cash (excluding significant items).

This is nonsense. Earnings before interest and tax excludes two very real costs (that’s interest and tax). Significant items also makes a huge difference. Especially when you are Fletchers. From the horse’s mouth:

Disappointingly, total significant items for continuing operations for FY24 were $333 million. This was primarily due to a $117 million non-cash impairment and write-down in the carrying value of the Higgins business, and the $180 million additional provisions required on our legacy Construction projects announced at HY24.

“After factoring in the Tradelink discontinued operations, we recorded a net loss after tax of $227 million, compared to net earnings of $235 million in FY23. Our return on funds employed (ROFE) before significant items was 10.0%, compared to 17.1% in FY23.

Significant items of $333 million! Holy heck, that’s significant and if I were the board I’d be paying attention.

But wait, there’s more:

…and Tradelink net loss of $141 million (discontinued operations, including impairments)…

I have to say — that’s a fairly significant whack of a loss too. All in all, obviously, calculating a return on funds employed while excluding significant items is a bit like racing a Ferrari while declining to tell anyone you have just stabbed yourself in the eyes.

Anyway, resolution five is a non binding adoption of the renumeration report. In other words, voting is indicative only. On the other hand, it’s a good chance for shareholders to make their pleasure or displeasure known. Here’s another heuristic — proxy adviser ISS’s opinion on how much new CEO Andrew Reding should be paid (from Rebecca’s great article in BD):

Institutional Shareholder Services (ISS) is a proxy adviser that advises institutional investors, including the NZ Super Fund, on how to vote at annual general meetings.

Its report for clients recommended that shareholders vote in favour of all resolutions at the meeting; however, it has raised concerns. The proxy adviser said Reding, with a base salary of $1.45 million, was being paid about 24% more than his peers. It said the fixed pay of CEOs at similar-sized or peer firms was about $1.17m on average. “This may concern some shareholders given the company’s poor performance and shareholder returns in recent years.”

Unsurprisingly, Fletcher Building replied that they had commissioned PwC to do a report, and in fact the base salary is below the median provided by PwC (clearly, PwC know which side their bread is buttered on).

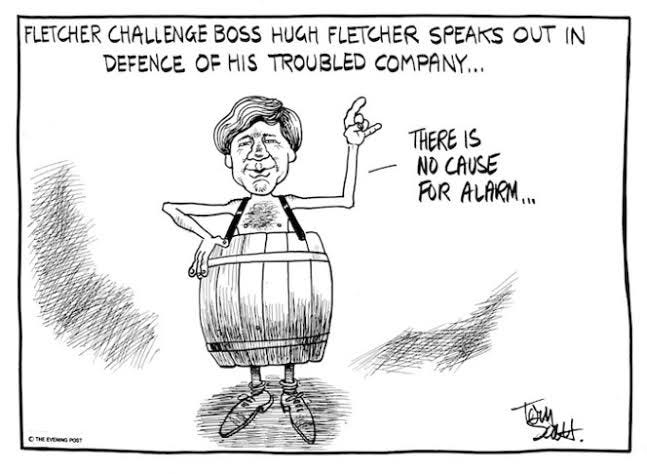

I think this actually speaks to a broader trend in NZ in particular — we have a lot of companies here that would be subject to a lot more scrutiny in bigger countries. For instance, Spark is a telco that has made baffling moves in recent years (streaming, Spark Sport..) (Jenny Ruth has a good piece on Spark today). Fletchers, I imagine, would be hung, drawn and quartered in the US (at this point, I’m fairly sure Fletchers still exists in part because of nostalgia for the “good old days” of Fletcher Challenge. Even then, the company was being skewered — see below).

I first said in Feb my preferred plan for Fletcher is a break up, and I still believe this. There’s very little argument left for Fletchers to continue existing in its current state, limping from cost blowout to cost blowout (and during a 15 year property bull market, too!).

I’ll see ya’ll there.

Cucinelli-nomics

Luxury has been having a tough time lately (though I don’t think LVMH’s sales are nearly as bad as some analysts have made out — like Clinton said, it’s the economy, stupid). You know who isn’t having a tough time? Brunello Cucinelli, that’s who. His mighty house bucked the trend, seeing revenue grow 14.1 per cent year-on-year to €620.7 million and operating income grow 19.3 per cent, to €104.6 million. Even margins expanded — 16.9% vs 16.1% on the previous period. We’re long Cucinelli, by the way — see it as a mini-Hermes with similar economics.

