Short and sharp one this arvo — I spent the morning having a very illuminating conversation with Brooke Howard-Smith (the podcast of that will be available tomorrow, if I have my shit together and upload it in time). A little preview…

But we have a bit to get through —

Duratec — Good news for investors in the world’s most boring company. Announced a couple of big contract wins — $21.8mn for a King Supply Base contract (significant as this could lead to more work with Woodside…) and a $54mn contract for DDR (49% owned by Duratec). Stock is at $1.34 as of writing.

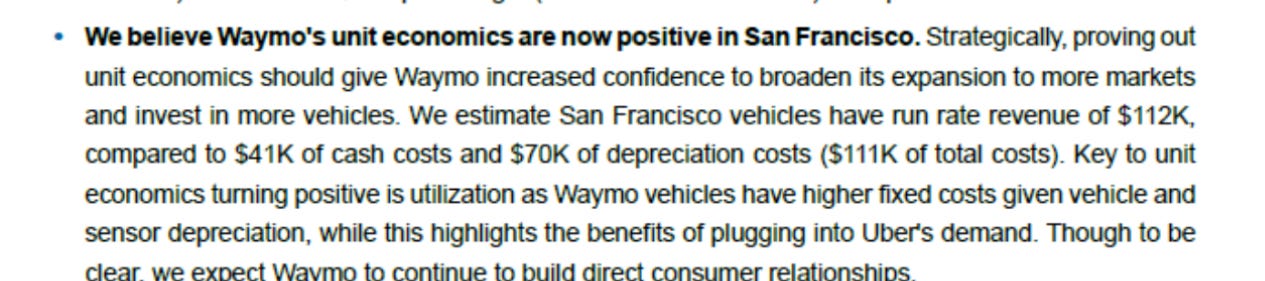

Self-Drive — Sorry for the blurry image that resembles a Xerox scan from 1983, but I was surprised to note that JPM are estimating that Waymo has positive unit economics (however, my Royal Adviser, Sir. Dylan, advises me that Waymo is universally hated in San Fran as Waymo cars simply stop when they don’t understand a situation).

