Everybody loves a burger, but there are too many burgers. I.e Carl’s Jr is closing 20 of their 24 Aussie outlets, which shouldn’t surprise anyone. What is Carl’s Jr, anyway? It’s not high-end enough to say, be “gourmet” in any real sense; it’s not consistent enough to compete with McDonald’s; it doesn’t have an iconic burger like the Whopper at BK. I don’t even know what burgers Carl’s Jr sells — perhaps the Phat Whatta Burger Cheese American Doggo Hot Doggo Meat Attack (would you like fries with that?). That’s the issue — and it’s a good warning to lesser fast-food retailers. If you don’t define what you are and are relentlessly sure about that, then you’re in trouble.

The gold standard for burgers is In-n-Out Burger. In-n-Out is family owned and controlled; it has expanded gingerly, slowly and deliberately. Their most recent menu item is hot chocolate and marshmellows — it took them 15 years to add it. The company is incredibly successful as a result.

McDonald’s is perhaps the gold standard for a burger you can access anywhere in the world. It is a miracle. You get the same amount of ketchup on your cheeseburger in Rome (there’s a McDonald’s right next to the Vatican City walls) as you do in Gore. Fantastic! Sales slowed for the first time in recent memory this quarter — global comp store sales down about 1% and net income down 12%. They’re not as awful as some in the media have been mystically making out (please) — but it’s a sign of slow-down.

McDonald’s has consistently increased prices over the last five years. That’s where most of the profit has come from. Volumes have sat relatively flat. Now — in ‘cadence’ (don’t you hate that word?) with the rest of the industry, it’s seen that earnings machine slow to a standstill. I have been writing for a while that the consumer can only be squeezed so much — you know, when real wages sit basically flat and the cost of living goes up, you can only increase prices so much before the model breaks. We’re at that point now (Starbucks, by the way, has hit a similar point).

You can see it reflected in pricing, too — in the States McDonald’s has re-released its $5.00 value meals; while competitors like Dominos have lowered the prices of their value pizzas. I suspect that as consumers trade down, McDonald’s and co will continue to benefit from shrinking consumer wallets. But it doesn’t answer the big question: how does McDonald’s increase volumes?

One of my favourite Roman writers is Juvenal, who lived some 2,000 years ago. Here, in Ancient Rome, you have someone writing about the rent being too damn high —

If you can tear yourself loose from the Games, a first-class house can be purchased, freehold, in any small country town at the price of a year’s rent, here, for some shabby, ill-lit attic.

Juvenal, Satire 3.223–225

Some shabby, ill-lit attic! The rent is too damn high!

My point is — the device that has slowed McDonald’s sales (and Starbucks, and so on) is a combination of high interest rates and low real wages. It is particularly noticeable in NZ because most of the wealth created here isn’t productive — property ownership is not beneficial to the GDP or productivity. I’ve written on this before — but in short, our fetishised property society has come at the expense of the country itself. To raise real wages (and thus, sell more McDonald’s burgers, coffees, widgets, and what-have-you) you need businesses that produce things. Hence our particular issue as a country.

Happily enough — for McDonald’s investors (not for Kiwis) — their main market is the US and then international territories. The US has a great number of productive, innovative businesses. As Buffett is always saying — don’t bet against the US economy. McDonald’s will be just fine (this is why I prefer investing in global equities, by and large).

