It’s 24 hours since tariffs have been enacted and I have to wonder — did Trump get his idea for tariffs from Ferris Bueller’s day off?

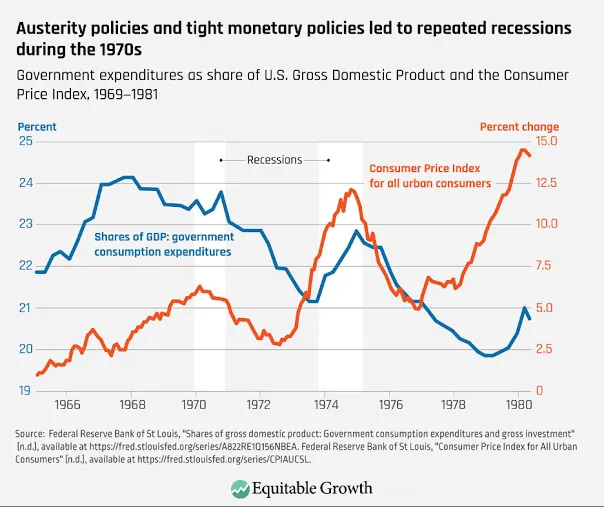

I guess I have to write about tariffs1 . So let’s keep it short and sweet. Trump has more or less created a situation of stagflation because at the end of the day the consumer has to pay for these one way or another. I have warned of the risk of stagflation several times2, and tariffs greatly increase the risk of it. The reason is fairly simple: you increase the cost of things, your money is worth less because it can buy less, so the solution if you are JPow is either i) buckle up and throw the economy into recession or ii) cut rates 3 or so times and hope that makes the cost of money cheaper. Of course, if you do the second one, you end up with a potential stagflationary scenario where inflation sits at an elevated and stubborn rate for some time. It will not surprise you to know that tight austerity policies lead to repeated recessions:

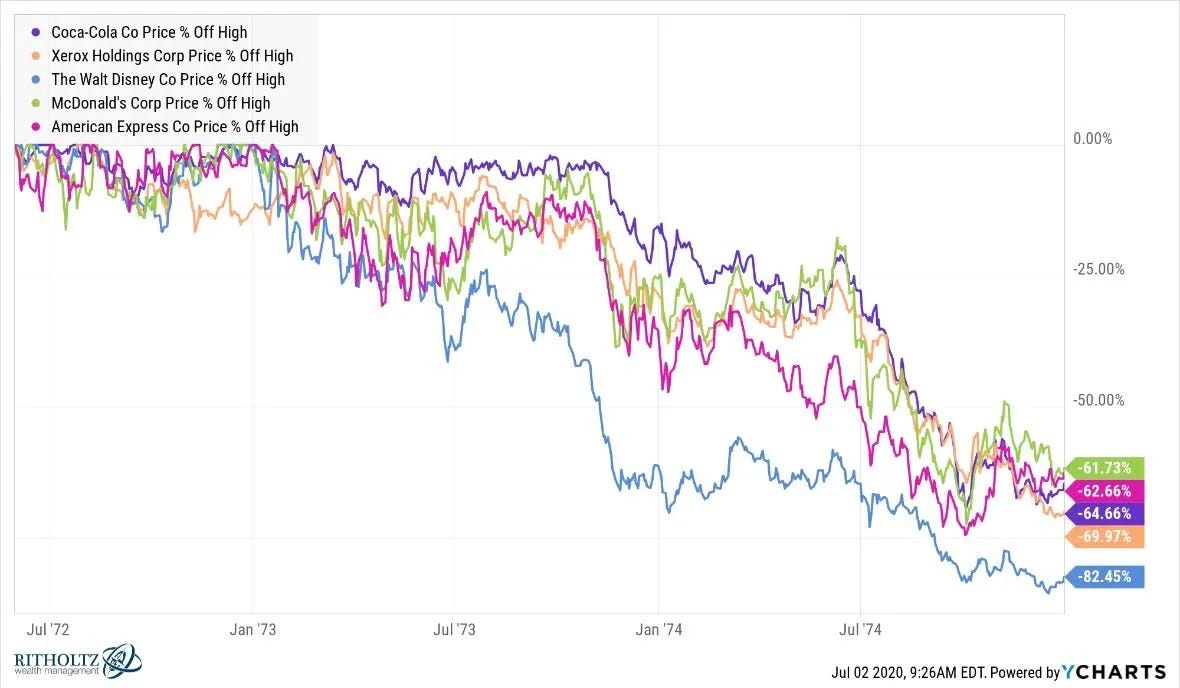

So, you know, there’s that! Here’s how some Nifty 50 stocks did during the peak of stagflation (you’ll recall that the Nifty 50 was like the Mag 7, only with 50 stocks).

