We built this Sky City on rock and no divvys

NZ

Enough words have been spilt on Sky City but during a site visit a couple of weeks ago doing “boots on the ground” research (McKinsey could never) we walked through and noted how quiet things are — Casino Royale it is not. But more worrying is the looming spectre of Star, the embattled Aussie casino and once-alleged Hard Rock target. AUSTRAC doesn’t take kindly to money laundering! The refrain is something like — if it can happen to Star, it could happen to us?

Suspending a divvy though — that's par for the course in this climate. Arvida just suspended theirs. Spoke to ARV management on Weds. They’re confident of a future pipeline — demurred when I asked about that NBIO — “highly conditional”, etc. Of all the listed retirement villages it is the least geared up — if you’re into retirement villages you can buy the whole thing for 94c a pop. NTA $2.050 (I mean — discount that by 20%, and you’re still batting well…)

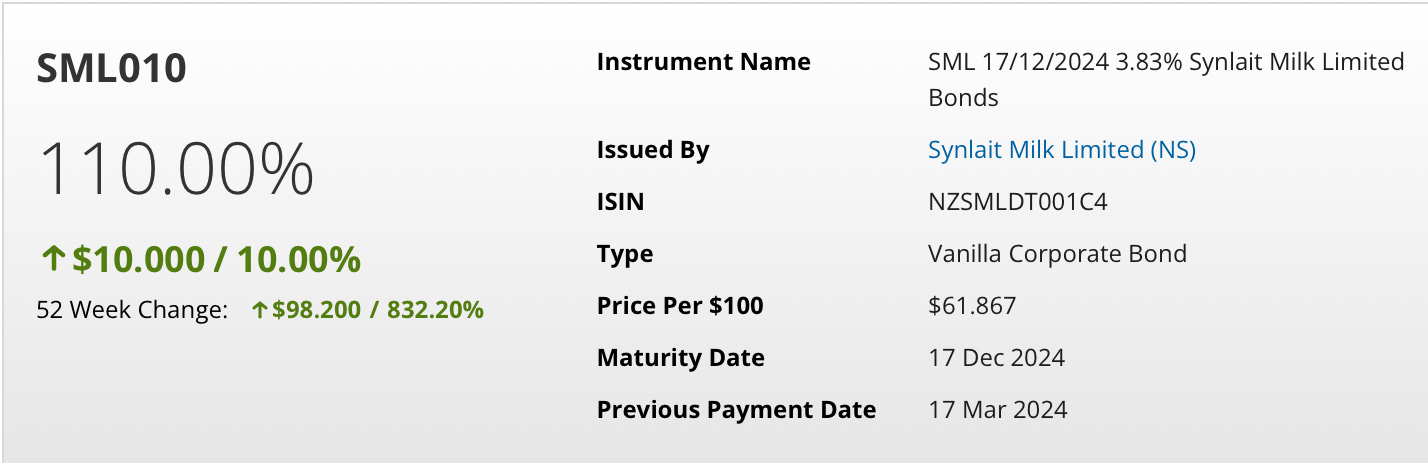

And what of Synlait? What a disaster! SML bonds yielding 110% as of writing. Obviously their Chinese friends (Bright Dairy) just need to take it private…

NZX Metrics — You might think the NZX closed down in the 80s. It’s still going. Funds management is still the golden goose (or, as McKinsey would say, the “profit centre”). FUM +10.9% to $11.6bn, SmartShares ETFs (external and internal) +33% to $8.1bn. Like all that and — I am going to sound like a broken record here — I think value would be better reflected if the business either sold a small stake in a JV (the Infratil method — sell a little bit to obtain a valuation of said asset) or floated it on the exchange. Actual capital markets data a bit grim — total number of trades down -22% YTD. Total equities listed a paltry 126. Also — did NZX cut the cost of their wholesale data? See below — their data was not the cheapest…and I view this as part of the problem…

King’s Birthday Honours

Well done to king Rod Duke and Dame Joan Withers — but what is the dame going to do about The Warehouse? As Carrie Bradshaw wrote — “I couldn’t help but wonder…”

RAK day ??? — Where are we now? A thought experiment

Possible reasons we are still waiting on the NBIO outcome.