Brunello is a kind of philosopher-king who doesn’t function like a usual CEO, Chairman, or founder (thank Christ for that). It’s well worth reading his comments from today’s earnings call — applicable across many industries, I think (it’s long, I know, but it’s a masterclass in how to think about luxury and I think goes to explain why Brunello has bucked the trend re sales and margins).

As always — the proof is in the pudding. Brunello saw sales grow versus the rest of the lot. Worth listening to, then.

…You see, I've always maintained since when I was very young that there is always a lot of trust in luxury, because luxury means dream, it means exclusivity. Well, of course, this is life. Some brands are losing out in terms of customer trust, but this is the result of your corporate policies. You see, a very important topic that I want to broach here is how customers are welcome in the stores. You see, I stepped into the Milan store. I think that the lady there did not recognize me, and she said, what would you like? And I said, what would you want me to, of course, I want to buy something. And she said, well, you have to wait for 10 minutes. And I said, well, but there's no one here.

Well, so of course this was another store by another brand and I was not treated well and I would never go back to that kind of store. You see, our sales people, they are not hustling our customers, because 80% of their wages is fixed. It's not variable. So, they are not driven to steal customers mutually. So, I have a very important Indian friend who was in the UK the other day, and he sent me a text, and he said, I'm enjoying a great macchiato coffee in your store. He did not mention anything about shopping or buying any suits. He just said that he was enjoying coffee. So, I believe that we need to rediscover some kind of love, because some customers have become disenchanted somehow.

And if you fall out of love with the brand, you will stop shopping, buying that brand, because in that store where I was treated poorly, I will never step into the store again. Because I don't know if you agree with that, but what you don't like, others don't like either. And this is something that also is part of our 10 golden rules for the company to survive two centuries. Greed, greed should never appear in your company. If you have a greedy company, greedy business, you would not survive for long. So I talked about this.

We have pretty high prices. What I say is that multibrands are really good at analyzing prices. And this year, I would say that customers have started complaining about high prices, which means that there's a new awareness around.

I said it last time I went to a restaurant and I was presented with a huge bill. You see, the cigar that I smoke used to cost 30, and now it's 70. So today, for the first time, final end customers, in our view, they feel somehow conned, cheated, because, you see, they say they do have this desire to wear special garments every day, but they need to be treated accordingly. You see, we are talking about wealthy customers here. And I was saying to my daughter the other day, prices have skyrocketed. And next time, instead of staying at that hotel, I will sleep in my car, because prices have really gone through the roof. So, we really need to redress the balance. So, one last thing I want to say. In 2019, our friend Louis Ferla came to visit a former CEO of Vacheron Constantin and currently Cartier…We have always been fascinated by Vacheron Constantin, because they will be celebrating 270 years of heritage with just a few units manufactured every year.

And he said, we can't over-raise prices, because then you can't go backwards and the market can forget about you very quickly. So whereas we, you see, for us, for this reason, pricing was -- has always been a very important theme. And the way we treated prices really had a positive impact on how our business went. We believe that there is still a lot of desire for luxury, for exclusivity, even more so we are always overexposed through the social media and everything. So this, we will come out of this time with a new vision of true luxury of how to believe and what to communicate.

Amen to that.

Meanwhile, at Pernod…in the land of booze

Stock is up in the maker of Jameson’s because everyone thought earnings would be worse. But still, it’s not a pretty set of results… sales totalled 2.78bn euros for the first quarter - a reported decline of 8.5% year-on-year.

Sales in China were even worse, dropping 26% during the quarter due to weak consumer demand. Noting Strategic International Brands were impacted particularly badly — down -10%, mainly driven by Martell in China, Royal Salute in Korea and Glenlivet in the US. As they say in Scotland — “Yer erse is oot the windae”.

I think this speaks more to shifting trends in alcohol — the big players (Pernod, Diageo, Brown-Forman) need to adapt to playing in smaller arenas. Brute force will only get you so far. I still think the booze stocks are very, very cheap, but I don’t think you should expect a turnaround for at least a year.

Very different in practice! See: the Sacklers.