The multiples were too high. McDonald’s traded at 85x earnings in 1972. It doesn’t matter that they were growing like gang-busters; the issue is the multiple was so high combined with stagflation — it isn’t pretty.

Can you think of companies that trade for a high multiple today? Oh, maybe Tesla? (104x earnings). DoorDash? (241x). If I were holding those stocks, I’d be a little worried.

More than that, you’ve got to think about the biggest victim of the tariffs — China, where you’re looking at +50% tariffs.

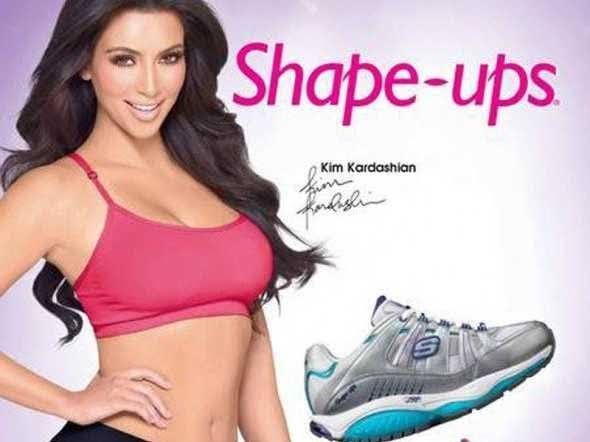

Now I will talk about one of the companies I’ve wanted to talk about for a while but I have had no reason to: Sketchers — Sketchers has had a surprisingly litigious history, my favourite being the lawsuit where its “Shape Ups3” were found to not, unsurprisingly, actually “tone” or shape your body whatsoever4.

Why is Sketchers interesting here? Well, they’re a low-margin company and most of their shoes are made in China and Vietnam (46% tariffs). ~50% of their shoes are sold in the US. Either the company takes a much lower margin on its product (already sits around the single digits) or pushes some of the cost to the consumer, who in turn may buy less Sketchers because they’re now too expensive.

There’s a bunch of companies like this that rely on China to some degree — fast fashion is a major one — Tapestry, which owns mid-market bag maker Kate Spade, makes most of their goods in China and Vietnam. You’re either going to see a lot of on-shoring and likely earnings that look very, very bad.

There’s really no winners here, but I suspect those lower margin companies will do worse. Luxury companies like Hermes have pricing power and make a lot of their goods ex-China. Low margin and mid-margin fashion companies (I’m not sure if you could ever call Sketchers fashion?!).

So let’s invert, like Charlie Munger said. Likely outcomes:

1) If you are a rich American you just go on holiday to Europe to buy your luxury goods

2) If you are an average Joe American consumer you are screwed. Ditto if you are in the business of serving those guys. Think Dollar General, etc.

3) The best businesses to own are still toll booth companies like Visa and Mastercard, that collect a fee on every transaction regardless of inflation, stagflation, or spending.

4) You are a fool to believe countries won’t reciprocate with their own tariffs. So you end up with the cost of goods becoming more expensive across the board.

5) The USD as a reserve currency is in doubt; if I were a large company, especially with a reliance on China, I’d look to sell as many goods as I can elsewhere (the US isn’t the only market!)

See below chart on reserve currencies and their staying power…

I mean, look — the earnings power of companies with monopolistic-like qualities remains the same. If you can buy GOOG or something for 12x earnings then you are buying +$100bn of net profit in a business that shares and advertising oligopoly with Amazon and Meta and a good price. I’m not worried about those companies. It’s going to be bumpy, but like Lord Rothschild said, “buy when there’s blood in the streets…”

By the way…Buffett had a much better solution to tariffs5. But he’s just an old man eating McDonald’s and …wait, Trump eats McDonald’s too, right? Nevermind…

I mean, they’ve locked me in a safe room here until I do, like Jodie Foster in Panic Room.

Hello Stagflation, my old friend

Every market cycle (i.e. a bull market) there’s a point where “alternatives” becomes an asset class, and you get dubious whisky clubs and art marketed as an investment class and fine wine, antiques, and so on. There’s a fairly obvious explanation for this: bull markets mean more money, which means more money to be spent on other asset classes.

https://www.businessinsider.com/skechers-class-action-lawsuit-shape-ups-2013-5

https://www.berkshirehathaway.com/letters/growing.pdf