Whiskey outta the jar for Good Spirits

Plus: the discount issue -- NZL, Hipgnosis, and a chunk of London

NZ/AU

GSH - Danny Doolan’s might be the site of many polyester-dressed girls tripping over and their dates undoubtably about as understandable as someone speaking in tongues, but even that amount of slosh sold hasn’t stopped the bar group - Good Spirits hospitality - from defaulting on its $19.5mn loan which it owed to Pacific Dawn. CEO Richard Tuttle stood down. Good Spirits was already whiskey down the drain — it was being wound up and sold to an entity associated with Tuttle for about $20.7mn. Prior to the loan default, the idea was to pay off debts, delist and pay shareholders a paltry $600,000 dividend (never buy a hospitality business, unless it’s for vanity…). Any dividend required a binding ruling from the IRD, which it has not yet received. Hard to know if there’s any dividend left given the loan default (“bad spirits hospitality?”).

Not much to take from this — but I was a little surprised nobody has been interested in the remnants of GSH (I.e. the shell company for a backdoor listing). Saves all the regulatory set-up…an empty box ready for a co to come in. Of course, back door listings have a patchy history in NZ. The late, great Brian Gaynor wrote a good piece on that back in 2008. Link. Anyway, it’s all whiskey in the jar for Good Spirits…

NZME — Pinnacle Investment mgmt has upped its stake in the Herald owner to 6.3% (we were wondering what was behind the stk’s ascent prior to market close). We view the stk as obviously undervalued but also something we’d never invest in — the NYT has made a good go of being a trad entity in the 21st century, and we wouldn’t even touch that.

NZL — Elevation Capital published a good write-up on farmland as an asset class. Link. We’d avoided the stk as they undertook cap raises (we just don’t like being diluted, we are greedy like that) — now they are doing buybacks (which we like a lot more and consider superior to a dividend in cases where the stk is undervalued) and they now appear to have stopped cap raising. Key catalysts are i) CPI-linked raising of rents mid next yr (55% of portfolio, ~+12.6% increase in rents, ii) possible RBNZ rate cuts and iii) the fact that NZL’s portfolio is mostly dairy and forestry — beef, sheep etc had an abysmal year last yr, as reported by Alliance’s awful result1. A third potential catalyst is the new govt’s potential change of foreign investment rules (this is our same rationale for why we think Port of Tauranga looks attractive). This is a two-parter idea, though — Allied Farmers owns the mgmt contract for NZL. We like to own the horse and the cart, so if you buy NZL, which tends to trade at a hefty ~45% discount to NAV, you might as well buy some ALF too (note that entities associated with Waterman Fund own a significant chunk of ALF…make of that what you will). The fact that the mgmt contract and the land entity are seperate is a little bit of a bugger…which may have disincentivised some investors2. We couldn’t help but think this letter to the FT on Dec 30 remained true as ever…

We like the stock (NZL/ALF combo) as long as there’s no more dilution in future. A several years long play, we think, which should do well with lower interest rates…3

Across the ditch

Bruce Mathieson finally got heads to roll at Endeavour Group, the owner of liquor retailer Dan Murphy’s — the removal of Peter Hearl follows months of animosity between the pair, where Mathieson said

“Hearl’s hobbies in the retail business have failed spectacularly, and it’s clear for all to see…When I said get back to everyday low prices, I didn’t intend for Hearl to start with the share price.”

Ari Mervis is the new chair. Let’s see what happens. The stock has languished largely due to poor mgmt, and we still think it’s a “show me” story.

US/EUR

To the surprise of nobody tech stocks fell on their first day of trading (no shit, José). We’ve been underweight tech stocks for some time and were a little embarrassed after almost anything vaguely related to tech did well last year. Luxury also fell — LVMH, CFR, RACE (that’s Ferrari, for you novices to my perennial obsession with luxury). All adding opportunities. Can you replicate the history of Ferrari, or Loro Piana? Another one to add — Brunello Cucinelli. I never “got” him until now — I’ve been wearing his scarves every day here and have to say — the quality is better than Loro and the workmanship impeccable. Ticker is BC.BIT. Trades at an elevated multiple, like Hermès, but I added some to my personal portfolio….if you read one New Yorker article, read this one about Brunello — link. Worth extracting this section in full:

Cucinelli pays his employees a higher wage than the market rate—in Italy, a factory worker typically starts at a thousand euros a month. And he attempts to infuse pleasure into the process of making clothes, which he describes as tedious and repetitive. The whole company takes a ninety-minute lunch break; employees can go home to feed their families or eat at the heavily subsidized company cafeteria—they pay less than three euros—and still have time for a nap afterward. (Given the quality of the cafeteria—where long tables are set with bottles of Pellegrino and wine, and local ladies serve minestre, pastas, platters of grilled meat, and salad—a nap is recommended.) Cucinelli has also installed a small library, near the theatre, where workers and visitors are encouraged to browse volumes that look as if they had been selected by an eager undergraduate: there are works by Dante, Kafka, Proust, Ruskin, Rawls, Nietzsche, Derrida, Deleuze, in many different languages.