Reversing the Karenpocalypse Trade; return of Becky

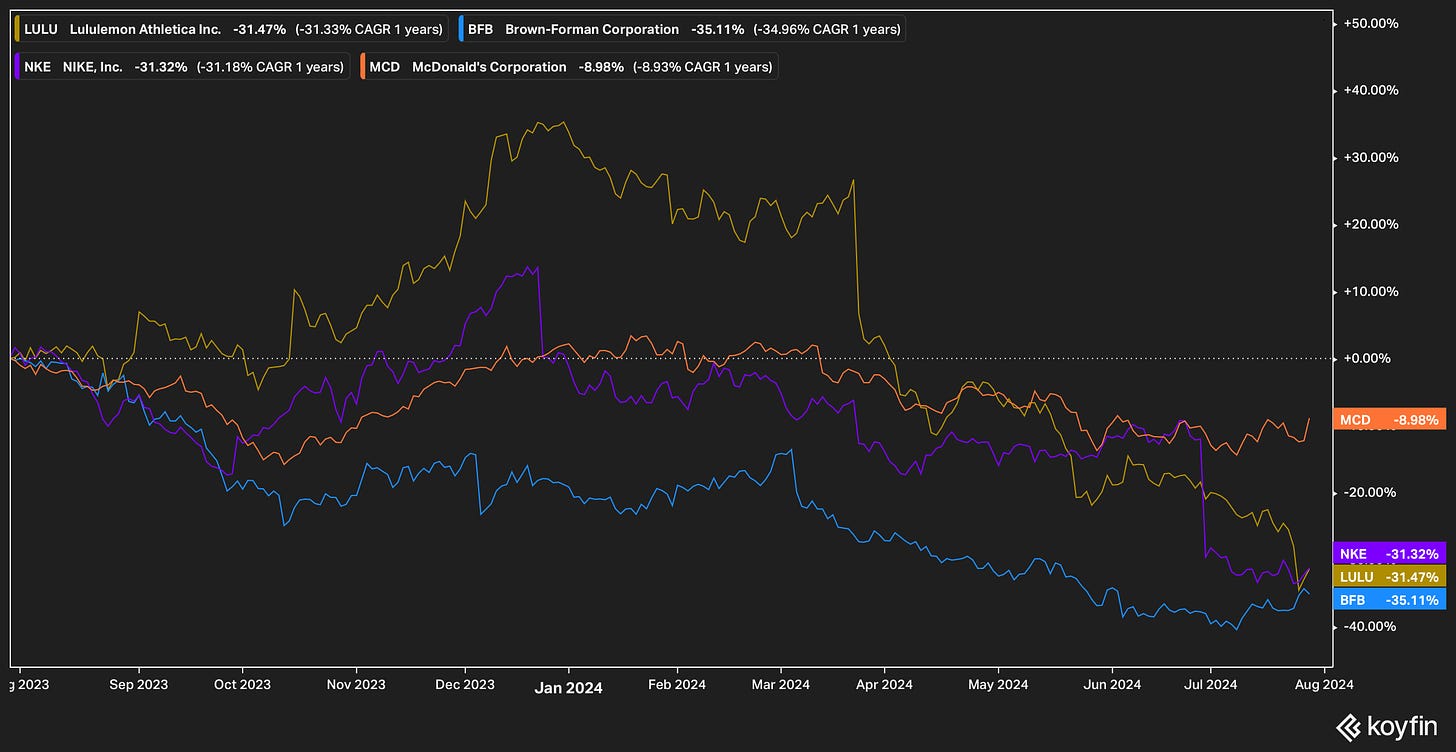

This brings me to another proposition — The Karenpocalypse Trade. I first wrote about this on 6 December1 — I wrote that those middle-brow companies like Starbucks and Lululemon and so on are likely to do poorly, due to that shrinking middle-class dollar. Most of those companies have sold off now. It was a good trade!

Now I am suggesting the reverse trade. Let’s call it RETURN OF BECKY.

You have things like Lululemon, Starbucks and McDonald’s now trading well off their historical P/E ratios. They’ve endured a sell-off. I'm wondering if it’s time to load into them now — price is what you pay, value is what you get…

Questions to ask yourself, if you do this:

Are people going to keep drinking Jack Daniel’s and so on (BFB)

Is Nike going to recover? (I am not sure on this — I note every well-dressed person these days seems to be wearing New Balance)

Is Starbucks going to continue selling coffee to Beckies? (I think so)

Is Lululemon going to continue selling leggings (to Becky and her friends) (I think so).

The biggest question is, though — will the US economy continue to produce interesting and strong companies that eventually increase real wages?

