No more Sharimania

Regular readers will know how obsessed I’ve been with the will-they-won’t-they theatrics of Shari Redstone and David Ellison, the Paramount and Oracle scions. Paramount was once a very valuable asset; and I mean, it still is — but nowhere what it used to be. Shari controls Paramount via National Amusements Inc with Class A shares. NAI also owns a bunch of basically worthless cinemas and owes debt, primarily to Shari’s banker, Byron Trott (the one tasked with selling Paramount). Ellison is the son of Larry, who is worth about a squillion dollars. Ellison is getting Paramount! Yay for Ellison!

In some ways this felt the quintessential story for me of 2024 — it had all the elements of a great drama. Shari just couldn’t let Paramount go — not after fighting for it for most of her adult life. But Paramount is that thing most companies become at some point or another — a melting iceberg. Yes, great IP. Yes, great legacy. But a decade or so of yes man and former CEO Bob Bakish left the company a kind of leprosy-ridden second-tier media company, in spite of all the great IP (and yes — I don’t think it was just Bakish. I’m sure Shari had her part to play, too).

In came a few bids — there was one from Apollo and Sony ($26bn or so). There were bids that were never going to come to fruition. In the end, Ellison was the only real player — he had the cash, yes, but also he is the “same” as Shari — they are both children of rich, domineering men. Shari never quite made her mark. Perhaps David will.

Also, Nordstrom got sold (back to the controlling family)

It reminds me of news just out today of Nordstrom being taken private. In 2018 the family offered $50 a share to take the retailer private. The board rejected it, saying the valuation was too low. Now the company is being taken private, at $24.25 a share. That’s approx a loss of $4.3bn for shareholders. And I think it’s reflective of the danger of thinking in of the valuation of a company as merely what it might be worth in the present. As Buffett reminds us, a company is merely worth all future cashflows from now until judgement day. I mean — now Nordstorm’s board looks pretty silly for rejecting that 2018 offer! Shoulda coulda woulda.

My year of rest & ‘zempy

I think this was also the year of Ozempic (or 'zempy). You might go, duh. And I’d go, yeah — but have you noticed all the people on it? More importantly, have you noticed the uniformity of people on it, and the odd sagging? That’s more what I’m getting at. Beauty is quite often dictated by what is scarce or rare. My question is — in a world full of size zeros, what is beautiful?

I guess this is more a philosophical or aesthetic point than one of money, though I think it’ll be interesting how this trickles down in the culture — think clothes, fashion, etc. Remember that beauty standards very often change. I wonder if the “wonder” of Ozempic has actually created a shift in those beauty standards, though it’ll be a decade before we know for sure.

On the other hand, Ozempic sag is a real thing. People lose weight in the face. Which is why I think the filler makers will do well — think Botox owner AbbVie. There’s always trade-offs, so buy the pick-axes, etc…

There’s more implications here, of course. Market darlings like Fisher and Paykel, CSL and Resmed all benefit from an obese population. FPH actually faces two headwinds — Mexican tariffs and Ozempic. They haven’t particularly answered that question. Some think that the booze makers will also be affected — I think that’s already priced in and they are already oversold. Look — it’s not that fun being skinny and free of sin, is it?

It wasn’t a year for…

Obviously it was not the year for booze & beauty. The booze makers (Pernod, Brown Forman, Diageo…) are all trading around generational lows. Cosmetics makers like Estée Lauder had a hell of a year — the Lauder family will be cutting back on the Krug this year (who am I kidding — of course they’ll be fine). My gut says that we’ll see those sectors rerate next year — if only for reversion to the mean.

Two great ‘Murcican heroes

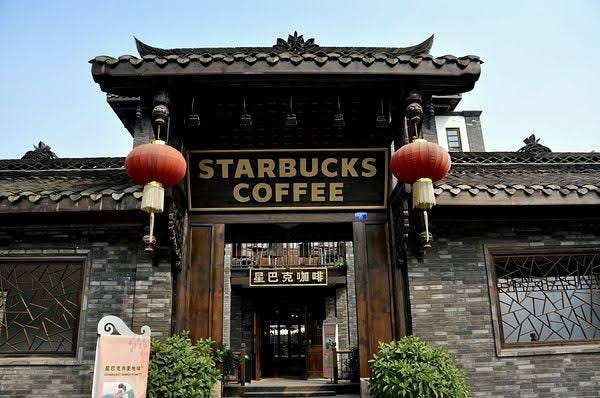

I thought a lot about both Starbucks and Nike this year, both of which saw new management come in — Starbucks saw the end of whatshisface from Reckitt (dumb idea hiring him in the first place) and the ascent of ex-Chipotle CEO Brian Niccol. Stock popped on that, but I think there’s going to be a harder time had to turn around Starbucks … China continues to face an existential threat from locally grown chains, while there’s the larger issue of needing to slim down a bloated menu (how long did those olive oil coffees last?)

Nike has a similar set of problems. Producing shoes is hard. There’s a lot of moving parts. There’s a lot of inventory. There’s a lot of stock, and know-how, and moving that product (for an example of how not to do it, see AllBirds). What once was a fantastic compounding machine is now a company in a very crowded market, facing not only established competitors like Adidas but also relatively new companies like On Running.

Both companies aren’t dead in the water, of course, but they do have turnarounds that — if executed correctly — will take 3-5 years to really see results. Wall Street works in quarters, which is stupid. Results take years. But I think the Starbucks question is perhaps more interesting — the west has made bank from China over the last twenty years as China’s ascendant middle class was chomping at the bit to embrace western status symbols (Nike! Starbucks! Louis Vuitton!). I think the fact that home grown companies like Luckin’ Coffee are doing well suggests that there’s a shift in mindset from wanting western brands to creating their own brands and desiring those1.

Why I am still a negative Nellie

I mean, it was the year of American “exceptionalism”, by which I mean flows went into American equities because they were doing well, therefore more flows went into American equities, therefore they went up more, etc etc. Soros at his finest. I see Mike Taylor at Pie Funds is in the Herald today saying that the S&P will go up another 15-20% next year2. I think he is plain wrong, with all due respect. American equities did very well this year due to mostly the “mag 7”, which now all trade at very high valuations. Apple has a P/E ratio of 41x earnings. Just to remind the ones at the back, a P/E ratio is merely earnings divided by market cap — i.e. if Apple never earned another single cent more than the profit it makes now, year after year, you’d have to wait 41 years to make your money back. Apple is now a company that grows in single digits — its revenue grew around 2% YoY. You do not have to be a math genius to work out that you are overpaying there.

Mag 7 stocks account for around a 3rd of the index and in the first half of this year they accounted for over 60% of the index’s returns, so these valuations matter. Tesla stock trades over 100x earnings. Etc. You need to be confident that these companies can continuously smash growth rates (which Apple is not doing) in order to continue with such hefty valuations. Because they carry the rest of the index on their shoulders, any weakness in these equities will have an outsized effect on all returns of the S&P. This is only one reason why I am not so optimistic.

I am also not optimistic because tariffs are inherently inflationary. They are not just free money. You don’t, like, just shout at China and say — hey! Pay me some tariffs, buster! Sure, China will pay your tariffs, but the cost is going to higher because the cost is higher for them. That’s inflationary!

It’s also inflationary to pump up bitcoin, because by doing that you are essentially pumping money that didn’t otherwise exist into the wallets of people. I wrote earlier:

40% of Americans own Bitcoin or some other cryptocurrency.

Do you know what that means? That means STEALH QUANTITATIVE EASING !!!

I.e Asset class go up, wealth of Americans go up, more money to be had. That’s QE! STEALH QE but QE none the less.

Also, you know, Trump is very funny but also thinks the US should have the Panama Canal back, because the fees are too high. This isn’t how treaties or international politics work. Combine all these factors and you end up with a situation that does not look like another +20% year for the S&P (really now…) — rather it looks like stagflation. I hope I’m wrong, ‘cos stagflation sucks.

But still…

Still, plenty of ways to make money. I think there are asset classes which are clearly undervalued. Booze, luxury, etc. As the pundits say, “a rotation is due”.

Merry Christmas Etc

A big thank you to everyone who reads this. It means the world — I enjoy hearing from each and every one of you. I wish you and your families a wonderful Christmas and New Year’s — thank you again.

Eden

Sidenote — one company that has been able to navigate this change well is Prada. Their Miu Miu sister brand has sold like hotcakes in China. Comes back to what I was saying y’day re: Mecca — Prada is small enough to understand the local climate and how to promote locally. It pays off.

https://www.nzherald.co.nz/business/market-watch-what-to-expect-in-2025-and-what-we-picked-right-and-wrong-in-2024/2FKKOFJDQJBI3MWWIQUCODQXFA/