Cucinelli expects discipline among his employees, and refers frequently to the model of the Benedictine Rule, upon which the saint founded the monastic tradition, five hundred years after Christ. “St. Benedict says ‘ora et labora’—pray and work,” he said. “Work and pray, and take care of your soul by your work.” In Solomeo, discipline is expected rather than imposed: workers are not asked to clock in or out. (Emphasis mine)

I wrote to you about the far less pretentious Don Braid a while ago, and the reason I got into Mainfreight (and even more into it at $57.00 per share) isn’t because of numbers or any kind of multiple. It was the answers Don gave in a few interviews that showed a good manager whose priorities placed himself last. Reading the NY’r piece, I was reminded of similar qualities — the staff of Mainfreight might not be encouraged to read Dante but they are looked after and incentivised, and so are the staff at Brunello. Here is another choice quote:

I met Rosella Cianetti, a seamstress in the repair department. (The moth holes of select customers are fixed free.) When we spoke, Cianetti, who was fixing a small hole in a seam of a sweater with the skill of Arachne, told me that she had been making clothes for forty years, the last seven at Cucinelli. “It is better than any other experience I have had,” she said. “We’re treated like humans, and in other places we are treated more like machines. We get respect for what we do with our hands. It doesn’t seem like a lot, but we appreciate it.” She did not, she admitted, have much time for reading Marcus Aurelius.

Aurelius or not, good management tends to lead to good results. So, I picked up a little stock in the co. Hard to recommend as a buy, but Hermés always has had the same issue…perhaps add in smalls.