Here is my bigger theory. We are heading towards a recessionary environment, and this has been largely hidden from the white-collar analysts because they’re so removed from the real world. You can see the recession within the already discounted stock prices of the above companies.

My theory (and maybe it is a ridiculous idiot theory) is that the recession hasn’t yet been shown in the numbers, or stock prices, of companies hither yet to see a decline in demand. We have started to see signs of the cracks — the tech sell-off (I wrote this in Sea Change, last week) — but I think there is more to come. The “value” end of the market has factored the bulk of this in — the rest hasn’t.

Therefore, it might be fun to buy those sold off companies — hold onto ‘em for a while — and see how they go. I expect more bad results to come — Starbucks reports earnings today — but I think those bad earnings are already expected.

Becky is, like, back??

The Arnault Olympics

Quoting from Lauren Sherman’s excellent newsletter, Line Sheet (you all should subscribe!)

The R.O.I. on that €150 million…: I’d argue that LVMH has already earned a return on its sponsorship of the Paris games. The brand exposure has been simply staggering. LVMH is already larger—and, in some cases, many times larger—than the sort of mass consumer brands that traditionally align with the Olympics, such as Johnson & Johnson, P&G, Unilever, McDonald’s, Coca-Cola, and Nike. And yet, the company’s exposure raises an interesting, almost philosophical point. These days, a lot of consumption is virtual and doesn't require the exchange of funds, so people are consuming LVMH brands all the time through imagery on social media without spending hundreds or thousands of dollars on a particular SKU

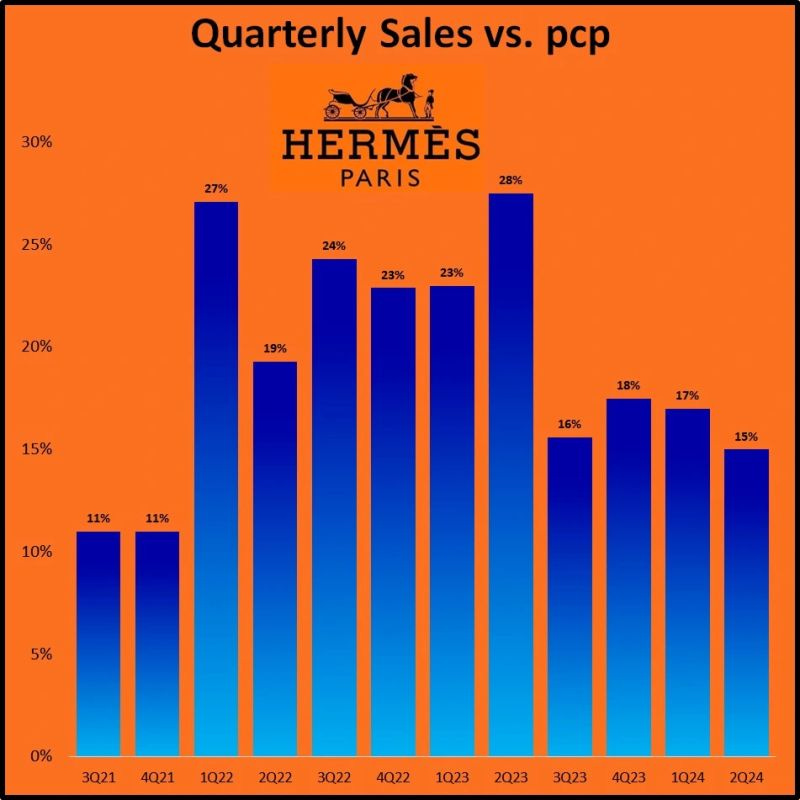

LVMH is also good buying at the moment … 23x earnings … just think about the ROI they’ve got from the Olympics — marketing coup d'état. I am forever long luxury (in my heart) because the connection of emotion and high margins is just too good… see Hermes results below… it is the goose that continues to lay the golden eggs…

Misc.