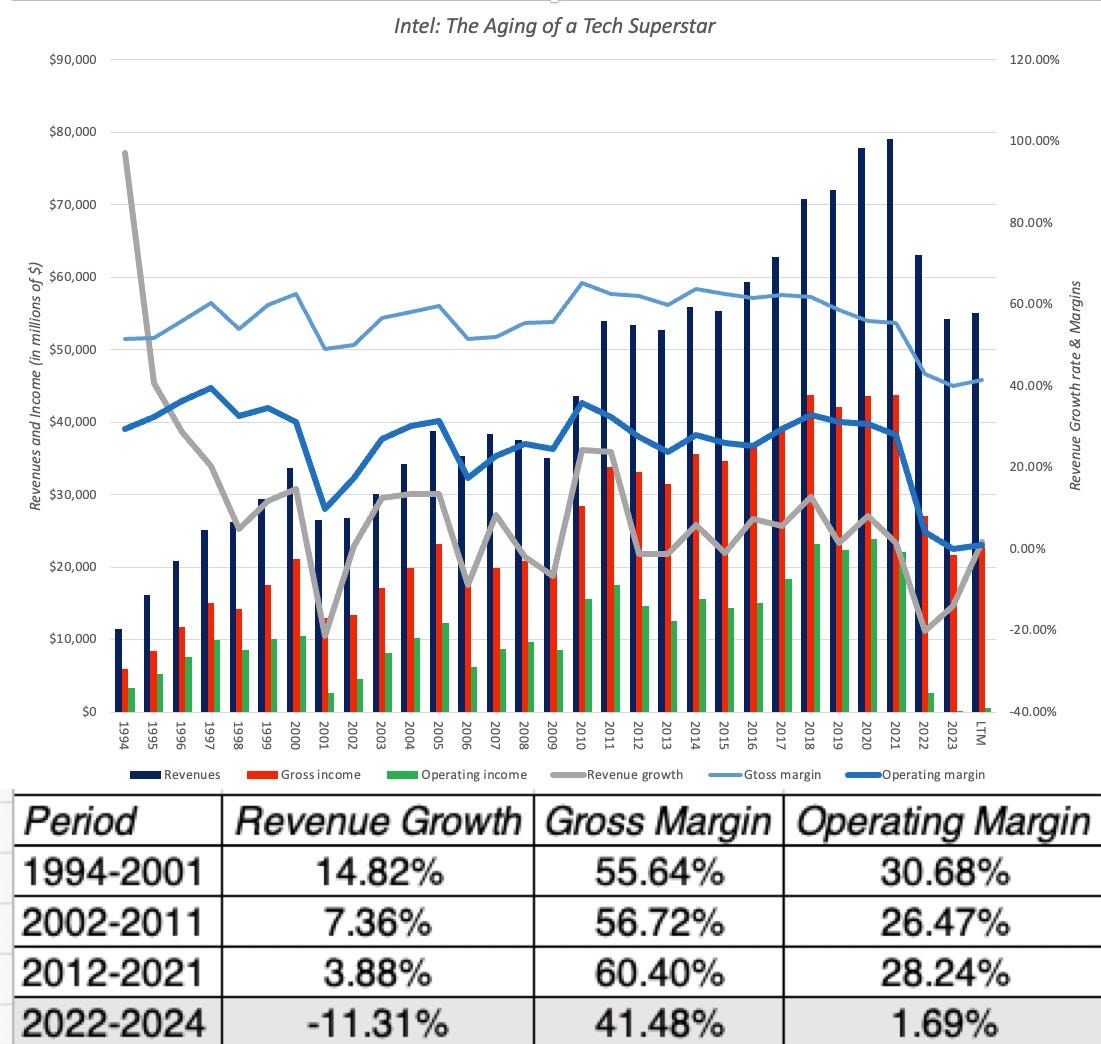

I also love this chart of Intel — it’s a textbook study of decline and fall… (“I am Ozymandias, king of kings1”) (What’s more shocking is they have received +$8.5bn in funding from the US govt alone this year…they also get a tax credit of up to 25% on $100bn of qualified investments…wow).

Fashion land (I know, I’ve talked about fashion two days in a row!)

Sarah Burton headed to Givenchy, in probably the most exciting fashion news in at least the last few months. Burton, of course, used to be at McQueen, where she was Lee McQueen’s right hand.

Chanel — The biggest job in fashion has been open for some time (ever since Karl died, obvs). Apparently the top names being considered are Alaïa’s Pieter Mulier, Thom Browne, and Simon Porte Jacquemus. Pieter has remade Alaïa beautifully (as I wrote y’day, the Alaïa show was the only one worth watching) — it’d be a shame to see him go.

Last fashion tidbit (I promise) — Kering is currently trading at 12x earnings, an almost 10 year low. Yes fwd earnings will likely look a lot worse, but I can’t help but keep thinking about the Berkshire 1994 AGM (surely everyone’s favourite audio to listen to in bed…) — a fellow asked what free cash flow yield Berkshire would consider buying a company at, and Buffett replied that a company could have no earnings (or negative earnings), if the promise and certainty of future cash flows is good enough.

We could conceivably buy a business — I don’t think we would be likely to — but we could we could conceivably buy a business that had no current after-tax cash flow. But, we would have to think it had a tremendous future.

But we would not find — obviously the current figures, particularly in the kind of businesses we buy, tend to be representative, we think, of what’s going to happen in the future.

But that would not necessarily have to be the case. You can argue, for example, in buying stocks, we bought GEICO at a time when it was losing significant money. We didn’t expect it to continue to lose significant money.

But if we think the present value of the future earning power is attractive enough compared to the purchase price, we would not be overwhelmed by what the first year’s figure would be.

While current cash flows at Kering may leave much to be desired (nobody is rushing out to buy Gucci…), I think you need to project cash flows at least five years into the future. I am certain — fairly certain — that Gucci, Balenciaga, Bottega, etc will continue to generate strong profits in 2029 and beyond.