Unpicking Hipgnosis - singing the cigar butt blues

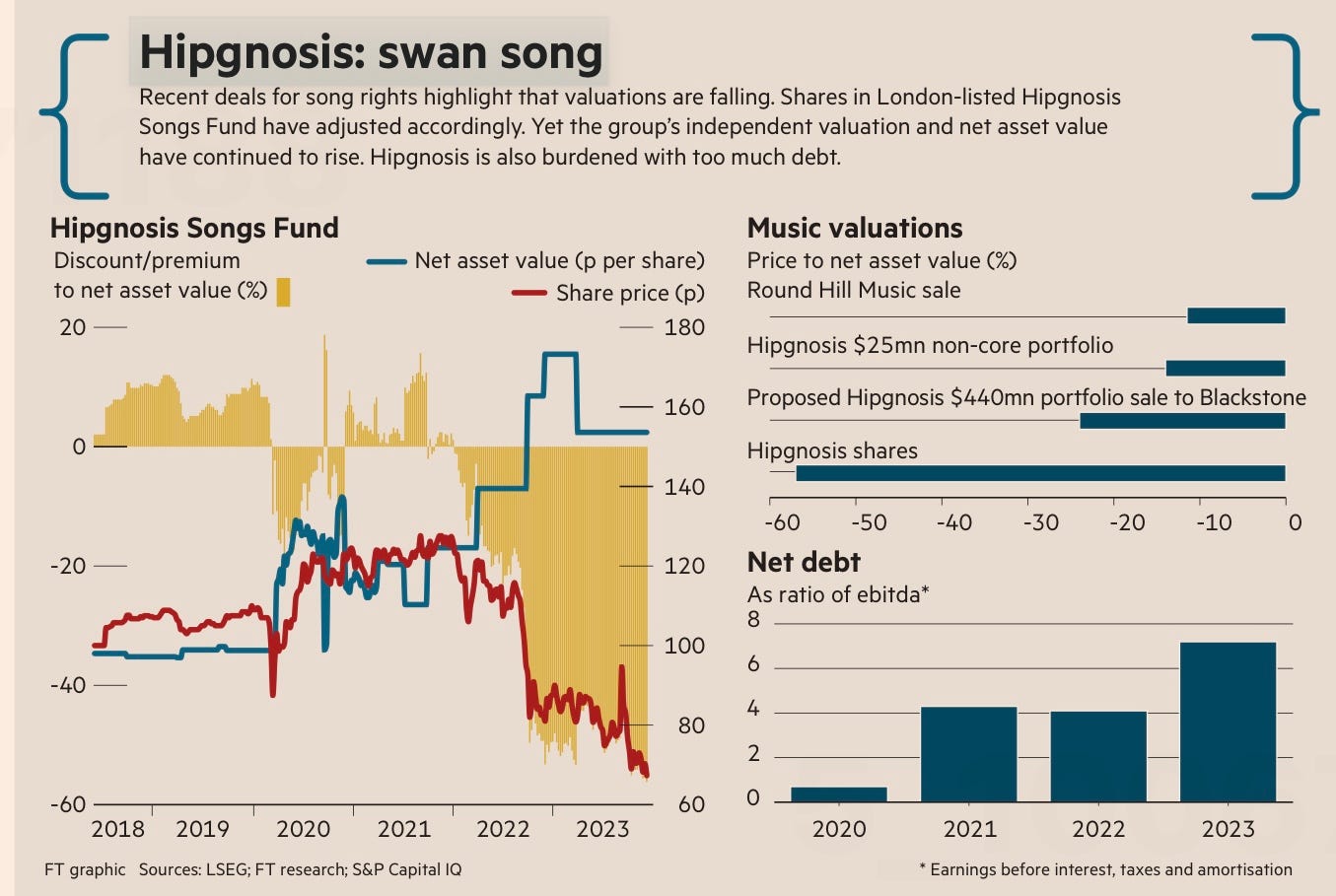

Chart from the FT’s always fantastic Lex. Hipgnosis bought a lot of song royalties and rights — it owns part of Neil Young’s catalogue, Blondie’s, etc. The appeal of song royalties is that they are like the bond that keeps on giving — with the resurgence of classic music (I.e. Kate Bush in “Stranger Things” with “Running up that Hill” there’s plenty of gold to be spun from the spinning wheel…anyway, Hipgnosis was stupid and overpaid, and now they have a lot of debt and their NAV (as fictitious as it might be) is at deep discount to its stock price, which currently trades at 73 pence. I don’t think Hipgnosis will exist for much longer as a stock — it already hocked off part of its portfolio at a 11% discount at the end of last year. It has a lot of debt as a % of EBITDA and mgmt already tried to hock off an even bigger portion to Blackstone for a 24% discount, which was blocked by shareholders.

So here’s the game. I love a cigar butt. How many puffs are left at Hipgnosis?

Let’s discount the NAV by 20%. We remain in a high interest rate environment and yet there’s likely buyers for a portfolio of high quality assets (Blackstone, for one, but what about WMG or UMG?). There’s still a deep discount to NAV. Now, they’ve still got debt — that’s included in NAV, but debt covenants stipulate that debt must sit below 30% of NAV. That looks increasingly unlikely. OK, so let’s discount for that - a fire sale - all songs must go! Even a 40% discount to NAV gives us 90p per share or so, which is well below the 73p it closed at today. Maybe — and I say this gingerly — maybe there is a case to be made for a cigar-butt here. Is it a buy? No view yet…

And speaking of discounts…

The theme of today seems to be discounts (blame my mother, she loves a deal). Shaftesbury Capital PLC (SHC.LSE). They own a lot of London’s West End — they have tranches of property in Covent Garden, Carnaby, Soho, Chinatown and Fitzrovia. This is impossible to replicate property in a city that will likely remain one of the world’s most significant (Dr Johnson — “when a man has tired of London, he has of life”).

Shaftesbury was a dud for ages. It suffered from the LSE discount and the REIT discount. So, here’s the deal — money is flowing into buying London property. Here is Abu Dhabi buying London Square for $291mn. The Qataris have been purchasing Britain for years (including, unsuccessfully, MANU, r.i.p). We think there is potential for a catalyst here for the discount gap to close. NTA of ~135p and NTA of 194p. 43% upside.

Note that NZL owns the underlying asset - the land itself, but o.c, the worry any owner of an underlying asset has is if their tenants can’t pay rent — w dairy and forestry, the going seems to be good…

There is a long and boring tale of Allied Farmers and a significant amount of tax losses which are harvestable — $180mn or so — that goes some way of explaining why the two entities just don’t combine. Link.

Disclosure: I used to work for Elevation