1). Dog ate it

2). They posted it on MySpace or Xtra.co.nz

3). They accidentally launched it into space alongside a satellite

4). They are busy watching The Chase and will be back within 1-1000 business days

5). ??? (Insert your own answer here)

More thoughts on multiples

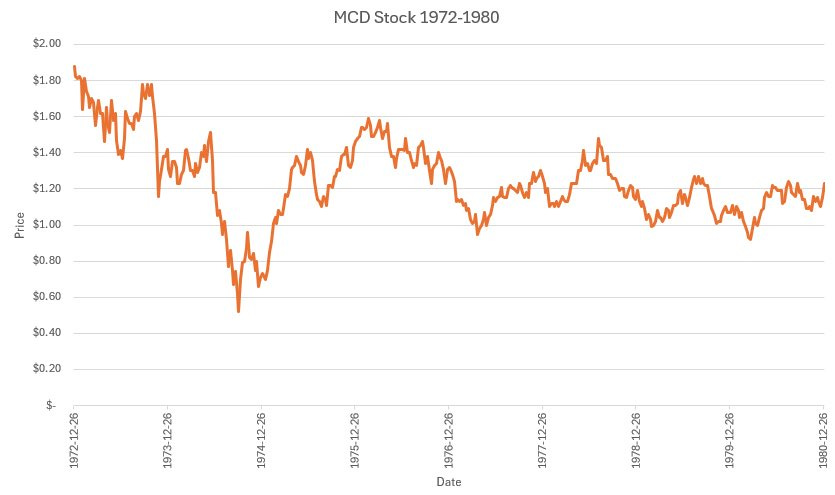

McDonald’s. It had a glorious and wonderful run in the 70s.

If you were reading this and this alone you would be very happy — double digits everywhere! Very small share count growth! Yee-haw. But as we talked about the other day, McDonald’s actually fell in value over that time.

Multiples, babes — multiples. 79x fwd earnings in 1971 and 58x in ‘72. You could buy McDonald’s for an astounding 8x earnings in 1980. I would be getting out my check book and buying up large, at that point. You make all your money in the buying.

More multiples — Brown-Forman & Lululemon (booze and yoga)

Brown Forman reported earnings this week and topline growth was down 1% for FY— more sales of tequila; less sales of Jack Daniels.

Stock is trading in the $53 range, or ~20x earnings. Previously BFB had been one of those stocks, like McDonald’s, that traded at +40x earnings. Yeah — there’s cause for concern when Jack Daniels is your flagship product — but net sales of $4.2bn for the year and $1bn for the quarter ain’t nothing to sneeze at, whereas operating income of $1.4bn for the year (+24%) is pretty cool runnings. Hilariously, while sales of old no 7 decreased, Jack Daniels Apple actually increased. People are getting trashier1? I don’t know. Point is, yer buying this thing cheap —

Then there’s Lululemon, another one we thought was oversold. It smashed earnings — as it has done consistently for a while.

Same deal. It’s sold off aggressively and was trading at a 4 year low (it has re-rated a little since earnings). It still sells plenty of leggings. It still has a 16% net profit margin and a 42% return on equity. It’s a great business with strong mindshare over a section of middle-to-affluent consumers. It still has risks — Alo, the competing yoga brand, is the thing I worry about the most here. But again — it is a brand that has consistently grown topline in the double digits and demonstrated real value (compare this to AllBirds — great product, flawed execution). See chart below which demonstrates Lulu’s compounding power…

So long, VV, we hardly knew ye…

Virginie Viard has excited Chanel — no surprises — she was always more of a technician than designer (remember — Lagerfeld’s designs were often wrought in makeup and pencil and didn’t include technical indications — that’s what Viard was for). She lacked vision, though, and has presented a steady stream of confusing and depressing collections that were at best incoherent. Who will replace Viard? Wishful thinking — Heidi Slimane — Lagerfeld was a fan of his and he’s demonstrated, with Celine and Dior Homme (old heads will know) that he has what it takes to take a brand’s DNA and reinvent it. Chanel needs creative direction — Heidi would be a good fit…

In other annals of fashion, second youngest Arnault son Frédéric has been made head of the family holding co. Does it mean anything? Maybe, maybe not. He did a good job reviving Tag in the watches division… in my view Freddy and Delphine are the most likely to take eventual control of the luxury empire.

What I’m reading

Private Equity Bosses warn of lower returns. Can Industry succeed Succession? Jenny Holzer has the last word. Sam Altman’s Opaque Empire.

Is Jack Daniels apple popular on sosha media?