I think you can apply the same to the booze companies (Remy, Pernod, Diageo, Brown-Forman…)…you need to consider future cash flows rather than how they are now. Consider also the barriers to entry in the booze market — I am told a modern whisky distillery would take at least $5mn to open (+ the time cost… you can’t have a twelve year old whisky without, uh, twelve years). And that isn’t even considering marketing and ‘brand-making’…

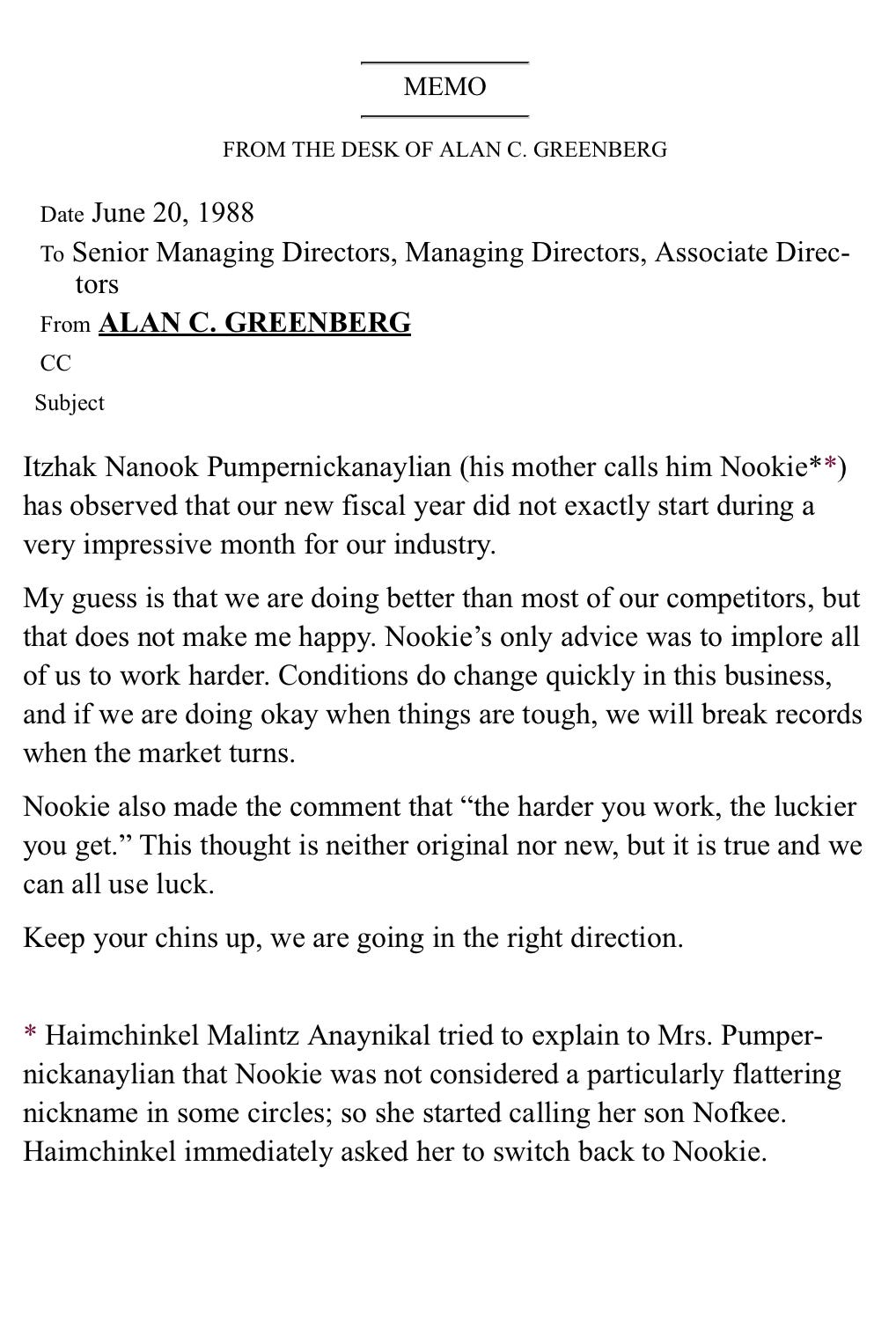

And finally… a word from our sponsor, the late Ace Greenberg

And on the pedestal these words appear:

‘My name is Ozymandias, king of kings:

Look on my works, ye Mighty, and despair!’

Nothing beside remains. Round the decay

Of that colossal wreck, boundless and bare

The lone and level sands stretch far away.