There may be a recession in stock prices, but not anything in the nature of a crash."

- Irving Fisher, leading U.S. economist, New York Times, Sept. 5, 1929

We feel that fundamentally Wall Street is sound, and that for people who can afford to pay for them outright, good stocks are cheap at these prices."

- Goodbody and Company market-letter quoted in The New York Times, Friday, October 25, 1929

As of writing —

BTC $100,013.20 (126.26% YTD)

NASDAQ: 19,859.77 (34.50% YTD)

Feels like a bubble, looks like a bubble, smells like a bubble — is a bubble.

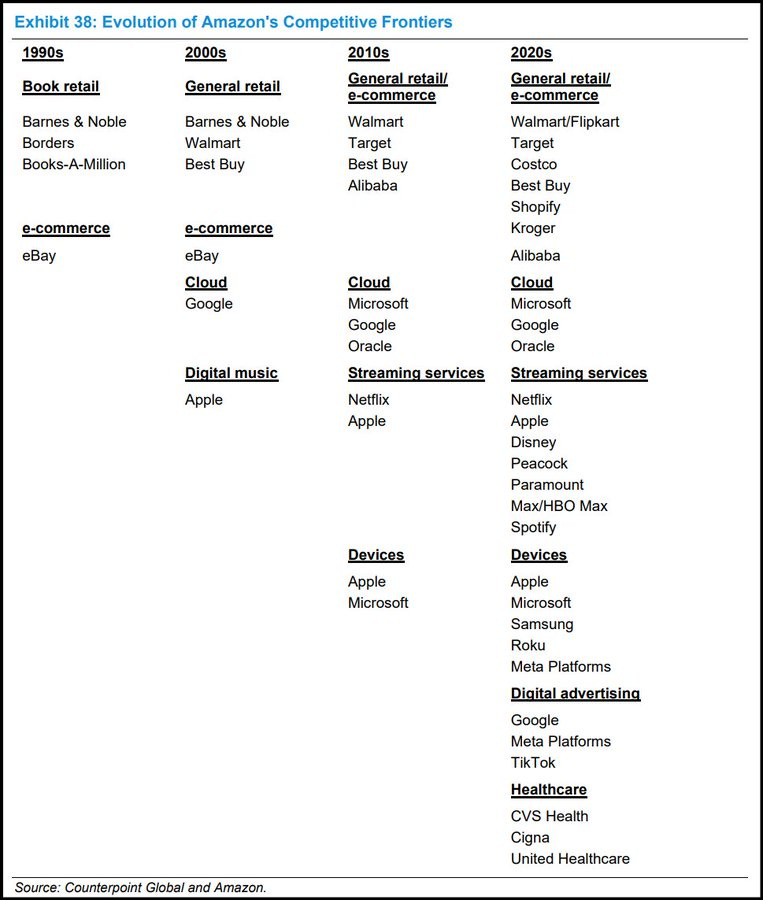

Starting the day with Amazon, everyone’s favourite dystopian everything store. Consider the chart below — how TAM has evolved over time. Like y’day’s LVMH Chart, it’s quite a site to behold:

But also — consider where Amazon has failed. Other than the Kindle and Alexa, Amazon’s never quite managed to break into decided (does anyone remember the “fire phone”?). Streaming has been another one that has a question mark above it — logging into Amazon Prime, you’ll find a grab-bag of old 2000s content, some new content, and a lot of filler. They don’t have the data-driven hunger and panache that competitors like Netflix have. Amazon’s healthcare unit still is running about $1bn of losses per year. Again — unclear if it’s much of a success.

Amazon’s key streams of revenue remain retail, advertising and the almighty AWS. The rest is noise.

Booze update

Campari — new CEO — Simon Hunt. Recently had weak results — market reacted well to appt, with stock up +5%.

Per JPM — European beverage market stats — few bright spots— “Remy Cointreau (UW): Value growth improved to +2.9% (vs +0.1% in prior 4-wk) driven by volumes improving to +9.7% YoY (vs +3.4% prior) on similar comps”.

Brown-Forman: Value growth improved to +4.9% YoY (vs +3.0% prior).

Guinness (is good for you!) — BBC reporting that supplies are limited given high demand in the Christmas season. Link. That’s one bright spot for Diageo.

At the risk of being a broken record — booze stocks

Max Stupid continues

“The sucker has always tried to get something for nothing, and the appeal in all booms is always frankly to the gambling instinct aroused by cupidity and spurred by a pervasive prosperity. People who look for easy money invariably pay for the privilege of proving conclusively that it cannot be found on this sordid earth.”

I coined “max stupid” when the market was being “max stupid”. Ever since Trump has been elected, it’s gotten worse — throw a dart at a shitco and it'll go up.

I was thinking about this with Dylan, our resident quant, yesterday. I said — how much can MicroStrategy corner of the Bitcoins market? And he said — in theory, it can keep buying as long as they keep issuing those zero-interest convertible bonds. And then I was thinking about our friend George Soros and his theory of reflexivity — MicroStrategy issues bonds > they buy bitcoin > they own so much of the active supply that it goes up > their market cap goes up > they issue more bonds > etc.

Add to this Paul Atkins being nominated as Trump’s pick to run the SEC (Atkins is pro-crypto), and Bessent as his treasury pick (also pro-crypto), and crypto backers like Peter Thiel implicitly being the power behind JD Vance, then you end up with a frothy situation that feels very reflexive and very very max stupid.

Here’s what I think — BTC rallies not because it has any value but simply because this market is so disconnected from fundamentals. And then at some point the bubble pops.

Shitco stocks continue to rally for a similar reason. And then at some point the bubble pops…

Coinbase, etc, are beneficiaries, because they clip the ticket on max stupid crypto transactions.

At some point it all falls down because gravity comes for everyone. Fact of life. The problem with reflexivity is that it cane go the other way, too — once rats start to flee a sinking ship, they flee en masse…

I have no idea how long the market will continue to be irrational. The dot com bubble reached higher levels of irrational exuberance. My feeling is the reflexivity cycle (“max stupid”) has more room to push forward before it unwinds. But that’s a feeling — really, we’re all in this blind, and if you think otherwise, you’re the patsy1.

Short Corner

We’ve looked at Plug Power before, and thought it’d probably make a good short as it’s a bullshit company. They lose about $1.2bn a year and they make hydrogen fuel cells, and subsists on loans from the government. I’ve been too weary to short it (personally) because, as above, we are in max stupid times. You can get your ass handed to you in max stupid times! Anyway, here’s Hunterbrook with a compelling short case against Plug. The problem is — the market can stay irrational longer than you can stay liquid.

“If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy”